European Exchange-Traded Funds Update - November 2017

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

Notional volume executed on the Tradeweb European-listed ETF marketplace reached €14.18 billion in November, while the number of completed trades increased by 6% on the previous month. Adriano Pace, managing director for equity derivatives at Tradeweb, said: “Last month, more than 29% of European ETF transactions on our platform were processed using our automated intelligent execution tool, significantly up from January’s 6% figure. The growing use of automated trading by Tradeweb clients demonstrates the efficiency that the functionality brings to the market, as it begins to adopt new ways of trading amid regulatory change and resource pressures.”

ETF volume breakdown

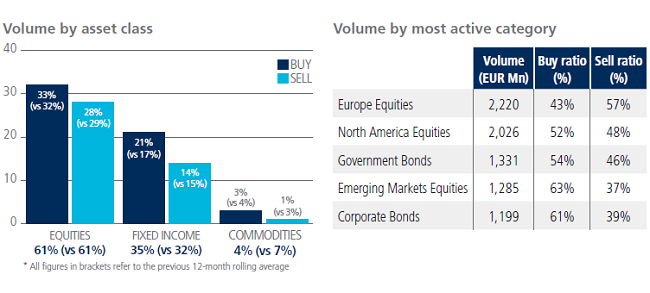

November’s activity in equity ETFs mirrored the previous 12-month rolling average at 61% of the total platform flow. Europe Equities was the most heavily-traded sector, and saw net selling unlike the majority of its stocks-based counterparts. Government Bonds was fixed income’s most active ETF sector with more than €1.33 billion in traded volume. ‘Buys’ in commodity ETFs surpassed ‘sells’ by two percentage points at 3%.

Top ten ETFs by traded volume

There was an equal split between equity- and debt-based instruments occupying November’s top ten ETF list by traded volume. The PIMCO Euro Short Maturity Source UCITS ETF returned to the top after last holding the spot in June 2017.