European Exchange-Traded Funds Update - March 2017

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

March proved to be the strongest month for the Tradeweb European ETF marketplace since its launch in late 2012. Trading activity surpassed €17.733 billion, beating previous record-holder January 2017 by €2.42 billion. The platform also enjoyed a record-breaking first quarter, with total traded volume amounting to €45.11 billion, up 19% on Q4 2016.

Volume by ETF asset class

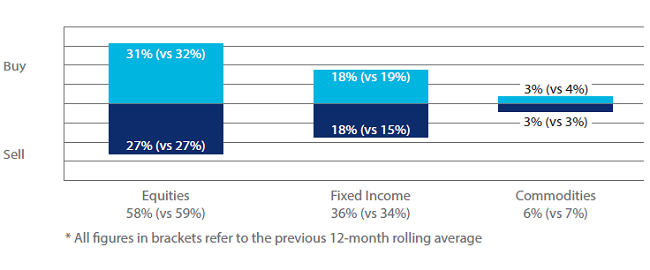

Equity ETFs were the only asset class to see net buying in March, as ‘buys’ mirrored ‘sells’ in fixed income and commodity-based products. Overall fixed income ETF activity was above average at 36% of the entire platform flow, outperforming the previous 12-month rolling average by two percentage points. Equity Europe was the most heavily-traded ETF category with €3.11 billion in notional volume. Nearly €1.75 billion was executed in Corporate Bond ETFs, the most active fixed income segment.

Adriano Pace, managing director for equity derivatives at Tradeweb, said: “Without a doubt, it was a very busy quarter for European-listed ETFs. Analysis of platform activity in the first three months of the year shows that ‘buys’ outstripped ‘sells’ in all ETF categories except for Aggregates and Government Bonds.“

Top ten ETFs by traded volume

A fixed income product topped the most actively-traded ETF list for the third consecutive month. The iShares Core Corporate Bond UCITS ETF, which aims to track the performance of the Barclays Euro Corporate Bond Index, was also ranked fifth among the top ten instruments during the first quarter.