European Exchange-Traded Funds Update - June 2018

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

Activity on the Tradeweb European-listed ETF marketplace showed no signs of slowing down in June, as notional volume surpassed €23 billion for the second time on record. The month also marked the end of the platform’s second best-performing quarter since launch, with more than €62 billion executed in the April-June period.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “Institutional trading of ETFs continues to grow on Tradeweb, as demonstrated by the 101% increase in European ETF average daily volumes year-over-year. Platform features such as automated trading, which now accounts for one third of our total flow in Europe, help clients reduce operational risk and focus on larger sized trades.”

ETF volume breakdown

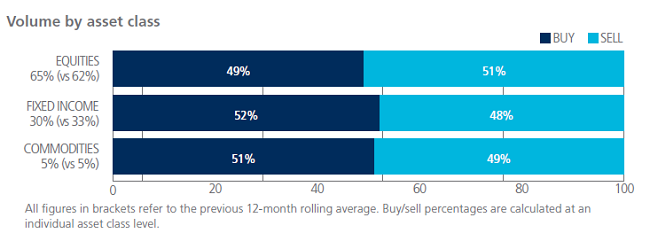

Fixed income and commodity ETFs saw net buying in June, with ‘buys’ outstripping ‘sells’ by four and two percentage points respectively. In contrast, equity-based instruments were mostly sold, while overall activity in the asset class beat the previous12-month rolling average by three percentage points at 65% of the entire flow.

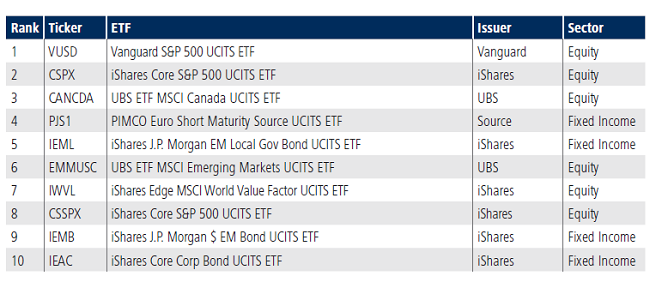

Top ten ETFs by traded volume

The Vanguard S&P 500 UCITS ETF was June’s most heavily-traded product, after last topping the list in September 2017. The fund seeks to track the performance of the Standard & Poor’s 500 Index, a benchmark comprising the stocks of large U.S. companies.