European Exchange-Traded Funds Update - June 2017

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

Against a backdrop of improving macroeconomic data and increasing speculation of monetary stimulus recalibration in Europe, notional volume executed on the Tradeweb European-listed ETF marketplace reached €12.15 billion in June. Adriano Pace, managing director for equity derivatives at Tradeweb, said: “June marked the end of the platform’s second strongest quarter on record, with total activity amounting to €43.65 billion over the course of the last three months.”

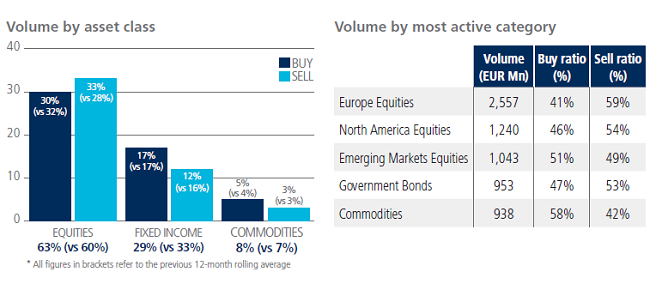

ETF volume breakdown

Equity ETFs saw net selling for the third consecutive month this year, as ‘sells’ outstripped ‘buys’ by three percentage points. In contrast, ‘buys’ in fixed income and commodity ETFs surpassed ‘sells’ by five and two percentage points respectively, as a proportion of the overall traded volume. Europe and North America Equities were the two most active categories during the month, capturing 31.5% of the entire platform flow.

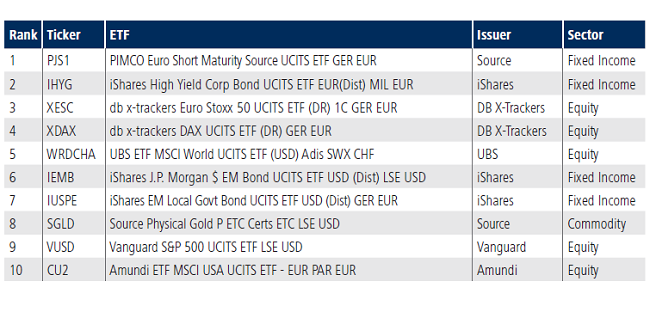

Top ten ETFs by traded volume

A fixed income ETF was ranked first among June’s list of top funds by traded volume. The PIMCO Euro Short Maturity Source UCITS ETF, which invests primarily in an actively managed diversified portfolio of Euro denominated fixed income securities, was also the most heavily traded product in Q2 2017.