European Exchange-Traded Funds Update - January 2018

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

January proved to be a record-breaking month for the Tradeweb European ETF marketplace, with total traded volume just shy of €20 billion, up 12% from the platform’s previous best performance in May 2017. The share of European ETF transactions processed via Tradeweb’s Automated Intelligent Execution tool (AiEX) remained high at 29%.

Adriano Pace, managing director for equity derivatives at Tradeweb, said: “Against a backdrop of sweeping regulatory reform and heightened market volatility, more than 93% of trade enquiries resulted in completed transactions, which attests to the strong pricing our clients receive on the platform.”

Pace added: “2018 promises to be a very exciting year for European ETFs. The new reporting requirements under MiFID II will provide investors with much-needed visibility into ETF trading activity, enabling them to better gauge the full depth of the market.”

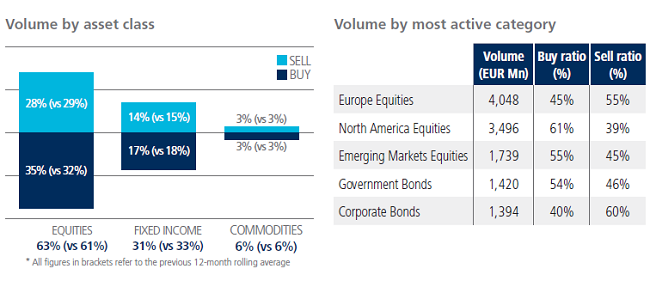

ETF volume breakdown

Both equity and fixed income ETFs saw net buying in January. ‘Buys’ in commodity ETFs matched ‘sells’ at 3% each, as a proportion of the overall platform flow. Europe Equities was the most heavily-traded ETF category with notional volume surpassing €4 billion; it was also the only stocks-based sector to see net selling during the month.

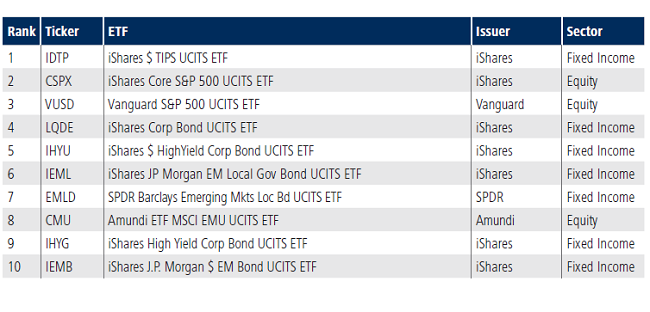

Top ten ETFs by traded volume

A fixed income instrument topped the list of most actively-traded ETFs for the third consecutive month. January’s top security was the iShares $ TIPS UCITS ETF, which aims to track the performance of the Barclays US Government Inflation-Linked Bond Index as closely as possible.