European Exchange-Traded Funds Update - April 2017

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

Against a backdrop of geopolitical uncertainty, April’s total traded volume on the Tradeweb European-listed ETF marketplace was just shy of €13.8 billion. Adriano Pace, managing director for equity derivatives at Tradeweb, said: “The platform has maintained momentum following the surge in activity around the U.S. election last November, both in terms of traded notional and key metrics, such as quote and hit rates.”

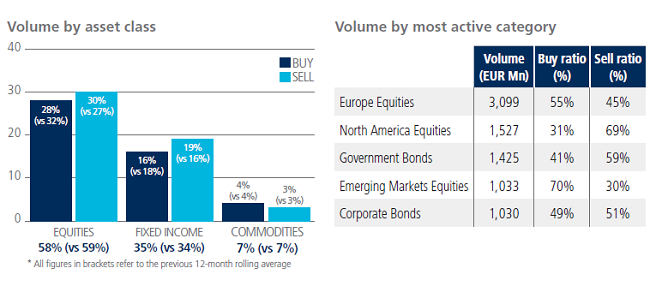

ETF volume breakdown

Overall, equity and fixed income ETFs saw net selling in April in contrast to their commodity-based counterparts. Monthly activity in the latter mirrored the 12-month rolling average at 7% of the entire platform flow. Equity Europe was once again the most heavily-traded ETF category with nearly €3.1 billion in notional volume. Ranked third, Government Bond ETFs proved to be the most active fixed income segment with more than €1.4 billion executed over the course of the month.

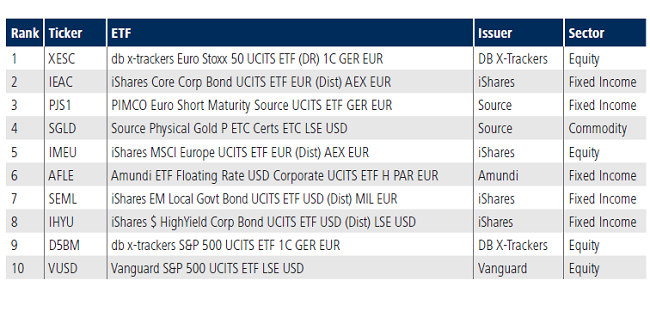

Top ten ETFs by traded volume

A commodity-based product featured among the ten most actively traded ETFs for the first time since November 2016. In fourth place, the Source Physical Gold P ETC Certs ETC LSE USD aims to replicate as closely as possible the performance of the London Gold Market Fixing Ltd PM Fix Price/USD. However, April’s top ETF by traded volume was the db x-trackers Euro Stoxx 50 UCITS ETF (DR) 1C GER EUR, which tracks a blue-chip index comprising the stocks of 50 market sector leading eurozone companies.