European Credit Update - November 2014

The Organisation of the Petroleum Exporting Countries (OPEC) failed to agree on oil production cuts, sending prices to a four-year low on November 27. According to a study published by BNP Paribas earlier in the month, falling oil prices could diminish global financial market liquidity, as energy-exporting countries would withdraw capital from world markets for the first time in almost two decades.

Inflation in the eurozone slipped to a five-year low of 0.3%, however, in the UK it picked up slightly to 1.3%. Meanwhile, Germany’s Bundesbank warned of "an excessive search for yield" in corporate bond and syndicated loan markets in its latest Financial Stability Review.

Non-farm payroll data released on November 6 showed that the US economy added 214,000 jobs in October, while inflation currently stands at 1.7%. In Japan, prime minister Shinzo Abe called a December election to secure support for his decision to delay a sales tax rise scheduled for 2015. The country’s economy descended into recession after two consecutive quarters of contraction.

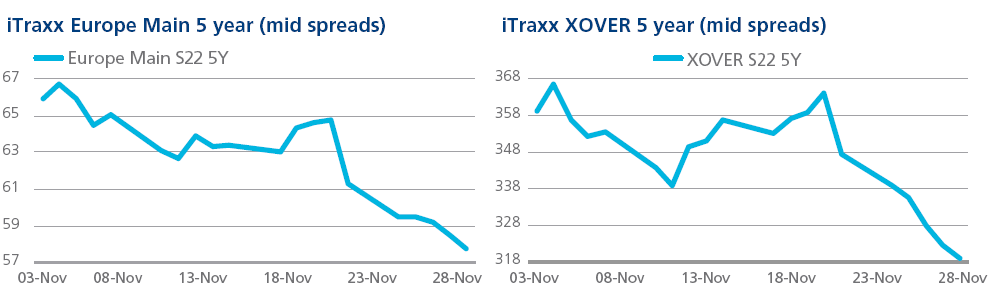

CDS on Tradeweb: After two widening spells at the start and middle of the month, European credit indices rallied in November. Europe and Crossover ended the month 8 bps and 37 bps tighter at 58 bps and 319 bps respectively. Financial indices had a similar trajectory, with the FinSen and FinSub tightening 8 bps and 17 bps on the month to close at 60 bps and 138 bps respectively.

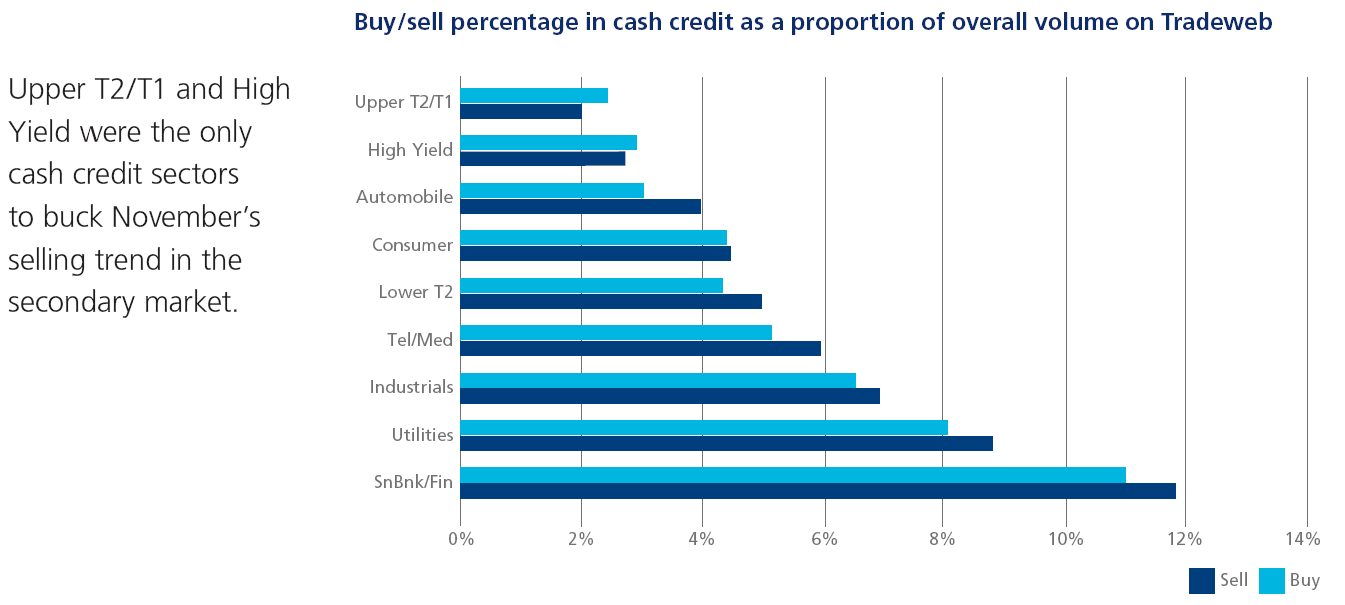

Cash on Tradeweb: There was strong activity in both primary and secondary markets in November, with overall spread performance staying buoyant and positive.

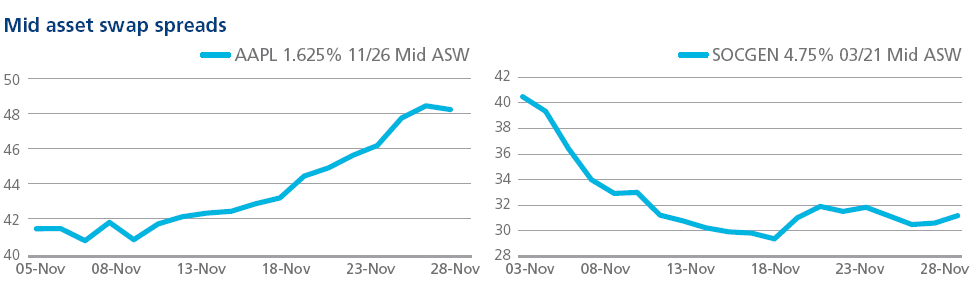

In the Telecommunications/Media sector, Apple issued its first euro-denominated bonds on November 4, borrowing €2.8bn to help finance share buybacks and dividends in the US without repatriating some of its overseas cash reserves. In the secondary market, the company’s 1.625% 11/26 issue widened by 7 bps from November 5 to end the month at 48 bps.

After passing last month’s ECB stress tests, two of the largest banks in France, Crédit Agricole and Société Générale, posted their third-quarter results on November 6. At Crédit Agricole, net profit increased 4% to €758m, while loan-loss provisions fell 8% to €581m. SocGen’s net profit rose 57% to €836m, as its loan-loss provisions fell 41% to €642m from a year earlier, when the bank took a €200m legal provision. Mid asset swap spreads for the latter’s 4.75% 03/21 bond tightened by 10 bps to 31 bps over the month.