European Credit Update - May 2015

As talks over Greece’s debt crisis continued in May, bank deposits in the country were at their lowest level in more than a decade. European Central Bank data published on May 29 showed that private sector deposits at Greek banks had dropped to €139.4bn in April, down €5.6bn on the previous month.

Meanwhile, annual inflation in the euro area increased to 0% in April from -0.1% in March. Conversely, Sweden’s inflation rate fell to -0.2% in April from 0.2% the month before; while in the United Kingdom, consumer price inflation dropped to -0.1% over the previous year – marking the first deflationary period for the country since March 1960.

Across the Atlantic, Federal Reserve Chairwoman Janet Yellen indicated on May 22 that she expected the central bank to raise rates this year should the U.S. economy continue to strengthen. A week later, however, first-quarter GDP data revealed a contraction of 0.7% in annualised terms.

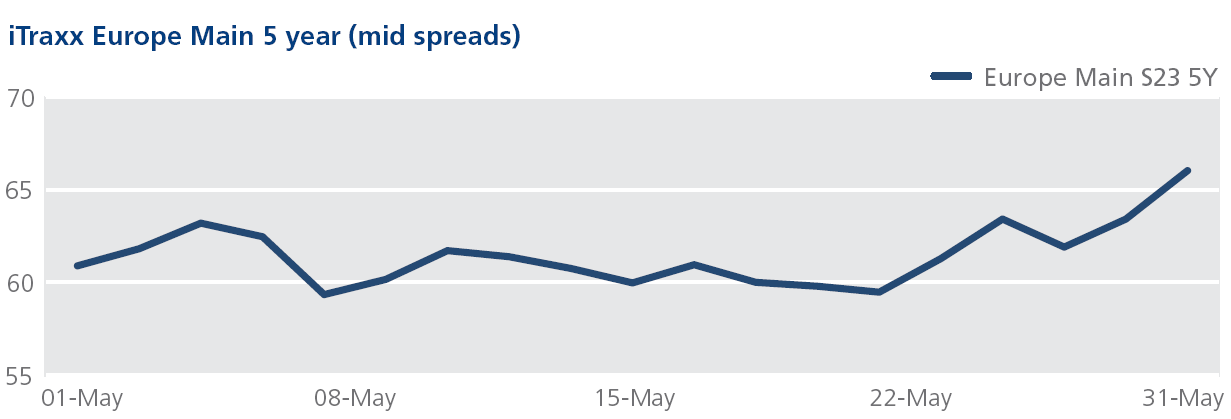

CDS on Tradeweb: European credit indices moved further into wider territory in May, with the Crossover widening 14 bps on the month to close at 286 bps. Spreads for the Europe index tightened to 59 bps on May 8, but closed at 66 bps on May 29. Financial indices had a similar trajectory, ending the month 6 bps (FinSen) and 12 bps (FinSub) wider at 77 bps and 157.5 bps respectively.

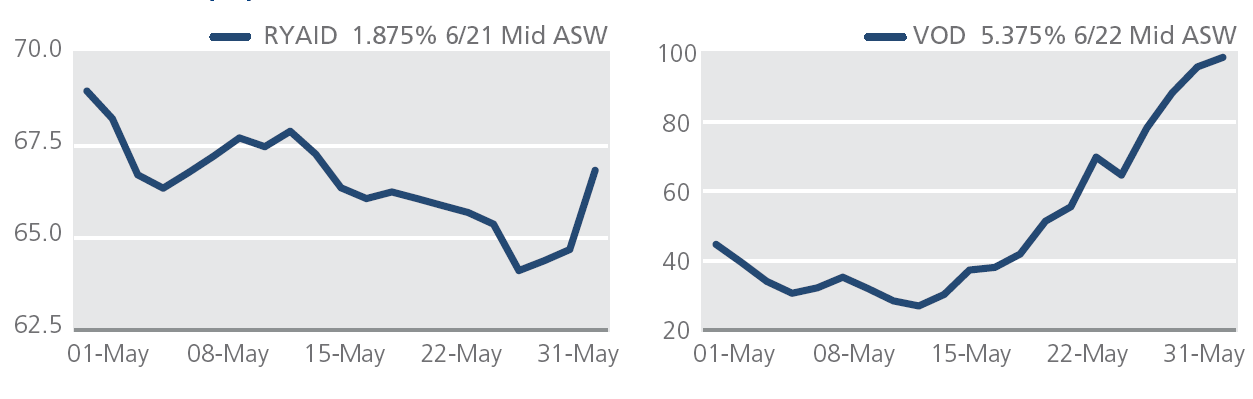

Cash on Tradeweb: Ryanair reported on May 26 a 66% increase in full-year net profit, which at €867m came in slightly ahead of previous guidance. The Irish low-cost carrier saw its passenger numbers grow 11% to 90m, and its total revenue rise 12% to more than €5.6bn. In the secondary market, mid asset swap spreads for the Ryanair 1.875% 6/21 bond tightened by 5 bps to 64 bps between May 1 and May 26, but ended the month at just below 67 bps.

On May 28, Standard & Poor’s downgraded Vodafone’s credit rating from A- to BBB+, citing “tough business conditions in key markets” due to strong sustained competition and consolidation in the UK. Eight days earlier, American billionaire John Malone had said that the British mobile operator would be a great fit for his cable group Liberty Global. Malone acknowledged, however, that while Vodafone’s approach focused on low leverage, low risk and high cash shareholder payouts, he preferred to “grow equity value”. Mid asset swap spreads for Vodafone’s 5.375% 6/22 bond widened by 54 bps to 99 bps over the month.