European Credit Update - May 2013

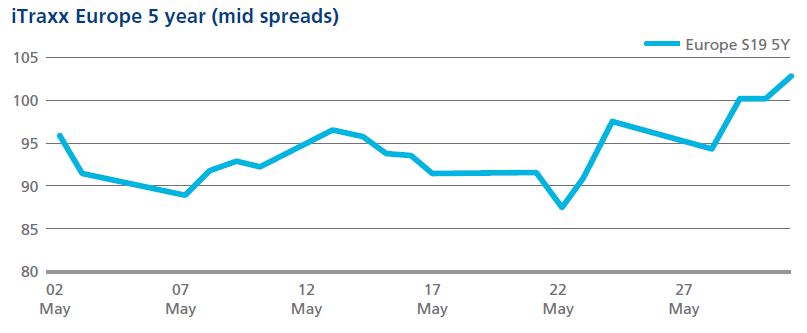

The equity rally continued throughout the first three weeks of May, and the iTraxx Europe index traded within a relatively narrow range during that time. At its policy meeting on May 22, the Bank of Japan reconfirmed its target to increase its monetary base and retained its 2% inflation goal, while on the same day the Bank of England’s monetary policy committee voted to keep interest rates on hold and to continue its quantitative easing (QE) programme.

In contrast, the minutes of the Fed’s meeting on May 22 noted that a reduction in QE in the U.S. was a distinct possibility and may even occur as early as June if there is evidence of stronger and more sustained economic growth. After these minutes were made public, there was relatively fast widening in iTraxx main, and the index reached 100 on May 29 for the first time since April.

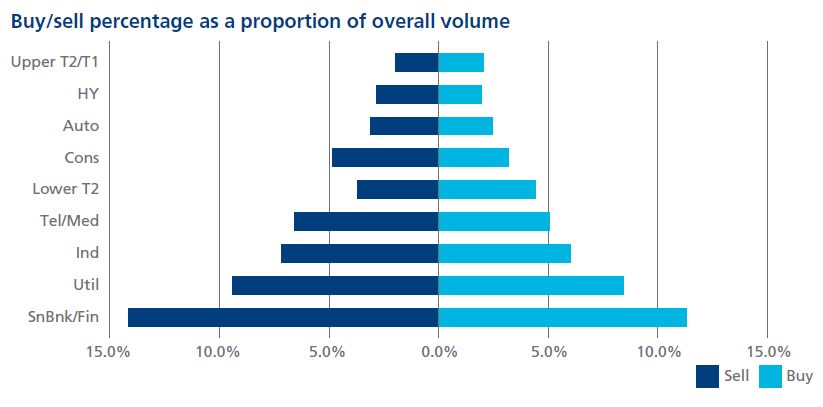

There was strong net selling in senior bank financials this month (in contrast to April) and this sector also saw the highest proportion of volume in the European cash credit sectors. The buying trend in April was reversed in May and there was net selling in most sectors this month.