European Credit Update - March 2015

The European Central Bank launched its long-awaited quantitative easing program on March 9, four days after cutting its 2015 inflation forecast to 0%. It predicted, however, higher inflation rates for 2016 and 2017 at 1.5% and 1.8% respectively. On March 16, the euro hit its lowest level since January 2003 against the U.S. dollar, but managed to bounce back in the second half of the month.

Meanwhile, the UK inflation rate dropped to 0% in February, according to data published by the Office for National Statistics (ONS) on March 24. Two days later, the ONS revealed that February’s UK retail sales were up 0.7% from the previous month boosted by a recovery in the housing market.

In the U.S., the Federal Reserve abandoned language describing the agency’s stance on raising interest rates as “patient” from its Federal Open Market Committee statement on March 18. Fed chair Janet Yellen later said that raising rates would be on the table after April, "depending on how the economy evolves".

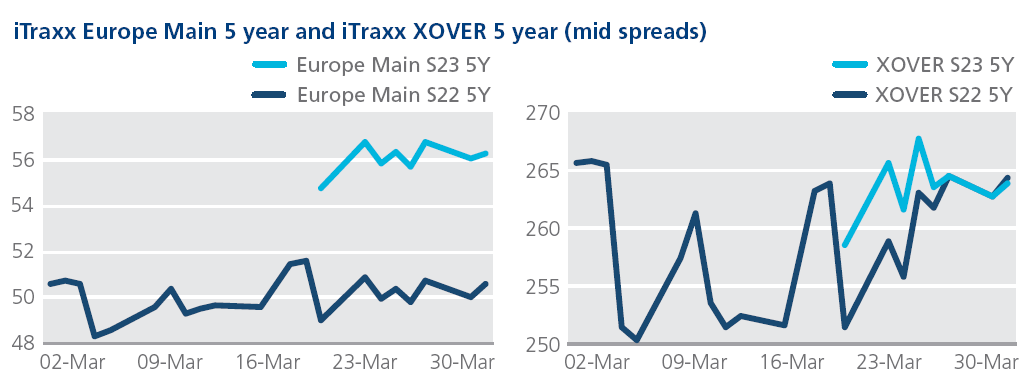

CDS on Tradeweb: Spreads for the Europe and Crossover indices saw significant volatility in March; however, both ended the month almost flat at just below 51 bps and 265 bps respectively.

Trading of the new series (23) for iTraxx indices began on March 20. During the roll, the Senior and Subordinate Financials indices were expanded from 25 to 30 names.

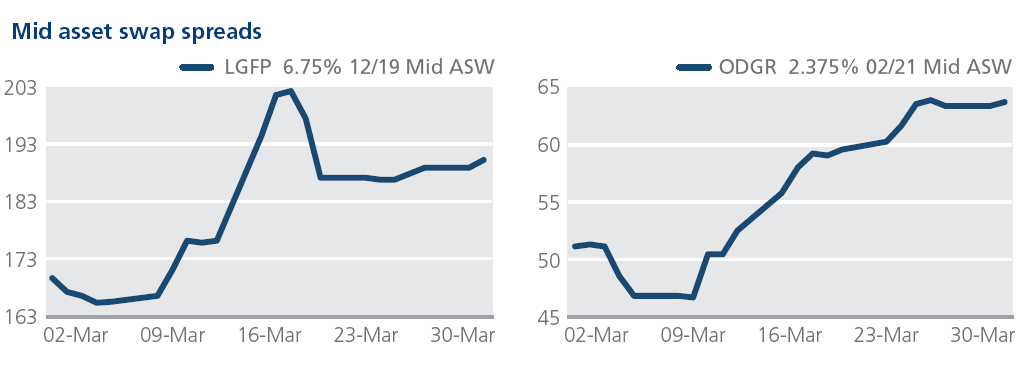

Cash on Tradeweb: The proposed merger of Europe’s two largest cement companies, France’s Lafarge and Switzerland’s Holcim, came to a brief halt on March 16, when the latter said the deal could not go ahead “in its present form”. The €41bn tie-up was back on track four days later, after both parties agreed new financial and leadership terms. Mid asset swap spreads for Lafarge’s 6.75% 12/19 bond widened by 33 bps to 202 bps between March 2 and March 18, but finished the month at 190 bps.

On March 24, Spanish telecoms giant Telefónica announced it had agreed to sell British mobile network O2 to Hutchison Whampoa, the Hong-Kong based owner of Three UK. The £10.25bn sale, due to be completed in the first half of 2016, will create the largest mobile operator in the United Kingdom. In the secondary market, mid asset swap spreads for O2’s 2.375% 02/21 bond widened from 51 bps on March 2 to 64 bps at month end.