European Credit Update - June 2014

After months of speculation, the European Central Bank announced on June 5 a set of measures aimed at fighting deflation and saving the Eurozone’s fragile recovery. These included deeper cuts to key interest rates (with the deposit rate moving into negative territory), a package of cheap loans for banks to improve lending to the non-financial private sector, and the start of preparatory work related to outright purchases of asset-backed securities.

A week later, Bank of England governor Mark Carney warned investors to prepare for an interest rate rise “sooner than markets currently expect”. Across the Atlantic, the U.S. Federal Reserve revealed on June 18 that it had cut its 2014 growth forecast to 2.1%-2.3%, but would continue winding down its stimulus program.

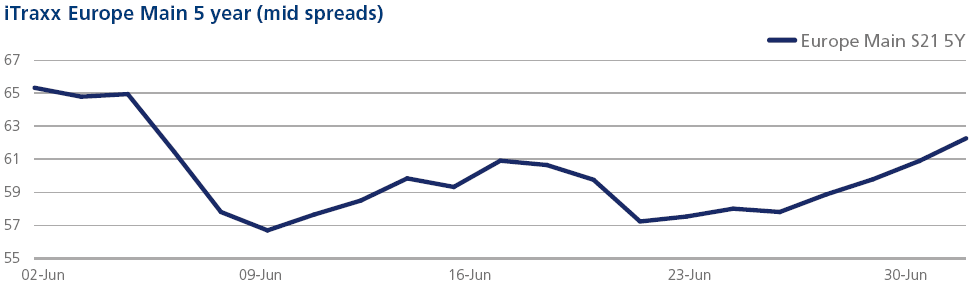

CDS on Tradeweb: Credit indices registered their tightest levels for the year in early June, with the Europe Main and Crossover trading as tight as 57 and 220 bps respectively. Financial indices performed in line and the FinSen came very close to trading flat versus the Main on June 9, with only 1 basis point between them.

The latter part of June saw a slow spread widening into month end, with the Main and Crossover closing 3 and 13 bps tighter at 62 and 242 bps respectively on the month. The FinSen/FinSub ratio compressed by 4.5 bps during the month and closed at 33.5 bps.

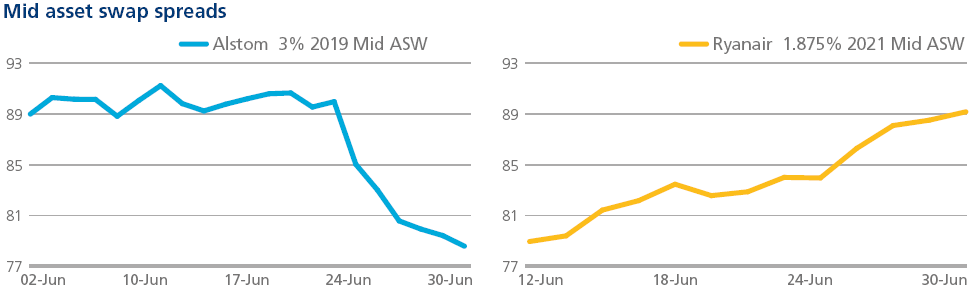

Cash on Tradeweb: The French government said on June 20 that it would back General Electric’s bid to acquire the power and grid business of rail and energy group Alstom. The following day, Alstom’s board unanimously voted in favour of GE’s offer and rejected a rival proposal by Germany’s Siemens and Mitsubishi Heavy Industries of Japan. Under the terms of the deal, which is expected to close in 2015, the French state will purchase a 20 per cent stake in Alstom. Mid asset swap spreads for Alstom’s 3% 07/19 bond ended the month 11 bps tighter from June 20.

Ireland’s Ryanair issued its first ever Euro bond at a final coupon of 1.875%, as part of its €3bn Euro Medium Term Note (EMTN) program. The seven-year bond was more than eight times over-subscribed and raised €850m for the low-cost airline, to help it finance its new 180 Boeing 737-800 NG order. In the secondary market, mid asset swap spreads for the bond widened from 79 bps on June 12 to 89 bps at month end.