European Credit Update - June 2013

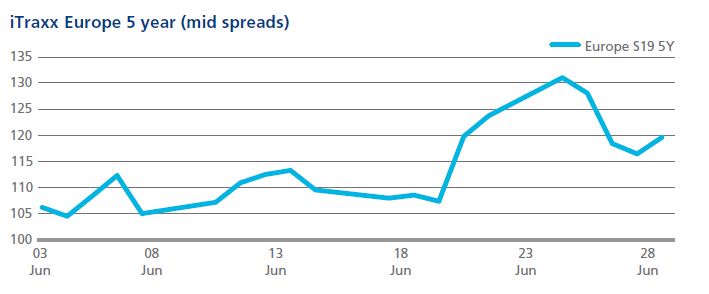

Volatility again characterised much of June in the fixed income markets, which awaited with some anxiousness the Federal Reserve meeting on June 19. Credit market concerns centred around the potential tapering of quantitative easing (QE) in the U.S. and its likely effect on long-term interest rates and credit spreads. Despite better-than-expected jobs data, markets were relatively weak, with emerging markets and high yield sectors being particularly hard hit. Corporate bond issuance was, as a consequence, relatively subdued in June.

Bernanke’s statement at the Fed meeting that tapering could begin later this year confirmed the market’s fears and iTraxx index spreads widened substantially across the board. After peaking on June 24, all indices rallied toward the end of the month, but closed weaker than earlier in June.

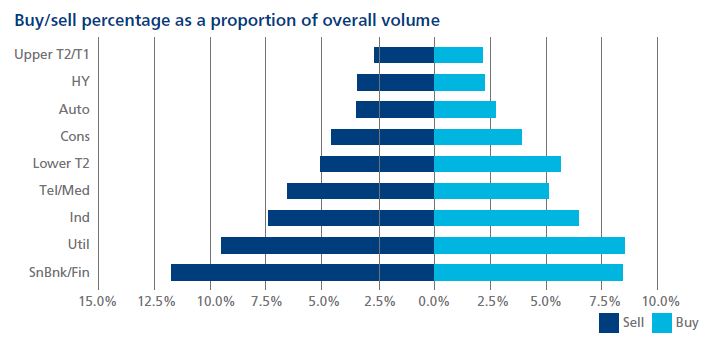

Strong net selling continued in June, in all sectors except “lower T2” financials. Senior bank/financials and utilities remain the most highly traded sectors.