European Credit Update - July 2015

Despite a decisive victory for the “No” camp in the July 5 referendum, Greece signed a last-minute deal with its creditors on July 13 to receive an €86 billion bailout package in return for further economic reforms. Greek banks re-opened a week later, although capital controls remained in place.

Meanwhile, euro area annual inflation held steady at 0.2% in July, according to a flash estimate by Eurostat. In the UK, figures by the Office of National Statistics showed a 0.7% expansion for the economy in the second quarter of 2015. However, the inflation rate slowed to 0% in June from 0.1% in May.

Across the Atlantic, the U.S. Federal Reserve left interest rates unchanged on July 29, saying it would need to see “further improvement in the labor market” before raising them. Nonfarm payroll employment increased by 223,000 in June, while the jobless rate declined to 5.3%.

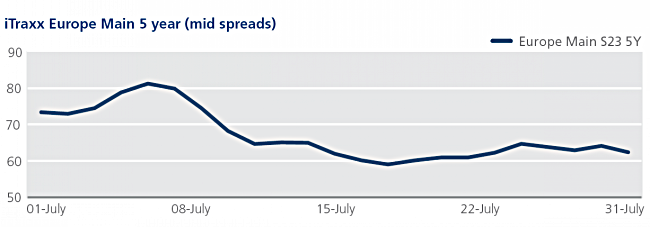

CDS on Tradeweb: In July, spreads for European credit indices hit their widest levels since the index roll on March 20. After closing at 350 bps and 81 bps respectively on July 7, the Crossover and the Europe index ended the month 66 bps and 19 bps tighter. Financial indices followed a similar trajectory, finishing the month 27 bps (FinSen) and 45 bps (FinSub) tighter from their closing levels of 100 bps and 196 bps on July 7.

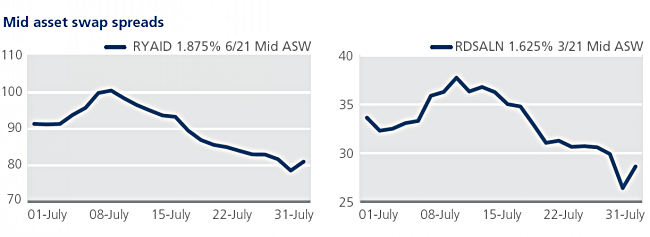

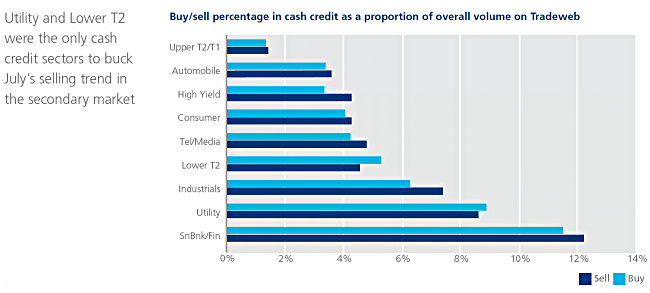

Cash on Tradeweb: Irish budget carrier Ryanair announced on July 10 that its board had voted unanimously to sell its 29.8% shareholding in Aer Lingus to the International Airlines Group (IAG). The IAG bid includes a cash payment of €2.50 per Aer Lingus share, plus a cash dividend of €0.05 per share. In the secondary market, mid asset swap spreads for the Ryanair 1.875% 6/21 bond tightened by 17 bps between July 10 and July 31, closing at 81 bps.

In the Utility sector, Royal Dutch Shell published its quarterly earnings results on July 30. The Anglo-Dutch energy company reported it was expecting operating costs to fall by around 10% in 2015 and that it was also “anticipating some 6,500 staff and direct contractor reductions”. Mid asset swap spreads for the company’s 1.625% 3/21 bond tightened by 5 bps over the month to close at just below 29 bps.