European Credit Update - February 2015

New issuance of euro-denominated corporate debt intensified in February in the wake of the European Central Bank’s announcement on January 22 that it would launch an expanded quantitative easing program, effective in March. U.S. corporations have also been taking advantage of the cheap fixed rate funding available, with their launch of “reverse Yankee” bonds.

Greece’s new government and eurozone finance ministers agreed on February 20 to extend the country’s bailout program by four months. Meanwhile, Sweden’s central bank cut its benchmark lending rate to -0.1% and launched a government bond buying program designed to boost inflation. In the UK, January’s inflation rate was revealed on February 17 to have fallen to a record low of 0.3%.

Across the Atlantic, U.S. Federal Reserve chair Janet Yellen signalled on February 24 that an interest rate hike could take place as early as June 2015. Earlier in the month, the Labor Department had announced an increase of 257,000 in January’s nonfarm payrolls, and revised upwards numbers for November and December 2014 by 147,000.

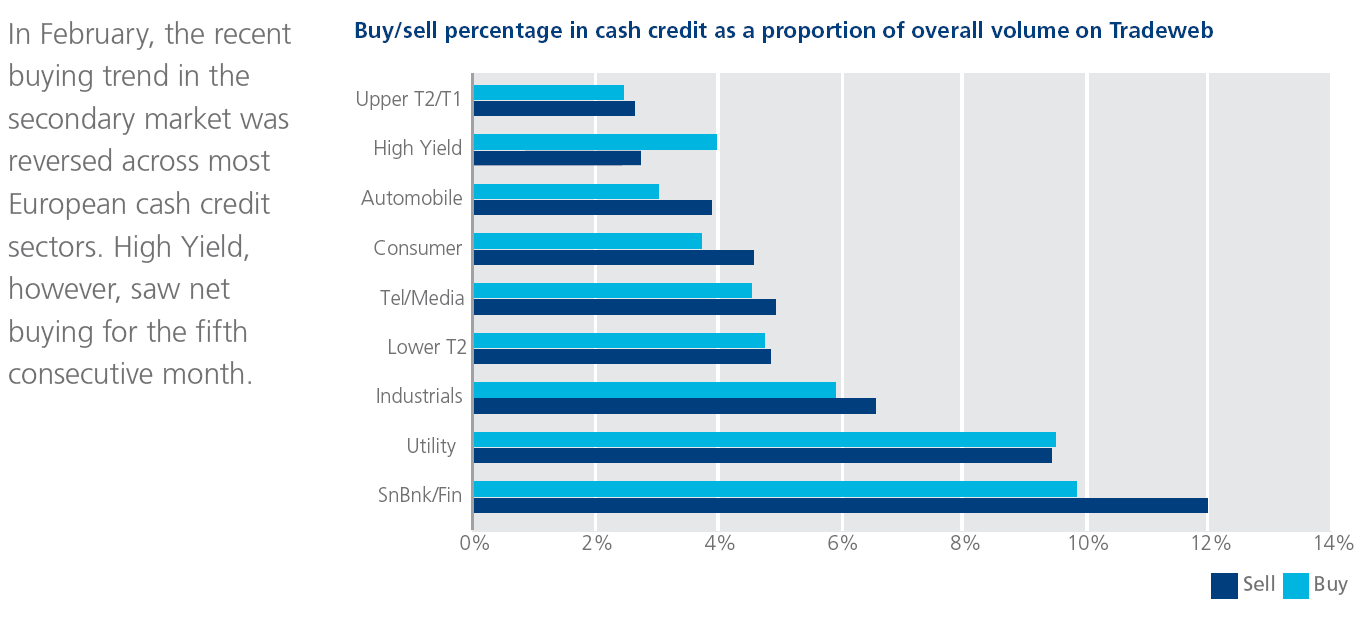

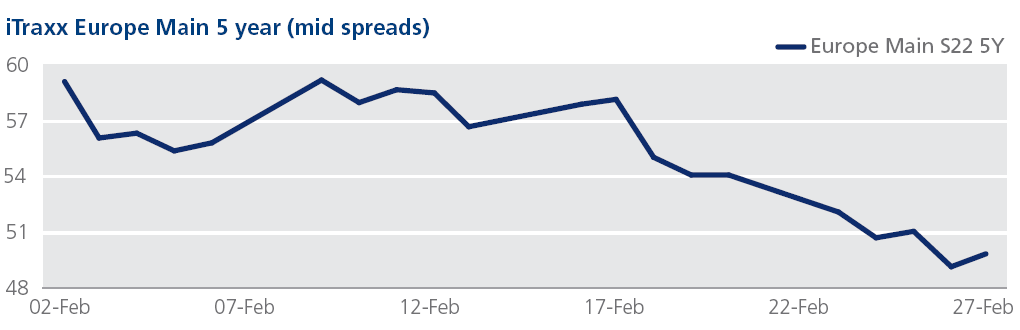

CDS on Tradeweb: In February, European credit indices hit their tightest levels for the latest series 22 since the index roll on October 6, 2014. Europe and Crossover spreads ended the month 10 bps and 63 bps tighter at 50 bps and 262 bps respectively. Spreads for financial indices also ended the month in tighter territory, closing at 54 bps (FinSen) and 122 bps (FinSub) respectively.

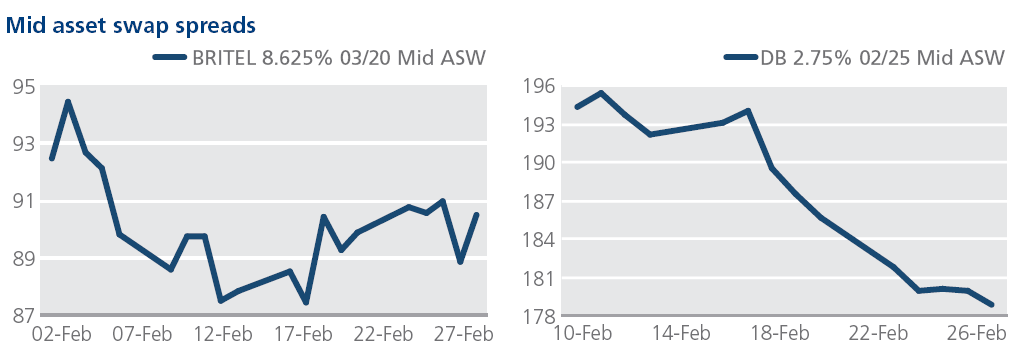

Cash on Tradeweb: Telecomms group BT said on February 5 it had agreed to buy Britain’s largest mobile network EE for £12.5bn. According to BT’s CEO Gavin Patterson, the deal would create the leading communications provider in the UK. Mid asset swap spreads for the company’s 8.625% 3/20 bond tightened by 5 bps to 87 bps between February 2 and February 17, but ended the month at 90 bps.

In Financials, Deutsche Bank announced on February 20 it would boost its investment in green bonds from €200mn to €1bn. Earlier in the month, Germany’s largest lender also sold a €1.25bn issue with a coupon of 2.75%, maturing in February 2025. In the secondary market, mid asset swap spreads for the bond tightened from 194 bps on February 10 to 179 bps at month end.