European Credit Update - August 2015

Concerns surrounding the strength of China’s economy intensified in August, when the country’s central bank devalued the national currency for the first time since 1994. August 24 was dubbed “Black Monday” by local state media, after a crash in Chinese equities spread to other markets and the CBOE Volatility Index surged to its highest level since January 2009.

In Europe, Bank of England governor Mark Carney said on August 29 that the financial turmoil in China was unlikely to affect the chances of an interest rate rise in the near term. Elsewhere, Greek prime minister Alexis Tsipras resigned on August 20, triggering a snap election scheduled for September 20.

Meanwhile, U.S. Federal Reserve members sent contrasting signals about the likelihood of a rate hike in September. While Atlanta Federal Reserve President Dennis Lockhart said on August 4 that it would take a “significant deterioration in the economic picture for me to be disinclined to move ahead”, for New York Federal Reserve President William Dudley the idea of a September interest rate increase seemed “less compelling” on August 26.

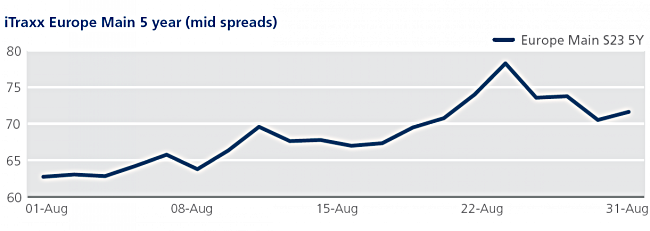

CDS on Tradeweb: Spreads for European credit indices moved wider amid the price volatility caused by China’s stock market crash and continued speculation over a September rate hike in the U.S. The Europe and Crossover closed at 78 bps and 367 bps respectively on August 24, before tightening by 7 bps and 42 bps at month end. Similarly, financial indices finished the month 9 bps (FinSen) and 20 bps (FinSub) tighter from their closing levels of 90 bps and 184 bps on August 24.

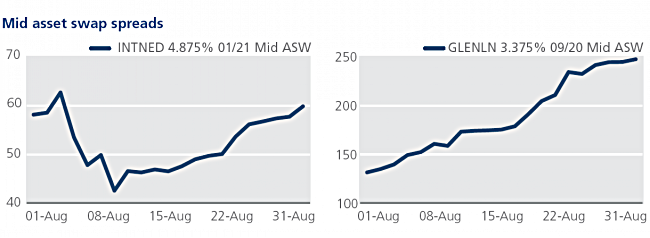

Cash on Tradeweb: The second-quarter earnings season saw ING report on August 5 a 21.1% rise in banking profits year on year. The increase was driven by strong loan and deposit growth, lower risk costs and positive CVA/DVA adjustments. Mid asset swap spreads for the company’s 4.875% 1/21 bond tightened by 20 bps to 43 bps between August 5 and August 11, but closed the month wider at 60 bps.

In Industrials, Glencore released its half-year results on August 19. The miner and commodities trader posted a 29% fall in earnings due to sliding metal and oil prices. In the secondary market, mid asset swap spreads for the Glencore 3.375% 09/20 bond widened by 116 bps over the month to close at 247 bps.