European Credit Update - August 2014

August was marked by heightened geopolitical tensions in the Middle East and Eastern Europe. Responding to July’s EU/U.S. sanctions targeting key sectors of the Russian economy, the country’s prime minister Dmitry Medvedev announced on August 7 an immediate ban on western food imports for one year.

Eurozone GDP figures released mid-month showed 0 per cent growth in the second quarter of 2014, with the area’s two largest economies, Germany and France, performing worse than expected. Meanwhile, eurozone inflation dropped to 0.3 per cent in August, well below the European Central Bank’s target of just under 2 per cent. Speaking at the Jackson Hole Economic Policy Symposium on August 22, ECB president Mario Draghi hinted that the bank’s Governing Council may respond to continued low inflation by easing monetary policy.

In Japan, the economy contracted an annualised 6.8 per cent in the second quarter, as household spending was seemingly affected by a sales tax increase introduced last April. Conversely, UK and U.S. second-quarter GDP data beat forecasts at 3.2 and 4.2 per cent respectively.

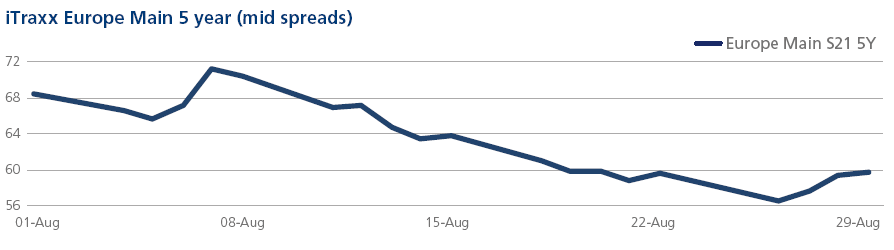

CDS on Tradeweb: European credit indices had a volatile start to the month with spreads for the Main and Crossover closing as wide as 71 and 299 bps respectively. Despite rising geopolitical concerns, both indices marched into tighter territory through the latter part of August, touching 57 and 230 bps on August 26 before closing at 60 and 242 bps respectively on the month. The FinSen index had a similar trajectory, ending the month 14 bps tighter at 61 bps.

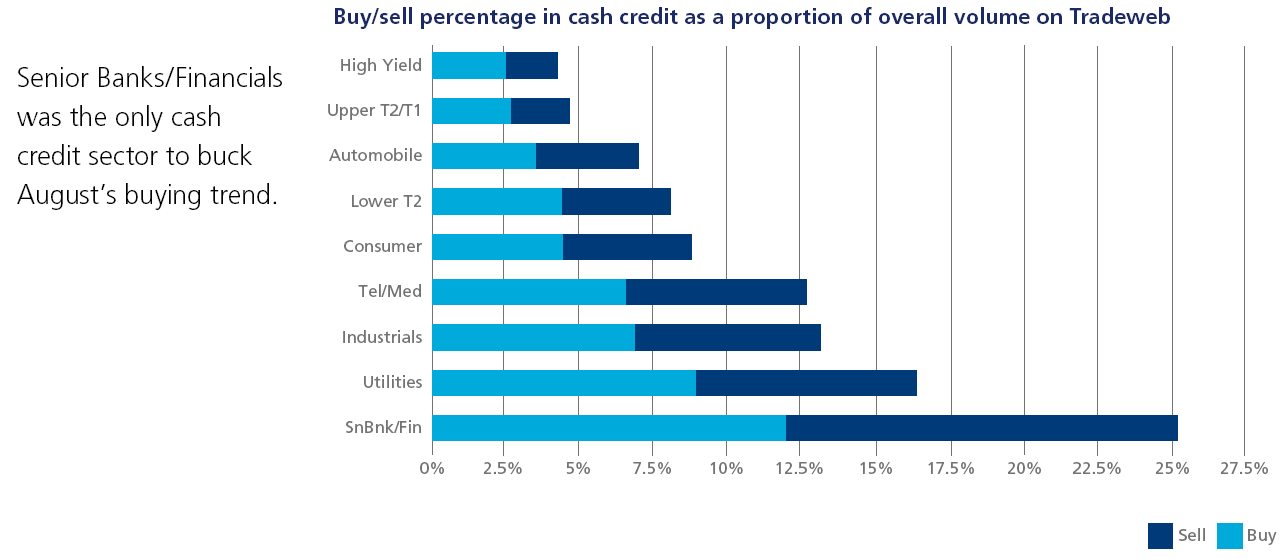

Cash on Tradeweb: Back in June, Mario Draghi announced the launch of the Targeted Long-Term Refinancing Operation (TLTRO), a low-interest loan program allowing Eurozone banks to turn to the ECB for their refinancing needs. Financial new issuance from banks has consequently diminished, dampening secondary market activity.

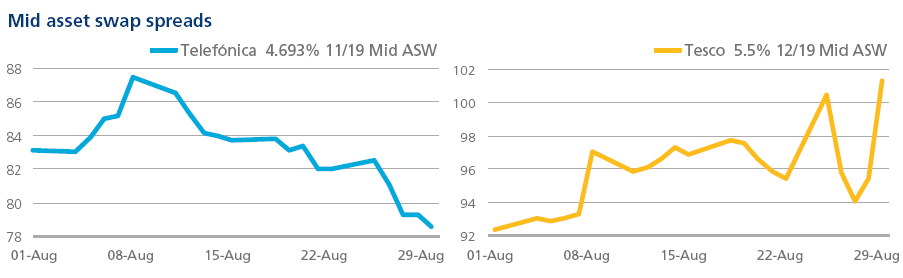

The bidding war between Telecom Italia and Telefónica for Vivendi’s Brazilian GVT arm concluded in favour of the latter on August 28, when the French media and entertainment group said it had decided to enter into exclusive talks with Spain’s telecom giant. Mid asset swap spreads for Telefónica’s 4.693% 11/19 bond widened to 87 bps on August 8, before tightening by 9 bps to close the month just below 79 bps.

Tesco, the UK’s biggest retailer, announced on August 29 that new chief executive Dave Lewis would start work a month earlier than planned, after the company issued its second profit warning in two months and slashed its half-year dividend by 75 per cent. Mid asset swap spreads for its 5.5% 12/19 bond widened from 92 bps to 101 bps over the month.