European Credit Update - August 2013

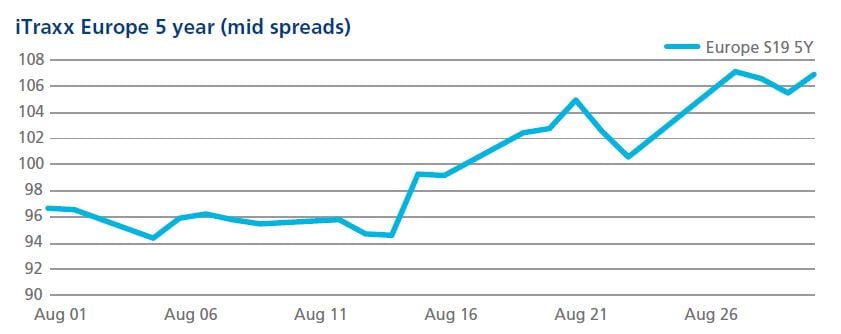

CDS: Mid-August saw the release of several pieces of data that indicated signs of economic recovery in parts of Europe and in the U.S. With this news comes not only the greater likelihood of higher interest rates in the foreseeable future, but also a greater impetus for central banks to reduce, and eventually remove, quantitative easing. Minutes of the June Federal Reserve meeting, released on August 21, confirmed that members are broadly in agreement that they can start tapering QE this year, with it likely to end in the middle of 2014.

Spreads on iTraxx indices were reasonably flat until the middle of the month, after which they all widened substantially. The iTraxx Europe index passed 100 basis points on August 19 for the first time that month, finally closing at 106.875.

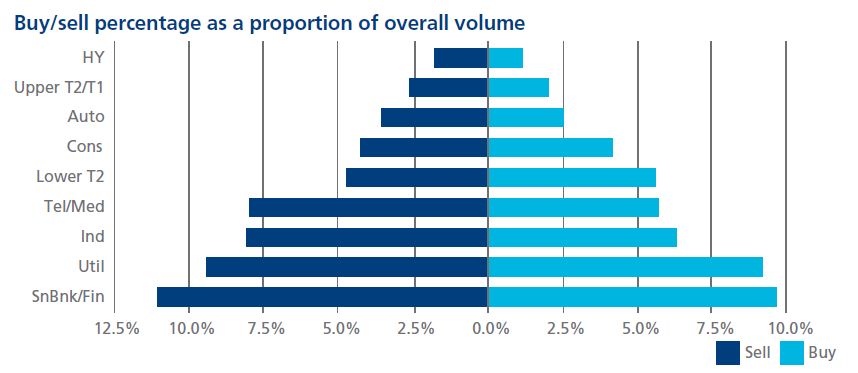

Cash: In the European cash credit markets, high yield, telecoms, autos and industrials sectors saw strong net selling during August. Although some sectors, including senior bank financials and utilities, saw more selling as a proportion of volume, the trend wasn’t as strong as it was in July.