European Credit Update - April 2016

The European Central Bank (ECB) announced the details of its corporate sector purchase programme on April 21. According to the ECB, purchases will begin in June and will include investment-grade euro-denominated bonds, with a maturity of six months to 30 years, and issued by non-bank corporations established in the euro area.

Purchases will be conducted in the primary and secondary markets, and will be carried out by the national central banks (NCBs) of Belgium, Germany, Finland, France, Italy and Spain. Each NCB will be responsible for purchases from issuers in a particular part of the euro area, with the ECB acting as coordinator.

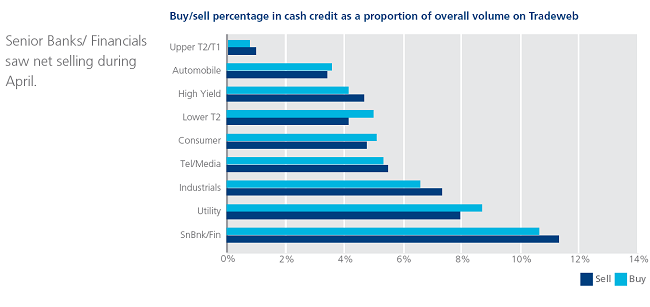

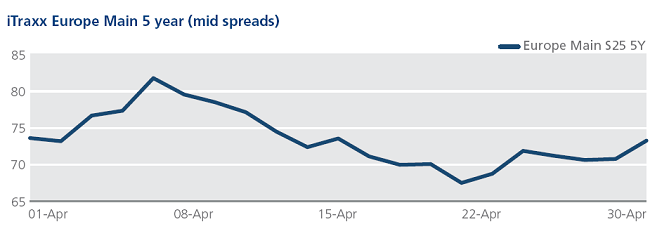

CDS on Tradeweb: April proved to be a volatile month for European credit indices. Spreads for the Europe and the Crossover closed as wide as 82 bps and 336 bps respectively on April 8, before retreating to 68 bps and 290 bps respectively on April 21. However, while the Europe, FinSen and FinSub indices finished flat on the month, the Crossover ended April nine bps wider at 312 bps.

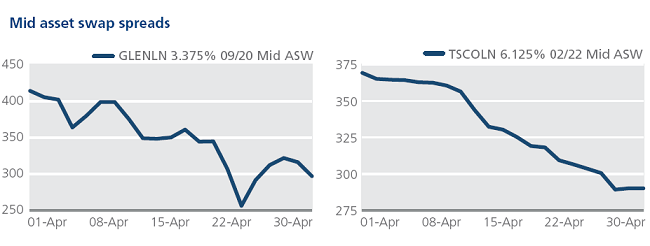

Cash on Tradeweb: Glencore tapped the bond market for the first time in a year with a SFr250m offering issued on April 26. The mining group had been locked out of the credit markets since September 2015, when a note published by Investec analysts commented on its equity value amid sliding commodity prices. In the secondary market, mid asset swap spreads for Glencore’s 3.375% 09/20 bond tightened by 117 bps over the month to close at 297 bps.

In Consumers, Tesco posted an annual pre-tax profit of £162m after last year's £6.4bn loss. The retailer’s CEO Dave Lewis said in a statement that the firm had made “significant progress against the priorities” it had set out in October 2014, and that it had “regained competitiveness in the UK”. Mid asset swap spreads for Tesco’s 6.125% 02/22 bond ended the month 79 bps tighter at 290 bps.