European Credit Update - April 2014

Geopolitical concerns were a recurring theme in April. Tensions in Ukraine showed no signs of easing, due to clashes between government forces and pro-Russian activists in the eastern part of the country. On April 28, the U.S. published a new list of Russian individuals and companies hit by sanctions, with the EU quickly following suit the day after.

In Europe, the ECB’s Mario Draghi hinted that the central bank will provide “further stimulus” if the euro continues to strengthen. April figures show that eurozone inflation currently stands at 0.7%, up from March’s four-year low of 0.5%. Mr Draghi has said that the euro’s strength is one of the main reasons behind the disinflationary trend in the region.

The Bank of England and the Bank of Japan both opted to keep their monetary policies unchanged, while the Federal Reserve announced on April 30 that it would reduce its asset purchases by another $10bn a month.

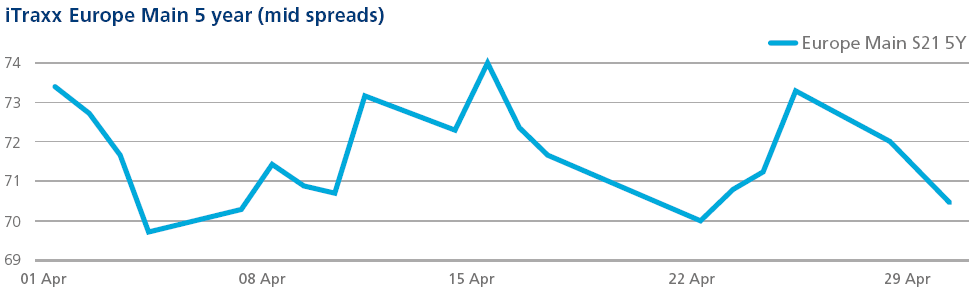

CDS: The 70 basis points level was once again a key support level for Europe Main in April, with the index making several attempts to break through. Any spread widenings occurring during the month – as geopolitical tensions in Ukraine intensified – were always capped.

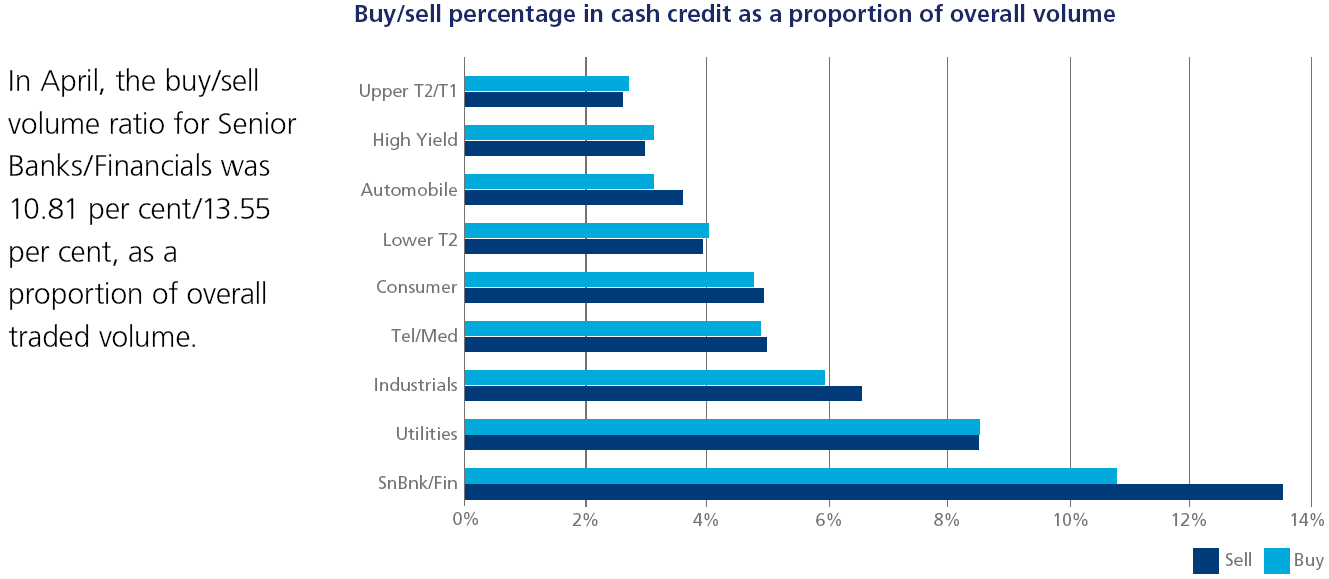

Price action in the Crossover index was also range-bound, with the channel holding within 275 and 295 bps. April’s overperforming indices were Financials; the Senior closed 8 bps tighter with 2 bps of Sen/Sub compression.

Cash: On April 29, the European Banking Authority (EBA) released its methodology and macroeconomic scenarios for this year’s EU-wide stress test. As part of EBA’s efforts to restore confidence in the banking sector, 124 banks will undertake the toughest test to date, hoping they will demonstrate that they are able to survive a series of hypothetical shocks.

In the health sector, British drug maker AstraZeneca rejected a second takeover approach from U.S. rival Pfizer. On Monday 28, the New York-based firm went public with its interest in the UK’s second largest pharmaceutical company. The latter announced its first quarterly profit in more than three years on April 24.

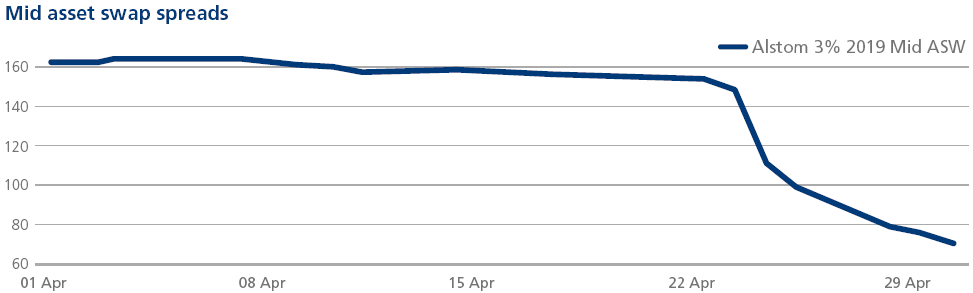

Over to industrials, the month ended with the news that the board of French engineering group Alstom had accepted a €12.35bn all-cash offer from General Electric for its energy arm. Germany’s Siemens, however, has said that it would also make an offer if given access to Alstom’s books. Mid asset swap spreads for Alstom’s 3% 07/19 bond tightened by 89 bps over the month.