Data Points: Government Bond Update - March 2014

Key Points

- Volatility Continues in Core Markets

- European Peripheral Bonds Continue Rally

- Ukraine Yields Fall

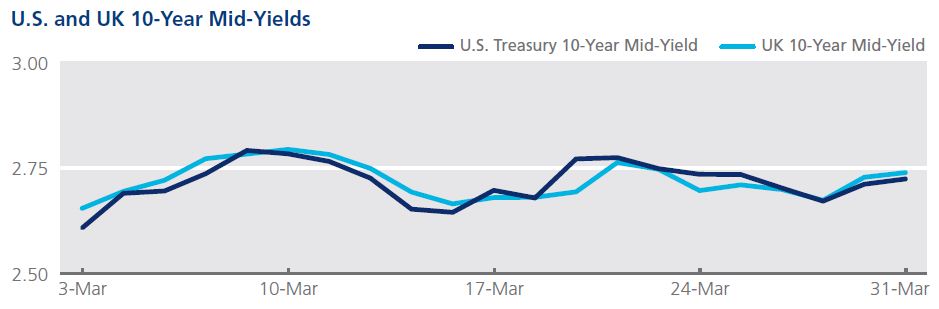

U.S. government bonds experienced a volatile month in March. Federal Reserve Chairwoman, Janet Yellen suggested that the central bank could potentially increase interest rates six months after the Fed ends its bond buying program. The mid-yield for 10-year Treasuries peaked at 2.79% on March 7, the same day the Labor Department reported a bigger-than-forecast increase in nonfarm jobs, later falling 7 basis points to close the month at 2.72%. Conversely, mid-yields on U.S. 5-year bonds climbed 27 basis points from the beginning of March to close at 1.73%. In the UK, the Bank of England altered its forward guidance and kept interest rates unchanged at 0.5% indicating that rate hikes could begin in the second quarter of 2015. However, BoE officials advised a potential rise in rates if inflation pressures increase. The country’s 10-year bond fluctuated over the course of the month, starting at 2.65%, hitting a high of 2.79% on March 10 and ending at 2.74% on March 31.

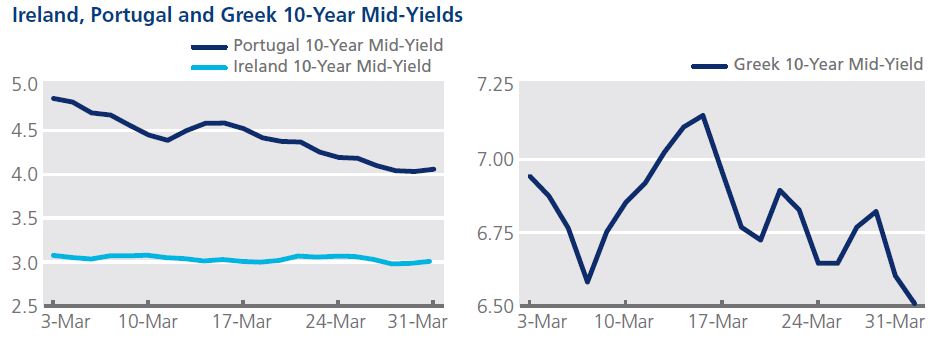

Yields on most European peripheral markets 10-year bonds rallied during a month of positive news. Ireland raised €1 billion in its first bond auction since September 2010. After peaking at over 15% in 2011, the mid-yield for the Irish 10-year bond closed below 3% on March 18 for the first time since June 2005, and ended the month at 3.01%. Similarly, yields on Portuguese 10-year bonds dropped below 4% for the first time since 2010. The country’s benchmark bond yield dropped 80 basis points from 4.86% to finish the month at 4.06%. In Greece, the parliament approved a structural reform package agreed with international lenders, opening the way for disbursement of €8.3 billion in aid in April as part of its €172 billion second bailout by the EU and IMF. The mid-yield on the 10-year Greek bond fell 44 basis points from the beginning of the month to 6.51% at month-end.

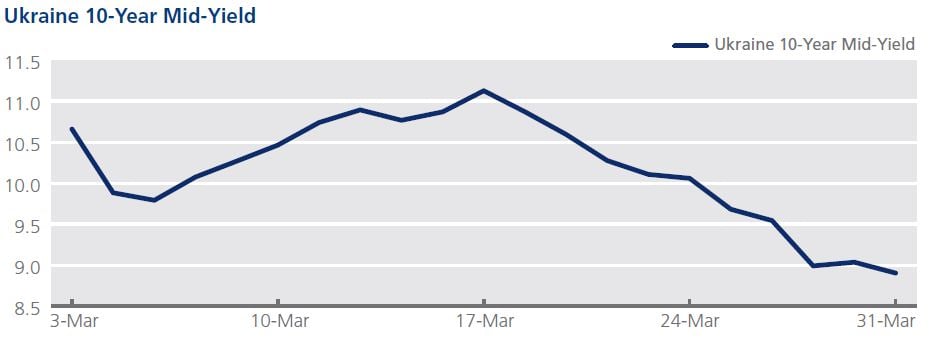

Rising geopolitical tensions in Central Europe continued to dominate headlines. On March 27, nearly 10 days after Crimea joined the Russian Federation, the IMF announced a $14bn-$18bn rescue package for Ukraine. The mid-yield on the Ukrainian 10-year bond saw significant volatility hitting a month high of 11.12%. It subsequently dropped 212 basis points to close the month at 9%.

The mid-yield on the Ukrainian 10-year bond saw significant volatility