Data Points: Government Bond Update - February 2014

Key Points:

- Leading Core Markets See Volatility

- European Peripheral Bonds Rally

- Ukraine Yields Suffer

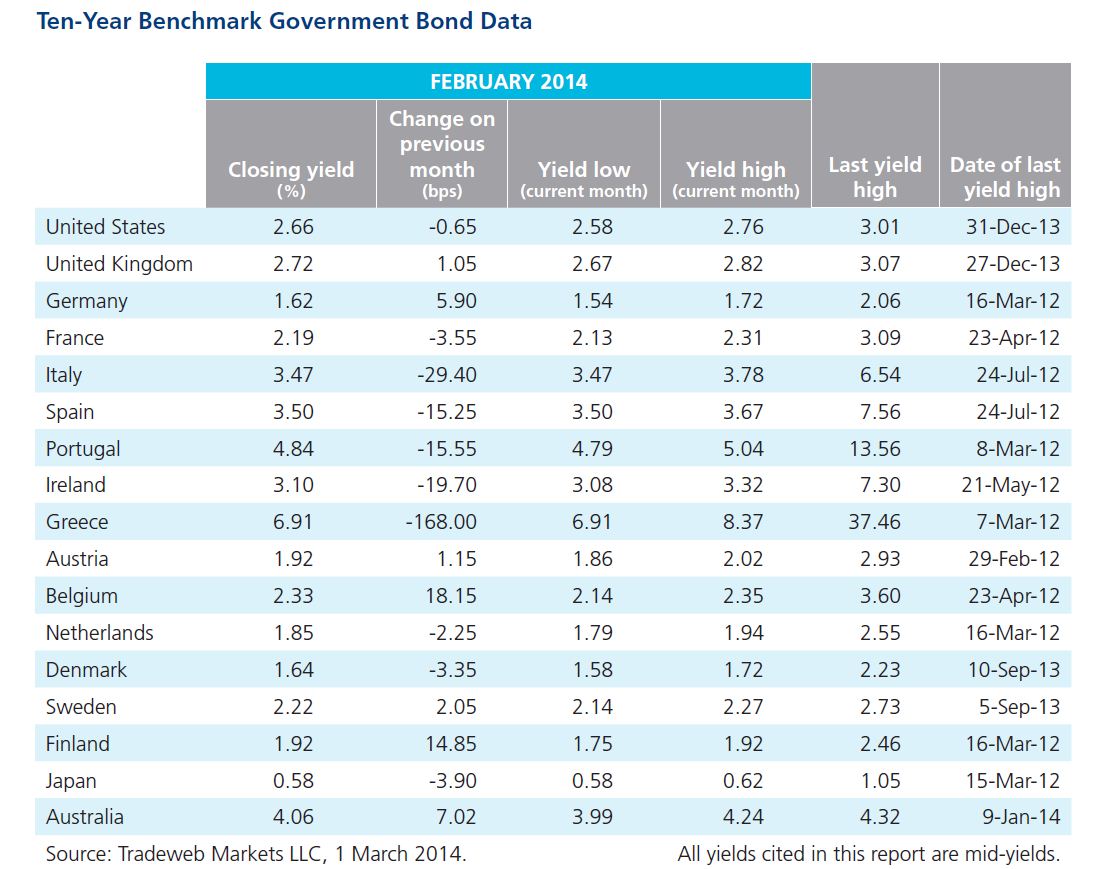

U.S. Federal Reserve Chairwoman Janet Yellen signaled that the central bank would continue scaling back its bond purchases, in her testimony before the House Financial Services Committee on February 11. Mid-yields on 10-year Treasuries fluctuated over the course of the month, starting at 2.58% on February 3, hitting a high of 2.76% on February 12 and dropping to 2.66% at month-end. Similarly, mid-yields on Gilts reached a month high of 2.82% on February 12, the same day Bank of England Governor Mark Carney delivered forward guidance that interest rates would remain steady. The benchmark bond which began the month at 2.69%, ended at 2.72%. Japan’s central bank expanded two loan-support programs to encourage borrowing in the country, while maintaining its monetary policy. Mid-yields on the country’s 10-year bond fell two basis points to end the month at 0.58%.

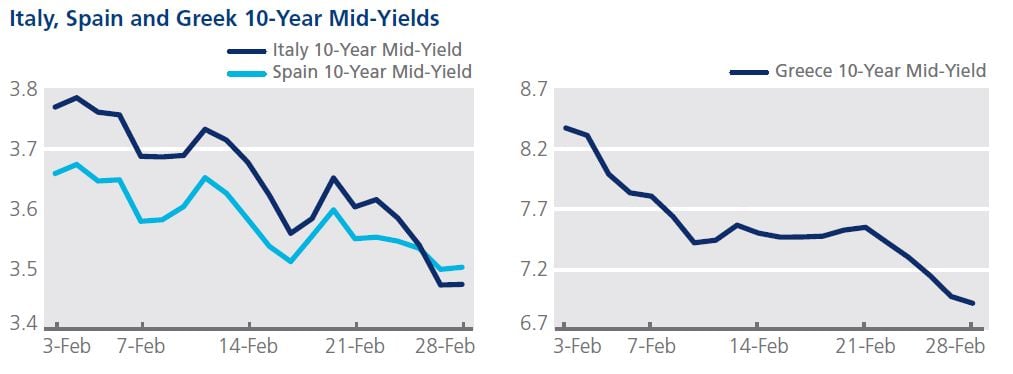

European peripheral markets saw bond yields decrease in February. Greece’s Public Debt Management Agency hinted at a return to international capital markets, and mid-yields on Greek 10-year debt fell below 7% on February 27 for the first time since April 2010. The benchmark bond which started the month at 8.37% fell 146 basis points to close at 6.91%. Meanwhile, Moody’s Investors Service upgraded credit ratings for both Spain and Italy. Spain’s sovereign debt rating increased one notch to Baa2 with a positive outlook. Mid-yields on the country’s 10-year bond fell 15 basis points from the start of the month to end at 3.50%. Moody’s outlook for Italian debt also improved to “stable” and re-affirmed the country’s Baa2 and Prime-2 debt ratings. Italian benchmark bond mid-yields dropped from 3.77% on February 3 to end the month at 3.47%.

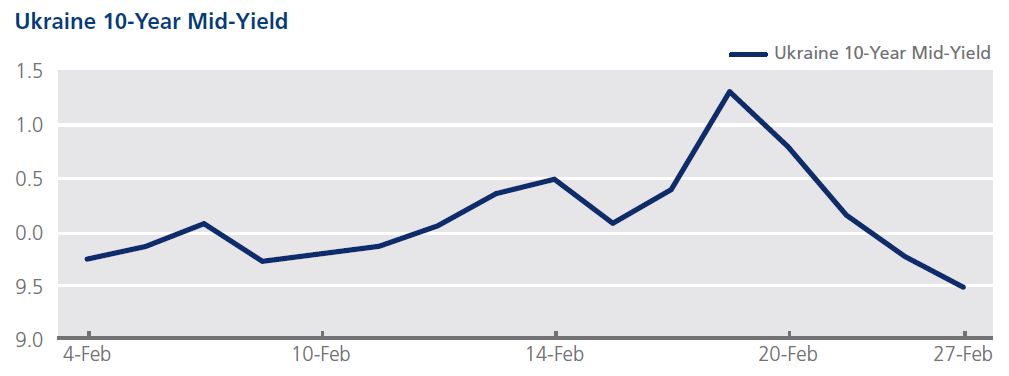

Headlines of political uncertainty in Ukraine dominated much of the news cycle, and the country’s 10-year bond yields saw substantial volatility in February. Mid-yields on the 10-year, which opened the month at 9.73%, jumped 155 basis points to reach a month high of 11.28% on February 19, and subsequently tumbled 181 basis points to close at 9.47% on February 28.

Mid-yields on Greek 10-year debt fell below 7% on February 27 for the first time since April 2010