Data Points - ETF Update - May 2019

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Total traded volume on the Tradeweb European ETF marketplace reached a record-breaking EUR 29.9 billion in May, narrowly beating February’s previous best performance by EUR 391 million. Furthermore, the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution Tool (AiEX) increased to 55.7%, a new monthly high.

Volume breakdown

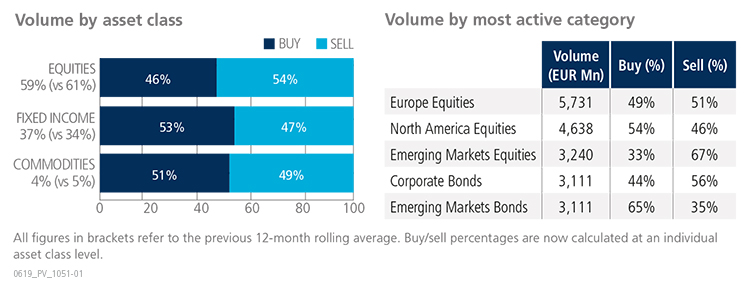

Fixed income and commodity ETFs saw net buying in May, in contrast to their shares-based counterparts. Trading activity in equity ETFs accounted for 59% of the overall platform flow, lagging the previous 12-month rolling average by two percentage points. Europe and North America Equities were the most active ETF categories during the month, with a combined traded notional of nearly EUR 10.4 billion.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “Stock ETFs were primarily sold in May amid investor concerns over ongoing trade disputes, geopolitical uncertainty and a global economic slowdown. Instead, assets such as government bonds were aggressively bought and saw high traded volumes.”

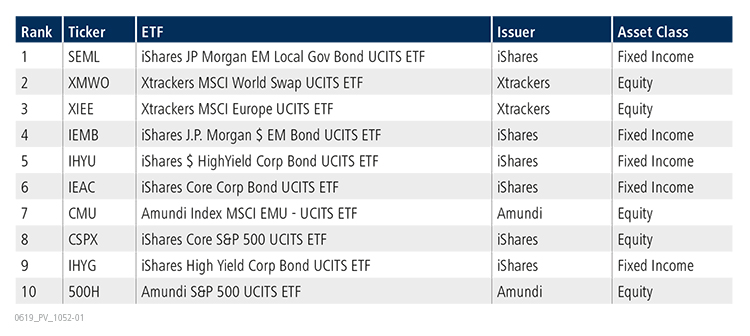

Top ten by traded notional volume

The iShares J.P. Morgan EM Local Government Bond UCITS ETF proved to be the most heavily-traded product for the second consecutive month. In second place, the Xtrackers MSCI World Swap UCITS ETF last featured in the top ten list in February 2019.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in May 2019 was USD 7.74 billion.

Volume breakdown

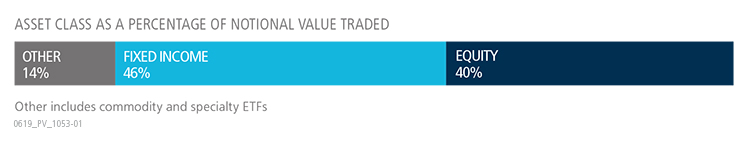

As a percentage of total notional value, equities accounted for 40% and fixed income for 46%, with the remainder comprised of commodity and specialty ETFs. Nearly 53% of U.S. ETF trades were executed via the Tradeweb AiEX tool.

Adam Gould, head of U.S. equities at Tradeweb, said: “As trade tariffs dominated the news, May proved to be a very challenging month for equities with most trading lower. Conversely, there was an outsized amount of activity in the fixed income ETF space. Some investors moved from equities to bonds, while others moved from high yield bonds to less risky shorter dated Treasuries. Nearly half of the Tradeweb U.S. ETF platform volume was in fixed income funds; an outsized number relative to the overall market and our platform generally.”

Top ten by traded notional volume

During the month, 500 unique tickers traded on Tradeweb’s U.S. ETF platform, with six of the top ten funds offering exposure to fixed income assets.