Compression Trading: A Move toward Operational, Risk Management and Cost Efficiency

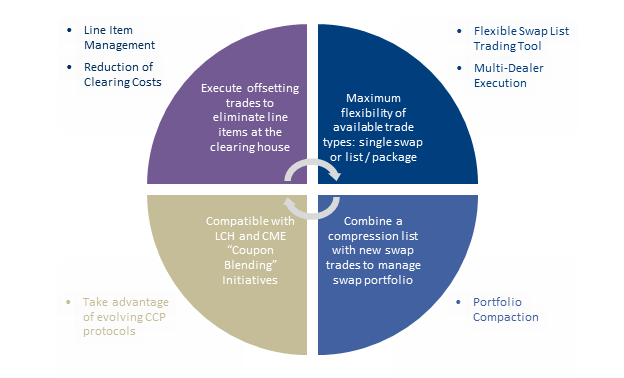

Market participants are adjusting to the new normal under global derivatives reform as e-trading of derivatives continues to increase. During this transition, Tradeweb has focused on delivering tools to help improve trade workflows and overall efficiency on its swap execution facilities (SEFs). Among these, Tradeweb is helping investors reduce line-item clearing costs and provide more efficient execution of custom interest rate swap lists for compression and compaction trades.

Tradeweb led the industry with the first fully-electronic compression trade on TW SEF in November 2013, and since then, Tradeweb has seen significant increases in this type of trading. Clients are now actively compressing and compacting custom lists of swap transactions, which includes trades that currently do not fall under the made available to trade (MAT) mandate. In July 2014 alone, Tradeweb has already seen more than $40 billion traded through the use of the compression tool.

For even more background on the new functionality and recent growth, please see our latest topic brief: Operational Efficiencies for Derivatives: Custom Swap List Trading with Line Item Compression. In addition, check out this Q&A on DerivAlert with Michael Furman, managing director at Tradeweb, for some additional color.