2015: A Year in Market Milestones

2015 will go down in history as a milestone year for global financial markets. Consider the list of monumental, one-of-a-kind market events, which reads like the résumé of an outrageous political candidate known for their liberal use of superlatives:

- Record low yields in German 10-year Bunds

- Largest one-day increase in Greek government bond yields on Tradeweb

- Widest 10-year U.S. Treasury swap spreads in history

- Highest yields in over 5 years for short-term U.S. Treasury notes

There’s no question about it; in the years following the financial crisis, the rates markets have become a macroeconomic seismograph, delivering an immediate feedback loop for global activity and uncertainty. Consider the performance of Eurozone debt, where yields for core and peripheral countries appeared in an un-choreographed dance. And in the U.S., the Federal Reserve’s long awaited decision to raise interest rates kept investors on baited breath all year long as yields gyrated on short term Treasury debt.

Meanwhile, the marketplace has continued to evolve in significant ways that have drastically impacted trade workflows and the business of trading fixed income and derivatives. The corporate bond landscape is in a new renaissance for electronic trading, introducing new protocols and functionality into the marketplace, and the dialog on algorithmic and high frequency trading in rates has reached new highs as market participants evaluate new and different ways of engaging liquidity.

Over the last twelve months, Tradeweb Markets has kept a watchful eye on all these moves in fixed income markets as a means of benchmarking the magnitude of different monetary and geopolitical events. At the center of the global government bond marketplace, here are the most significant events influencing trading over the course of 2015:

Negative Government Bond Yields throughout Europe

In January 2015, nearly one quarter of all Eurozone government bonds were yielding below zero percent.

This meant investors were paying for the privilege of lending to central banks. There were a number of reasons for this phenomenon. For one, the European Central Bank (ECB) had cut interest rates to below zero and initiated bond repurchasing to prop up the economy. And despite the negative yields, asset managers continued to hold fixed income instruments in their portfolios, keeping the bond-buying spigot open throughout the dislocation.

On January 22, the ECB announced its intention to purchase government bonds yielding above the deposit facility rate of -0.20% as part of its easing program that launched on March 9 – leading to a 33% increase in European government bond trading volume in January v. December 2014. Yields continued to fall, however, and the percentage of Euro-based government bonds with a negative yield increased to 38.03% on April 14. A sell-off set in and Euro area government bond yields moved upwards again, and the percentage of negative-yielding instruments fell back to 22.21% by June 10. On the same day, the 10-year Bund mid-yield closed at 1%–its highest level since September 23, 2014.

The summer brought speculation that the ECB would ease monetary policy further, and Mario Draghi announced that the governing council was ready to do so on September 3. Yields for bonds with shorter tenures plunged to new record lows by December 2, a day before the ECB lowered its deposit rate to -0.30%, a move expanding the universe of bonds eligible for purchase under the ECB QE scheme. The chart below depicts the bid yield on the 2-year German note over the past 12 months and shows the trend in stark relief, with negative yields for the entire 12-months of 2015.

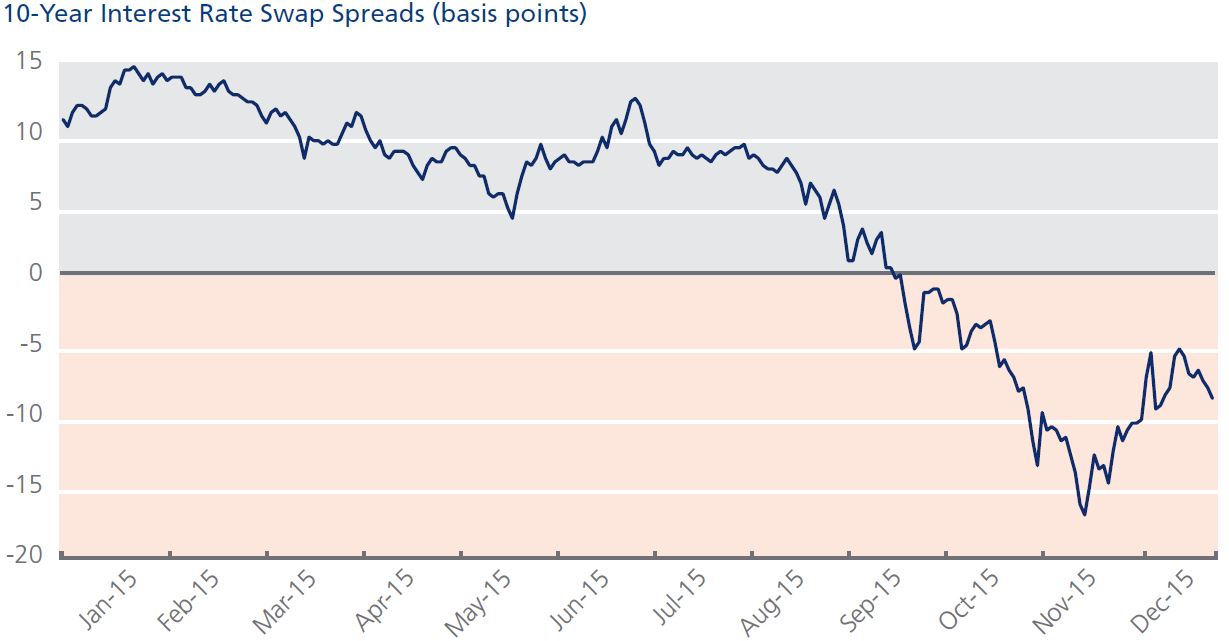

Negative Swap Spreads

In the U.S., one of the more notable market dislocations of 2015 has been the inversion of the 10-year interest rate swap spread, which turned negative in September and has stayed there ever since.

The 10-year interest rate swap spread measures the cost for investors to exchange floating-rate cash flows for fixed-rate cash flows in the interest rate swaps market. It had been falling since July of 2015 in anticipation of an interest rate increase by the Federal Reserve, but also in response to surging supplies of corporate debt and persistently low yields on U.S. Treasury securities.

The benchmark spread is calculated by adding the bid yield of the 10-year U.S. Treasury note to equivalent U.S. dollar denominated interest rate swap spreads. As the chart below indicates, 10-year swap spreads first went negative on September 25, closing at -1.75 basis points. The spread continued to widen to a record low of -16.75 basis points on November 20. Since then, the spread has been on a tightening trend, but is still holding in negative territory at -5.5 basis points.

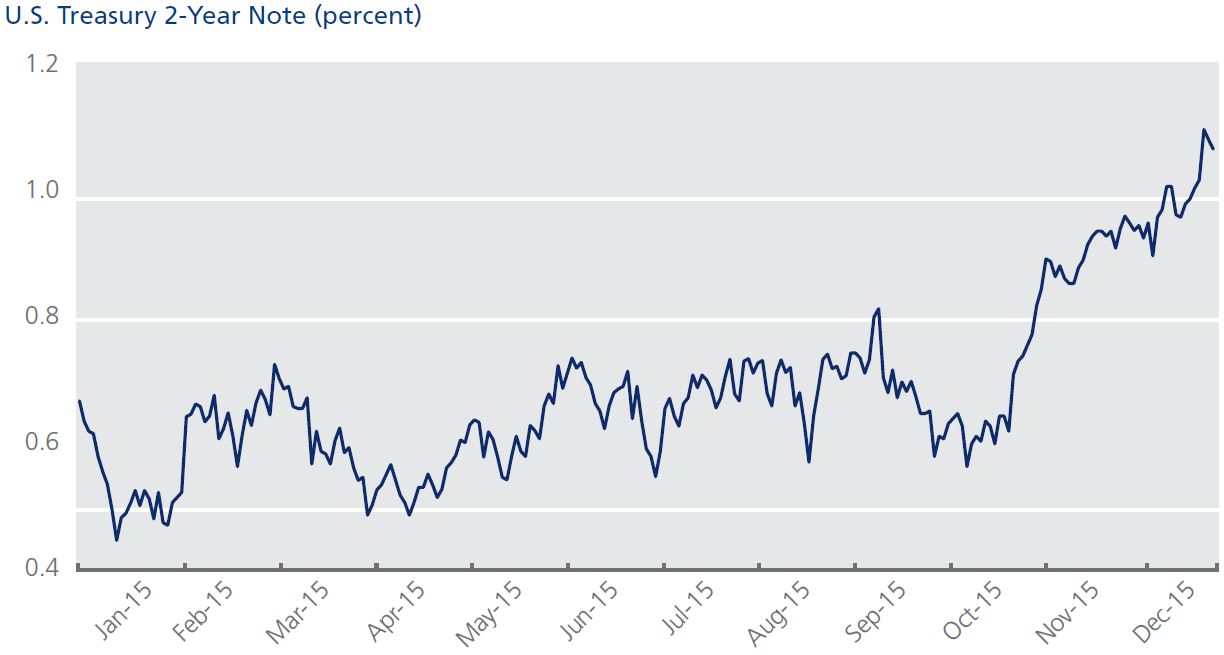

U.S. Treasury Yields Start to Climb on Fed Rate Rise

Perhaps the biggest market data event of the year was also the most hotly anticipated – the U.S. Federal Reserve ending its seven-year run of keeping the Federal Funds Rate at zero percent, with a historic decision to raise rates for the first time since 2006 on December 16, 2015.

The results were immediate as trading volume increased 10% from November. The bid yield on the 2-year U.S. Treasury note reached its highest level in more than five years, rising above 1.0% for the first time since May 3, 2010. A similar, but less dramatic move unfolded in the 10-year U.S. Treasury note, which closed at 2.29% on the day of the Fed announcement, up 2.3 basis points from the previous day.

The following chart depicts the 12-month trend in the 2-year U.S. Treasury yield as it has slowly climbed from a low of 0.444% in January to 1.064% in December.

Central Bank Policy Divergence Widens Further

However, the U.S. Federal Reserve was the only major central bank to tighten monetary policy in 2015. The ECB, on the other hand, boosted quantitative easing and other central banks maintained their own expansionary measures.

This divergence was highlighted in December 2015 when the Federal Reserve became the first major central bank to raise interest rates since the financial crisis, despite a low inflation rate of 0.5% in November. In contrast, the ECB announced it would extend quantitative easing until March 2017 at the least, and also cut its deposit facility rate to -0.30%. This move came amid low Euro area inflation – 0.1% in November – but promising GDP growth rose steadily from 1.2% in Q1 2015 to 1.6% in Q3 2015.

European government bonds generally traded significantly lower than their US counterparts, with 32.26% of the total issued amount yielding less than zero as of December 2.

Similarly, the Bank of England and the Bank of Japan maintained their asset purchasing programs in 2015, worth £375 billion and ¥80 trillion respectively, while Sweden’s Riksbank boosted its own plan by another 65 billion kronor (€6.9 billion) in October.

Political Uncertainty Tests Europe’s Peripheral Economies

A year of political uncertainty exposed a drop in public support for bailout commitments and strict deficit reduction targets in Greece, Portugal and Spain amid bond market volatility.

The threat of a Greek exit from the Eurozone, following the nation’s default on its rescue loan from the International Monetary Fund, increased as the newly-elected anti-austerity government sought to renegotiate the terms of its bailout. On June 29, at the height of speculation over how Greece would move forward, yields on the 10-year Greek government bond surged to their highest levels since 2012, when the nation’s debt was restructured. Yields on the Greek 10-year bond closed at 15.43% on June 29, after rising 462 basis points in a single day. It was the largest one-day yield move since electronic trading of Greek government bonds began on Tradeweb in 2001. The upward spike continued until its peak of 19.23% on July 8, when a bailout package was finally announced.

Meanwhile in Portugal, Socialist leader António Costa was appointed prime minister on November 25, ending six weeks of political uncertainty after October’s inconclusive election result. Yields on Portuguese 10-year bond rose to 2.85% on November 9, but finished the year at 2.52%, nearly a full percentage point above its lowest closing value of 1.54% on March 16.

Meanwhile in Spain, the December 20 election left the country without clear leadership as the incumbent Popular Party failed to secure a majority. The Spanish 10-year government bond finished 17 basis points higher over the year at 1.77% – comfortably between its lowest closing mid-yield of 1.08% on March 11 and the highest closing mid-yield of 2.37% on June 15.

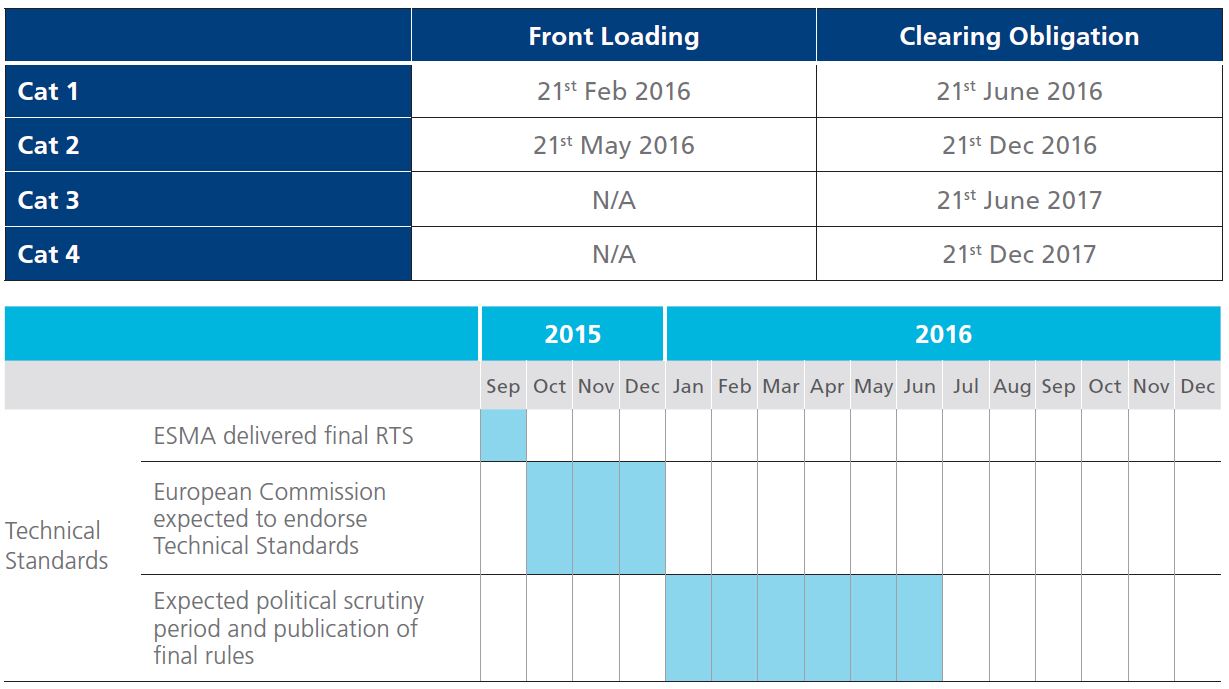

Regulation Sharpens Focus in Europe and Asia

2015 saw the European Securities and Markets Authority (ESMA) make considerable progress in writing the rules that will implement mandatory clearing and trading for OTC derivatives. On December 21, the regulatory technical standards (RTS) went live for the first instruments mandated to clear under the European Market Infrastructure Regulation (EMIR).

Additionally, ESMA further developed and consulted on rules to implement the Markets in Financial Instruments Directive II (MiFID II) and Markets in Financial Instruments Regulation (MiFIR). These rules include specific aspects of the new pre- and post-trade transparency for numerous asset classes, including OTC derivatives and ETFs, as well as a mandatory trading obligation for derivatives. And on September 28, ESMA delivered its final RTS to the European Commission, which are expected to be adopted during the first half of 2016.

However, the industry widely expects delays to the January 2017 implementation of these rules so that regulators gain ample time to build the necessary systems and infrastructure for surveillance and monitoring. Market participants and trading venues haven’t slowed down in the meantime, working together to interpret available rules and information in preparation for the transition to a new regulatory regime.

Japan was the first country in Asia to introduce mandatory electronic trading for specified OTC instruments on September 1, 2015. The Financial Services Agency now requires institutions with derivatives positions greater than ¥6 trillion to execute 5-, 7- and 10-year yen swaps on regulated Electronic Trading Platforms (ETPs), which must then publish trade-related information.

The first transactions under the new regime were completed on the same day the rules came into force. And e-trading has grown rapidly, with more than ¥2 trillion traded across five different ETPs in September, led by Tradeweb accounting for ¥765 billion alone (ClarusFT data).

Elsewhere, authorities in Australia are developing proposals for their own electronic trading mandate, while legislators in Hong Kong and Singapore have been drawing up requirements for reporting and clearing. In Singapore, even though the country’s Monetary Authority previously stated that it does not intend to introduce an e-trading mandate for derivatives, it has nevertheless proposed putting in place the necessary legal framework for its potential implementation. We’ll continue to see greater implementation of new regulations in 2016 as clearing obligations come into effect and approval of new rules are expected before the third quarter.

Innovation Grows in Transaction Cost Analysis

As electronic trading has driven greater efficiency in the fixed income workflow, the availability of new information to interpret and manage trading activity continues to increase the focus on business performance. Compounded by upcoming regulatory reform in some regions and demand for improved compliance and monitoring tools, transaction cost analysis (TCA) for the bond markets is beginning to take hold.

In the equities markets, firms have had access to analytical solutions for TCA for years. However, the availability of such tools in the fixed income space has only just come to the forefront, as more robust trading information has become more readily available and tracked in electronic workflows.

With real critical mass in electronic trading of government bonds, firms like Tradeweb have begun to introduce new analytics that help institutions better understand their trading activity and support efforts to ensure best execution. Connecting the point of execution directly with systems to process and view TCA has introduced a new level of transparency into fixed income trading desks. Most importantly, this new information is helping organizations continue to become more intelligent and efficient in their counterparty selection and discovery of liquidity. And on the back-end, risk and compliance managers have a real view of trading activity, benchmarked against aggregate market data, like Tradeweb’s composite pricing and other post-trade reports.

However, there is new ground to cover as TCA offerings continue to expand beyond government bonds, European credit, covered bonds, supranationals, agencies and sovereigns. As new regulation increases the quality and availability of post-trade information around the globe, we’ll continue to see new applications for TCA to enhance best execution and overall trading operations.

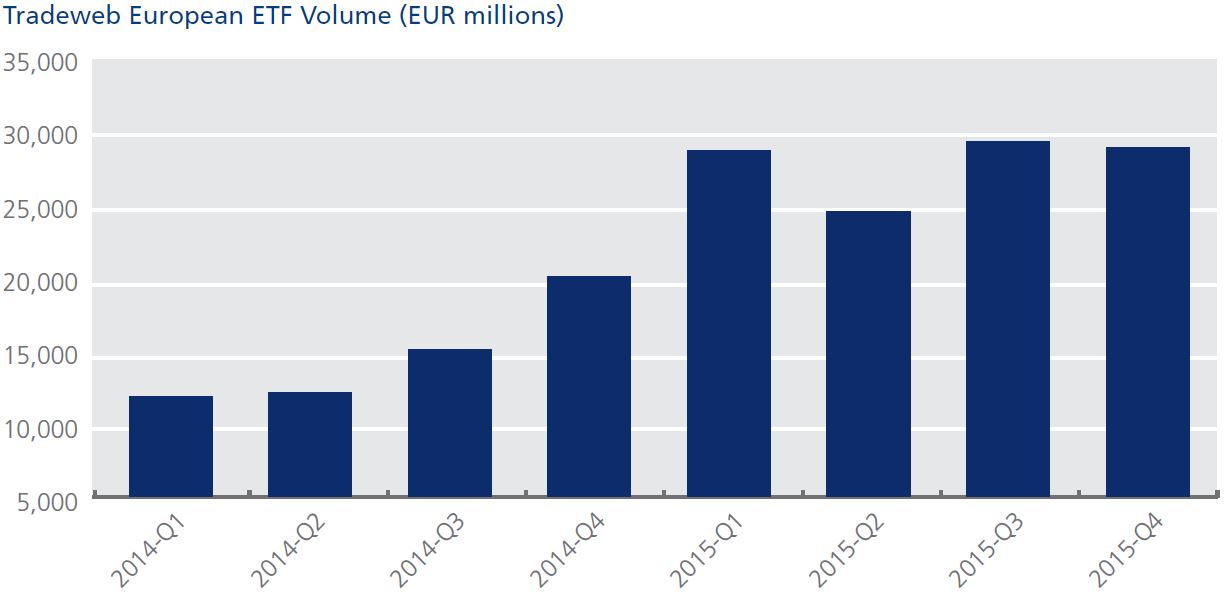

Popularity in Fixed Income ETFs Climbs Higher

Exchange-traded funds (ETFs) have enjoyed consistent, fast-paced growth in assets since their launch more than two decades ago, exceeding $3 trillion in assets worldwide in May 2015. However, ETF liquidity and the way in which it trades has continued to evolve in different ways.

Now in its fourth year, the Tradeweb European-listed ETF marketplace represents one of the largest venues for ETF trading in Europe. European ETF volume surpassed €112 billion on Tradeweb in 2015, with nearly one third of the overall activity resulting from the growing use of fixed income ETFs in Q4. This represents an interesting trend in how market participants are leveraging request-for-quote and other protocols to gain best execution in an otherwise fragmented marketplace.

Off-exchange trading continues to gain traction with the institutional fixed income community as they have begun accessing greater levels of liquidity through new trading protocols. And investors are quickly learning about the liquidity benefits of fixed income ETFs as they seek new ways of managing risk, especially in the corporate bond market.

Tradeweb is working with the industry to help support this crossover in trading of traditional equities products by fixed income investors, and partnered with BlackRock iShares and State Street to help develop new standards for analysis, evaluation, and calculations for converting yield, spread and duration with fixed income ETFs into identical terms for the underlying bonds.

Investors are also taking advantage of new post-trade reporting and access to dealer axes on venues like Tradeweb, introducing new data to inform better counterparty identification and improve access to liquidity. This has been so impactful, hit rates have shown to increase by five percent when sending a request-for-quote to axed dealers, and by ten percent when trading fixed income ETFs. And as market participants prepare to trade ETFs under MiFID II in Europe, we’ll continue to see even greater adoption of e-trading ahead of mandatory reporting coming into effect.

Derivatives Trading Outlook for 2016

2015 was a banner year for the electronification of derivatives markets, and some of the key issues and advances in swap trading seen to date may serve as indications for what’s next in the twelve months ahead. Market participants are leveraging new tools to source liquidity and optimize portfolios, while keeping a watchful eye on regulatory reforms in Europe and Asia. Average daily trading volumes on Tradeweb have increased to more than USD $30 billion on TW SEF. In addition, the platform has seen approximately 75% of D2C block trading, as of October 2015, according to ClarusFT.

The factors driving this growth include increased use of tools like buy-side compression, which helps improve line-item management at derivatives clearing organizations (DCOs), and the adoption of products like market-agreed coupon (MAC) swaps, that offer standardization to ease the process of rolling positions.

We expect innovation will continue in the U.S., Europe and Asia. Japan has already had a successful launch of electronic trading platforms (ETPs), and in the near future European market participants will focus their resources on the upcoming clearing mandate and the eventual trading and reporting reforms under MiFID II.

As swap trading continues to adapt to new regulatory requirements and we continue to see an increase in electronic trading, technological solutions are helping increase transparency, efficiency and compliance for all participants.

Record Corporate Bond Issuance Amid Rising E-trading

Bond sales by investment grade American corporations eclipsed the $1 trillion mark by September of last year1, putting 2015 squarely on track for a record-setting pace of corporate bond issuance in the U.S. A similar trend has played out around the world, with the notional dollar value of global bond sales topping $2 trillion in December2, not quite a record, but among the top four most active years for global bond deals in the last two decades.

The drivers of this trend are no mystery. Seven straight years of record-low interest rates have made the allure of cheap debt too hard to ignore for companies looking to raise funds and incremental improvements in the economy have given yield-starved investors the confidence they need to buy corporate debt.

Increasingly, the task of creating liquidity in the enormous market for corporate bonds is falling to electronic trading platforms. According to a December report from Greenwich Associates, the share of investment-grade bonds that trade electronically has doubled over the past two years and now makes up 20% of total market volume.3

Firms like Tradeweb are helping to drive this adoption with new methods of counterparty identification and streamlining trade workflows. For example, integrating its U.S. credit platform with its Treasuries marketplace, Tradeweb has deployed the industry’s first fully automated Treasury spotting tool. This significantly reduces a relatively manual and tedious process for hedging the interest rate risk of corporate bond trades, while reducing the likelihood of human error in the process. As we approach the brave new world of a rising rate environment, tools that improve the overall workflow and aid in the discovery of liquidity will gain even greater relevance in supporting greater efficiency in the marketplace.

Evolution and Progress of Algorithmic Trading in Fixed Income

Algorithmic trading firms now account for 60% of activity in electronic Treasury trading, up from 45% in 2012, according to Tabb Group research appearing in The Wall Street Journal.4 That’s a staggering number when you consider that the market for U.S. Treasuries, arguably the most liquid market in the world, is currently valued at about $12.7 trillion.

The growing presence of algorithmic traders in the Treasury market has been met with a combination of enthusiasm and caution on Wall Street. Proponents of the tech-enabled approach to rapid-fire trading have consistently shown that the increased order flow they create has improved liquidity and makes pricing less volatile.

Regulators haven’t been as clear-cut in their support for the algorithmic evolution of Treasury trading, and have been hard at work since the “flash crash” in Treasuries on October 14, 2014. But this November, the Commodity Futures Trading Commission (CFTC) proposed new rules as part of its regulation on automated trading (Reg AT) that will allow regulators to inspect the source code algorithmic traders use to guide their trading activity without a subpoena – a new step forward in oversight of the market. Trading industry groups have voiced concern that the rule exposes algorithmic traders’ proprietary information to third party security risk and could potentially undermine competitive advantage.5

Though buy- and sell-side demand, and liquidity within the institutional marketplace remains rooted in disclosed, request-for-quote trading, the debate over all forms of electronic trading in rates markets is bound to grow in the coming years.

Looking Ahead to 2016

While it’s impossible to predict the future, many of the issues that drove such significant market moves this year are still very much a factor for the year ahead. With stimulus still being pumped into European markets, a great deal of fixed income supply still owned by the U.S. Federal Reserve and continued concerns about market liquidity prevalent across all corners of the financial marketplace, it’s a safe bet that we haven’t seen the end of recent volatility.

This feeling of uncertainty is familiar, like when the industry first began working on reform under Dodd-Frank over five years ago: a commitment to preparation and improved operational performance. Whereas derivatives continue to provide market participants with effective risk management, access to efficient trading tools on SEFs will result in increased adoption of solutions like buy-side compression, and standardized instruments such as market-agreed coupon (MAC) swaps. When new products are made available to trade on SEFs, the scale of e-trading will increase.

Meanwhile, the global credit marketplace is warming up to new operational efficiencies afforded by electronic trading. We’re still in the early stages, but clients have begun to leverage a range of new technology to improve their ability to source liquidity, gain quality execution, and improve workflows at lower costs.

Similarly, trading in U.S. Treasuries will continue to hold its share of the spotlight, especially as the roles of market participants are changing and influencing liquidity. As the leading venue supporting Treasury trading in the institutional, wholesale and retail communities, we’re looking forward to leading the technical revolution by providing more efficient solutions, more liquid trading platforms, and more connections to more industry participants.

1 Tradeweb, Mixed economic data doesn’t dampen a buoyed investor sentiment http://www.tradeweb.com/Blog/Tradeweb/Mixed-economic-data-doesn-t-dampen-a-buoyed-investor-sentiment (January 16, 2014)

2 Tradeweb, Data Points: Government Bond Update - October 2014 http://www.tradeweb.com/Blog/Data-Points/Data-Points--Government-Bond-Update---October-2014 (November 07, 2014)

3 International Monetary Fund, Global Growth Disappoints, Pace of Recovery Uneven and Country-Specific http://www.imf.org/external/pubs/ft/survey/so/2014/NEW100714A.htm (October 7, 2014)

4 Sudeep Reddy, The Wall Street Journal, What the Economic Forecasters Got Right—and Wrong—in 2014 http://blogs.wsj.com/economics/2014/12/31/what-the-economic-forecasters-got-right-and-wrong-in-2014 (December 31, 2014)

5 David Milliken and Huw Jones, Reuters, Plunging oil prices could boost geopolitical tensions - BoE report http://www.reuters.com/article/2014/12/16/britain-boe-risks-idUSL6N0U01BV20141216 (December 16, 2014)