2021 Annual Client Letter

To our clients, partners and friends:

Looking back to this time last year, about the only positive thing any of us could say about the year 2020 was that it was nearly behind us. This year we find ourselves in a far better and more hopeful place. Clearly the pandemic has not been defeated – in fact at this moment we are all processing the potential impact of the latest Omicron variant – but the global vaccine push has nonetheless eased our return to a more familiar rhythm.

So first and foremost, we would like to thank our clients, our employees and all of those who have persevered during this historic year. From the forces driving the U.S. Treasury market, to the continued growth into emerging markets and an ever-increasing global focus on ESG, to name a few, it seems every single team of ours, in every single market, is going full tilt. We have never been busier, never served more clients around the world, and never facilitated more trading.

There is more to come. We feel like this year was sort of a prologue, with plenty of plot twists ahead in markets including a new chapter on electronic trading. Without spoiling the ending, here are some of the narratives we see unfolding in 2022.

Treasuries – Record Volume, Continued Evolution

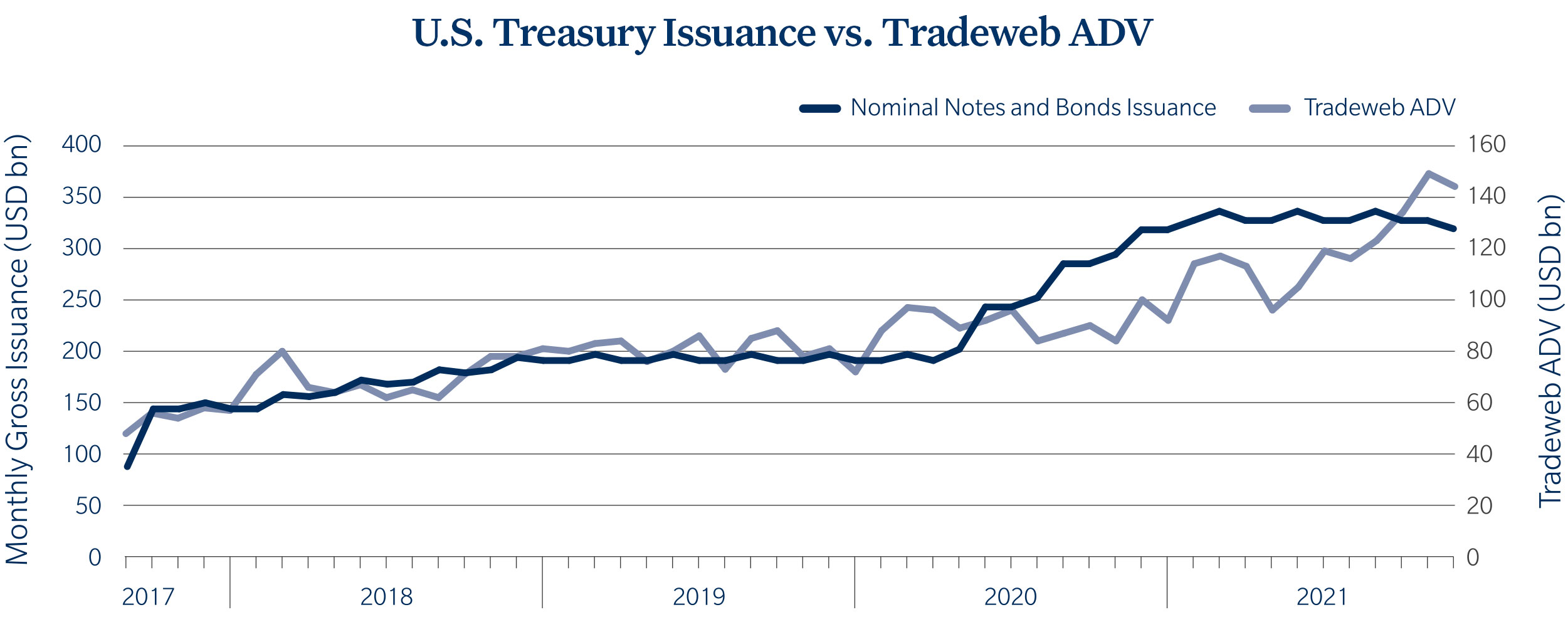

It is impossible to talk about U.S. Treasuries in 2021 without first acknowledging record volumes, both in terms of new issuance and trading activity: gross issuance of nominal Treasury bonds and notes hit an all-time high of $414 billion in February of this year. Additionally, trading activity on the Tradeweb platform broke records throughout the year, hitting a record $148.9 billion in average daily volume in October.

One reason for the heavy activity has been stimulus, which is expected to abate in the coming months. In early November, the Federal Reserve announced that it would start tapering the pace of its asset purchases. Similarly, plans to start reducing monetary stimulus have been considered by the European Central Bank and the Bank of England.

However, central bank intervention is only part of the story. New innovation and the increasing sophistication of the marketplace has fueled the growth of hybrid trading desks. Non-bank liquidity providers now assuredly play a far larger role in market making, particularly in more electronic, dealer-to-dealer markets. We currently estimate that roughly 80% of the wholesale market and 40% of the institutional market are trading electronically, and we continue to refine and differentiate our offerings to support this increasingly diverse marketplace. Our acquisition of Nasdaq Fixed Income in 2021 was another example of differentiation, and allows us to provide both direct streaming and central limit order book (CLOB) trading options for our wholesale clients, underscoring Tradeweb’s role as the leading marketplace for U.S. Treasuries. As the needs of markets evolve, industry dialogue has also increased. In November, the Inter Agency Working Group in the U.S. proposed a series of changes intended to strengthen the U.S. Treasury market and we will, of course, contribute to this important discussion going into the new year.

LIBOR is Dead, Long Live RFR

This year will also be remembered as the end of LIBOR as we knew it. New risk-free rates (RFR) have been introduced in markets around the world, including the Bank of England’s Sterling Overnight Index Average (SONIA), the Swiss Average Rate Overnight (SARON), the Tokyo Overnight Average Rate (TONA) and the European Central Bank Euro Short-Term Rate (€STR).

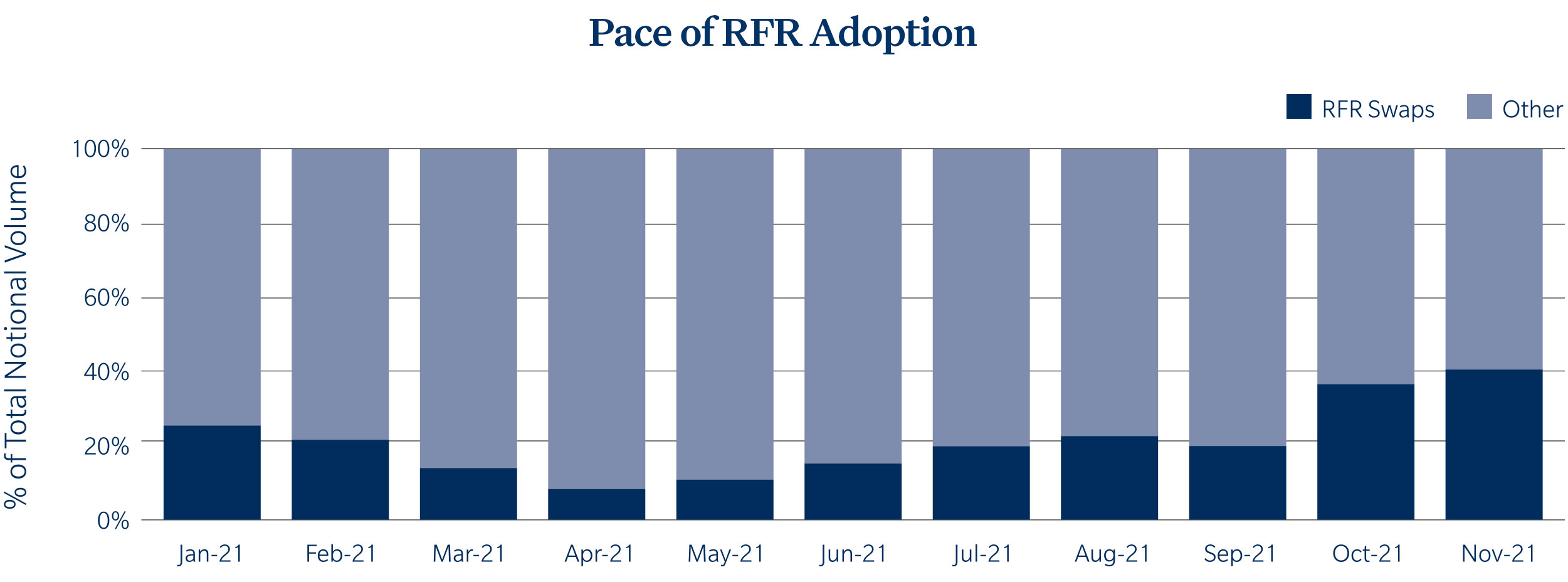

Uptake of these new rates, encouraged strenuously by regulators, has been robust: for example, the SONIA First Initiative for sterling swaps spurred volumes traded on our platform to grow from 31% in January 2021 to more than 99% ten months later in October 2021. Over the same period, SARON volume increased from a mere 1% of volume in January to 96%; while TONA was up from less than 1% to 99%.

For the U.S. derivatives market, the U.S. Federal Reserve’s Secured Overnight Finance Rate (SOFR) became the unofficial leader in the alternative reference rate horse race this summer. On July 26, 2021, dealer-to-dealer swaps markets officially moved to a SOFR-first posture in the U.S., and by November, institutional SOFR trading on Tradeweb as a percentage of new risk hit a new record of 24.3%[1]. So far, roughly two-thirds of our most active institutional clients have already traded SOFR, putting the benchmark firmly on the path to becoming the new market standard.

The transition to these rates has relied on very significant, and often arduous efforts by regulators and market participants alike, and we’ve worked alongside both groups to ease the transition. This includes building out our platform to facilitate every RFR trade our clients would historically do in LIBOR, while our compression tool helps our clients each day to switch from their legacy LIBOR positions and into other risk-free rates globally.

ESG Continues Move from Talk to Action

The world’s largest financial institutions made history this November at the UN Climate Change Conference, when they pledged to shift their funding to help reduce carbon emissions. Projected to generate upwards of $100 trillion through 2050 to fund investments needed for new clean energy technologies, the initiative marks a significant step toward aligning bold climate goals with the substantial financial backing required to achieve them. Along with this announcement financial regulators, including the U.S. Federal Reserve and the Bank of England, have agreed to add their own oversight to the process through reviews and disclosure standards.

This deepening connection between financial markets and environmental, social and governance goals has been building throughout the year in fixed income markets as well. According to Refinitiv, sustainable finance bonds surged 76% year-on-year to reach $552bn and an all-time first-half record in green bonds, which are financing products specifically designed to support climate or environment related projects, hit $259bn in the first half of this year, nearly three times first-half 2020 levels.

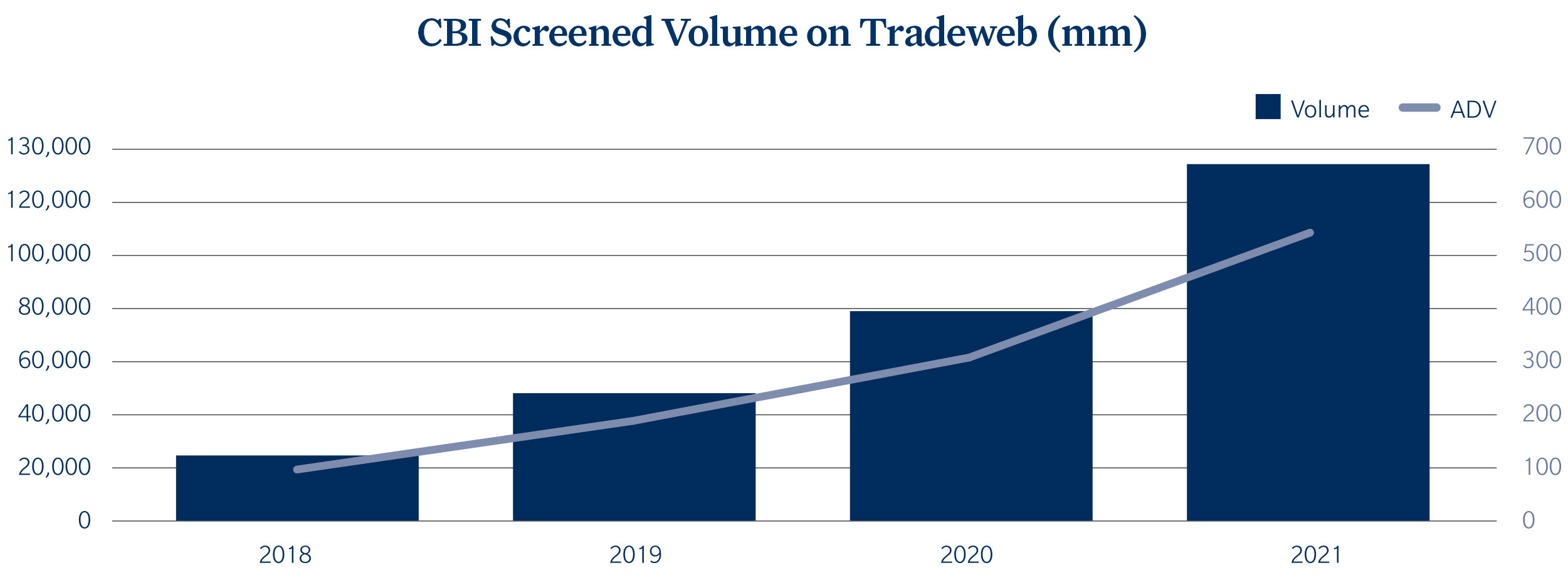

Reflecting that momentum, Tradeweb joined the Climate Bonds Initiative’s Partner program this year to offer increased market transparency. As part of the program, Tradeweb is leveraging Climate Bonds data and the Climate Bonds Standard and Certification Scheme to provide clarity and transparency around its green bond trading volumes. In a further step, we also published our first Sustainability Report, which outlines our own commitment to corporate transparency and the highest possible ESG standards across everything we do.

We expect to see this trend for increased ESG transparency and disclosure within the financial markets to continue, as global regulations such as the EU taxonomy continue to play an important role in ramping up sustainable activities across various sectors.

The Electronic Credit Trading Tipping Point

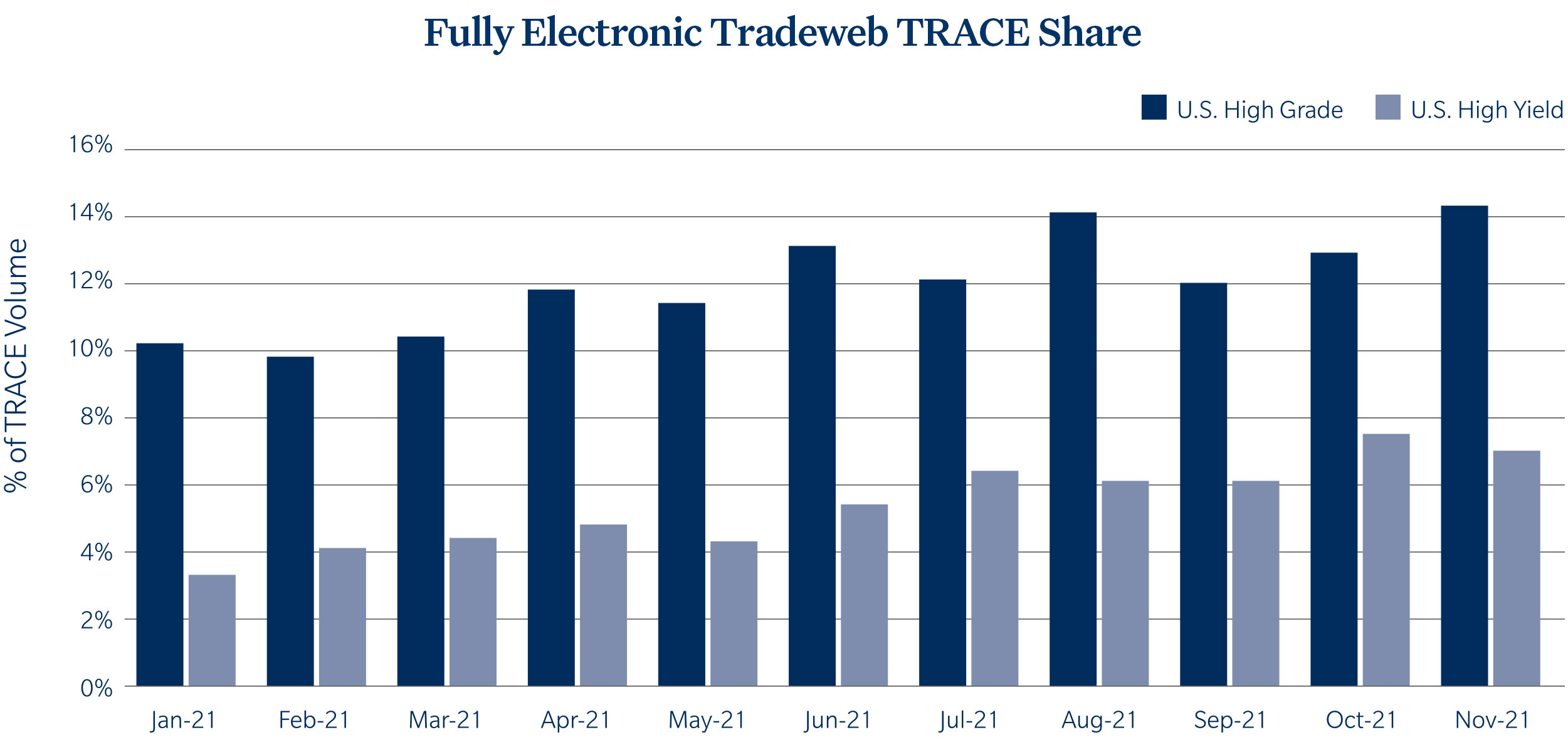

The widespread disruption caused by the 2020 pandemic marked a critical turning point for electronic trading in the corporate bond markets. With the entire marketplace suddenly working remotely, electronic markets became a vital lifeline. According to data from Coalition Greenwich, average daily volume in corporate bond electronic trading in the U.S. climbed from just over $5 billion to more than $10 billion in 2020. Further, over a three-year period from 2017-2020, electronic credit trading in the U.S. grew 111% for investment grade and 145% for high-yield bonds. In Europe, over the same period, electronic credit trading grew 60%.

Even as the runaway pace of U.S. corporate bond issuance normalized and traders started returning to their desks in 2021, increased reliance on electronic trading platforms has not slowed. In fact, average daily electronic trading volumes in U.S. credit climbed to $11.5 billion by March of 2021.[2]

Electronic credit trading, in all its many forms, has evolved from new kid on the block to the norm. At Tradeweb, our strategy has focused on serving the entirety of the credit market. This includes anonymous trading via Tradeweb AllTrade, which coalesces liquidity from across our institutional, wholesale and retail markets to power one of the most complete RFQ solutions on the street; portfolio trading, which is driving more efficient risk transfer for some of the largest trades the buy-side needs to execute; and next generation net spotting, which is making it easier for credit market participants to tap the U.S. Treasury market to hedge risks.

What’s most exciting to us is the sheer breadth of this evolution. Whether our clients are using automated trading for their U.S. High Grade volume from their desks in New York, or opting to exchange bespoke baskets of high yield and emerging market debt in Paris, the race is on towards a more electronic corporate bond market.

Further Expanding Global Trading

It is no secret that government bond yields have been low for quite some time. They’ve been so low, in fact, that it was major news this past October when the pool of negative-yielding euro-denominated government debt had fallen to just €5.42 trillion. In fact, the German 10-year Bund yield is still negative, currently sitting around -0.3%.

Meanwhile, the ICE BofA High Yield World Sovereign Bond Index, which consists of several emerging market sovereign bonds, currently yields just over 4% despite elevated global inflation rates.

That’s an important distinction for fixed income investors who need to source both liquidity and yield in this low-rate environment. Together, that push for yield, combined with increased access to emerging markets through electronic trading platforms, has driven more overseas investors into Latin American and Asian markets than ever before. Through the first half of this year, over $600 billion in emerging markets interest rate swaps volume has been executed on Tradeweb. That compares to roughly $500 billion for the full year 2020 and $200 billion for all of 2019.

A vital part of that effort is our expansion of investor access to China’s vast local bond markets. Building on our collaborative initiative with the China Foreign Exchange Trade System (CFETS) under the Bond Connect channel, in September 2021 we introduced a trading link to Southbound Bond Connect to allow China onshore institutions to invest in Hong Kong’s fixed income markets. Tradeweb was the first platform to enable offshore investors to buy and sell Chinese onshore bonds via its trading link to Northbound Bond Connect, and since the launch of Bond Connect in 2017 more than $900 billion in CNY cash bonds trades has been executed on the Tradeweb platform.

Bring on 2022

The resilience of global markets and market participants over the last two years is remarkable. In the face of seemingly insurmountable challenges and never-ending disruption, markets keep adapting and finding new ways to efficiently move risk.

With 2022 on the horizon, we are optimistic that the combination of positive economic indicators, increased control over the pandemic, and improved resilience and agility among market participants will set the stage for a period of exceptional growth.

For our part at Tradeweb, we will continue to collaborate alongside our clients and partners to introduce new innovations and workflow enhancements that make it possible to not only thrive as the macro situation develops, but also anticipate and respond to volatility, seize new opportunities and drive continued improvements in efficiency and profitability.

We look forward to continuing to partner together to move our markets forward in the year to come.

|

|

||

|

Lee Olesky |

Billy Hult |

Click here to download the letter.

Click here to view our Forward Looking Statement.

[1] As a percentage of DV01

[2] Source: Coalition Greenwich