Trading Activity in Italian Government Bonds Surges on Tradeweb

Weekly Italian bond trading volumes surpassed their previous record set in 2011

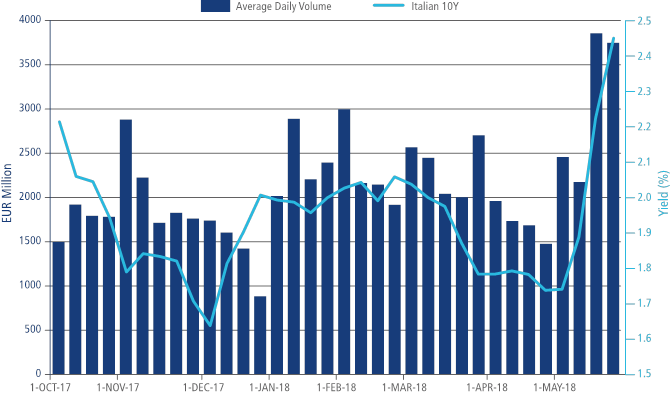

Italian government bond[1] trading volumes and yields saw sharp increases on Tradeweb’s European Government Bond marketplace over the last few weeks. Weekly average daily trading volume (ADV) in Italian debt set a new record at EUR 3.9bn two weeks ago and was EUR 3.8bn last week, as market volatility rose around political news in Italy. The record volume marked an increase of 75% relative to average weekly volumes in 2018 so far.

The previous record weekly ADV for Italian debt was reached during the summer of 2011 at EUR 3.5bn, when Italy’s 10Y benchmark bond yield rose from below 5% to 6.25%. Currently[2], yields on the Italian 10Y bonds are up by more than 130 basis points, and are 170 basis points wider relative to the German 10Y, from April closing levels. The country’s 2Y bonds are over 180 basis points higher today, and over 280 basis points – 310 basis points relative to the German 2Y – this month.

Meanwhile, May average daily volumes are up by over 60% compared to both April 2018 and May 2017. Both trading volumes and yields have remained above levels seen during Brexit.

“Quote rates[3] and hit rates[4] for Italian bond enquiries on Tradeweb remained robust, despite ongoing market volatility”, says Enrico Bruni, head of Europe and Asia business at Tradeweb. “Strong platform metrics demonstrate that buy-side clients continue to receive competitive pricing throughout the sell-off in Italian debt.”

Weekly ADV of Italian Government Bonds and 10Y Benchmark Bid-Yield Since 4Q17

The Tradeweb European Government Bond marketplace is a leader in D2C OTC electronic trading of nominal bonds, inflation-linked bonds, treasury bills, strips and CCTs from more than 20 countries in Europe. Launched in 2000, the platform provides buy-side firms with access to liquidity from 36 of the world’s largest dealers in EUR, GBP, DKK, SEK, NOK, CHF and HUF issues. Clients also benefit from enhanced pre-trade information and analysis to meet ‘best execution’ requirements thanks to 3,000+ live axes posted directly by European government bond liquidity providers. Furthermore, Tradeweb’s automated trading tool enables buy-side traders to define parameters that determine how to execute different profiles of orders, thus enhancing trading efficiency and capacity to focus on larger size transactions.

To learn more about Tradeweb’s European Government Bond platform, click here.

[1] Nominal bonds, STRIPS and Inflation-Linked Bonds

[2] As of 29 May 2018

[3] Quote rate=(# of liquidity providers responding to RFQ) / (# of liquidity providers queried ) for regular session trading only

[4] Hit rate=(# of trades executed) / (# of trade inquiries) for regular session trading only