Tradeweb Government Bond Update – September 2022

Elections, inflation, tax cuts and continued monetary policy tightening were only a few factors impacting the global government bond market in September. Yields on many major government bond notes hit 3-year highs, as central banks remain focused on taming inflation and markets reacted to geopolitical events around the world.

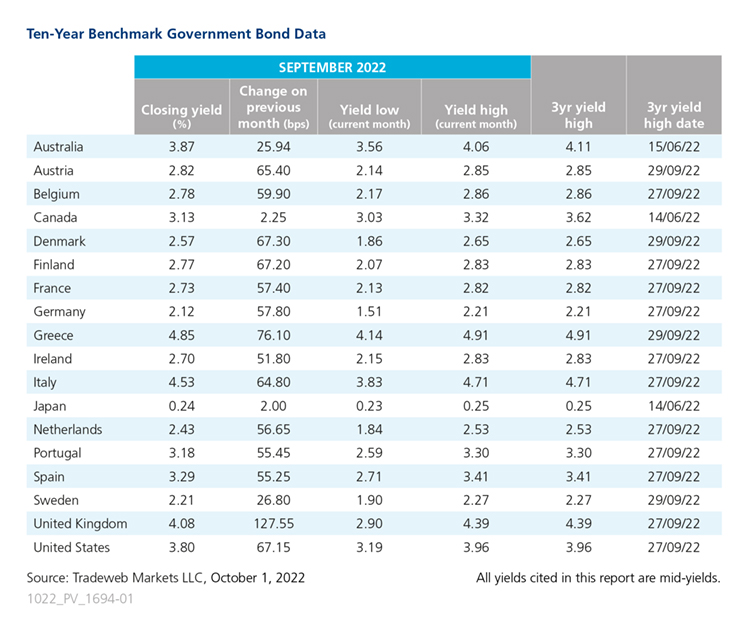

In the United Kingdom, Liz Truss was elected leader of the ruling Conservative Party and the country’s Prime Minister, while Prince Charles became king after the passing of his mother, Queen Elizabeth II, at Balmoral Castle. Inflation and soaring prices continued to cause concern in the country and on September 23, the Bank of England’s Monetary Policy Committee (MPC) voted 5-4 to raise rates to 2.25%. The MPC now expects inflation to peak just under 11% in October before falling back down a few months later. The Bank of England (BoE) announced plans to sell its bond holdings at the meeting but had to halt its strategy just a week later, after new finance minister Kwasi Kwarteng’s mini-budget was presented. The mini-budget’s energy subsidies and tax cuts sent the UK Gilt market into a spiral and left pension funds struggling to cope with the unprecedented rise in bond yields and market volatility. The BoE intervened and announced bond purchases at a pace of up to GBP 5 billion a day for 13 days to quell the market. The yield on the 10-year UK Gilt ended the month at 4.08%, a 127-basis point increase from the month before, which makes the note September’s greatest mover.

In the U.S., the Federal Open Market Committee (FOMC) met on September 22 and raised its benchmark interest rate by 0.75%, for a range of 3%-3.25%. This marks the FOMC’s third consecutive rate hike and fifth one this year. Fed officials indicated they would continue to hike rates until inflation was back down to their 2% target. The U.S. 10-year Treasury note ended September with a closing yield of 3.80%, a 67-basis point increase from the month prior.

The European Central Bank (ECB) also announced a 75-basis point rate hike at its September 8 meeting in Frankfurt, taking the benchmark deposit rate to 0.75%. The central bank indicated further hikes are expected as “inflation remains far too high and is likely to stay above target for an extended period.” Euro zone inflation surpassed forecasts and hit 10% for the month of September, and reinforced expectations of consistent hikes from the ECB.

Elsewhere in Europe, monetary tightening continued as Switzerland increased rates by 75 basis points on September 22, bringing the Swiss central bank out of negative territory. Switzerland had been the last remaining European country with a negative policy rate. Norway also hiked rates on September 22, raising its key interest rate by half a point. In Germany, the 10-year Bund mid-yield gained 57 basis points to close the month at 2.12%.

In Italy, elections held on September 25 ushered in a new far-right coalition government led by Giorgia Meloni, the first female prime minister for the country and leader of the Fratelli d’Italia (Brothers of Italy) party. The Italian 10-year note ended September 64 basis points higher than the previous month, with a final yield of 4.53%.

In Asia Pacific, the Bank of Japan met on September 22 and maintained its ultra-low rate policy. The Japanese 10-year government bond ended the month with a closing yield of 0.24%, a 2-basis point increase from the end of August. In Australia, the Reserve Bank raised its key interest rate for a fifth consecutive month to 2.35% on September 6. The Australian 10-year note rose 25 basis points, ending the month with a final yield of 3.87%.