Tradeweb Government Bond Update – December 2019

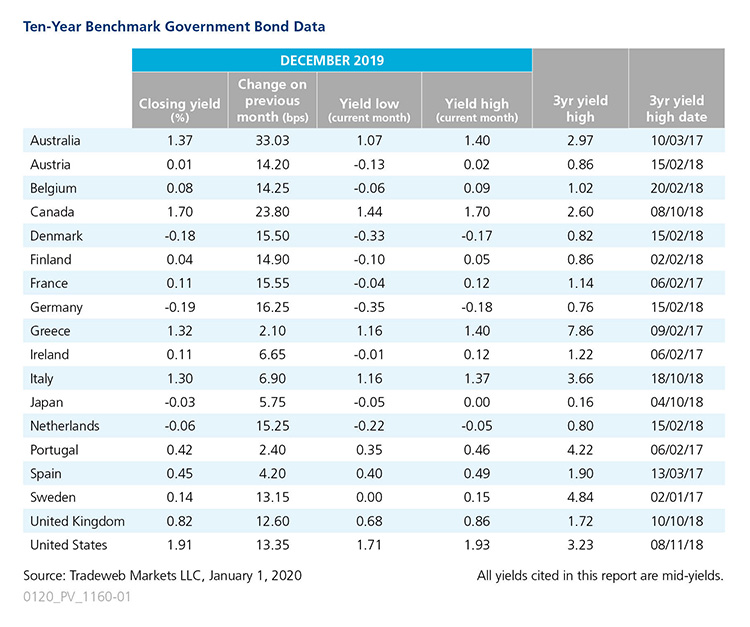

Mid-yields on 10-year government bonds finished 2019 – and capped off the decade – with across-the-board increases. In fact, amid an ever-uncertain monetary policy environment, several government bond markets tracked by Tradeweb saw their yields rise by double-digits over the course of December. In some cases, this helped push yields either closer or into positive territory.

The biggest move came from the Australian 10-year benchmark note, whose yield climbed 33 basis points to end the month at 1.37%. While the Reserve Bank of Australia did not change its cash target rate at its December meeting, it did institute three cuts over 2019, bringing the rate down from 1.5% at the end of 2018 to its current 0.75%. According to data from the Australian Bureau of Statistics, the country’s economy grew by a seasonally adjusted 0.4% in the third quarter of 2019.

Canada’s 10-year government bond saw the second largest move, with its yield closing the month 24 basis points higher at 1.70%. As with other central banks, the Bank of Canada did not change the overnight rate from its current 1.75%, where it has remained since October 2018, even though it noted that the global economy was stabilizing and growth could move higher in the next few years.

In neighbouring U.S., the 10-year Treasury mid-yield finished December at 1.91%, up 13 basis points from the previous month end. Meanwhile, the yield on Japan’s 10-year benchmark note rose by 6 basis points to close at -0.03%. The Bank of Japan left monetary policy unchanged in December, with the short-term interest rate at -0.1%.

In the Euro area, the largest shift was seen in Germany’s 10-year Bund, which increased by over 16 basis points to close out December still in negative territory at -0.19%. In contrast, its Austrian, Belgian, Finnish and French equivalents went positive over the course of the month to end the year at 0.01%, 0.08%, 0.04% and 0.11%, respectively.

At President Christine Lagarde’s first meeting, the ECB announced it would keep the main deposit rate at -0.5% and the lending facility at 0.25%. Later in the month, ECB policymaker Robert Holzmann said positive interest rates were unlikely in 2020. However, Sweden’s central bank, the Riksbank, raised the repo rate to 0%, bringing its five-year negative interest rate policy to an end. The Swedish 10-year bond yield rose by 13 basis points to close the month and the year at 0.14%.

It was also an eventful month in the UK, where a closely-watched election concerning the fate of Brexit resulted in substantial wins for Prime Minister Boris Johnson and his Tory party. Furthermore, Andrew Bailey of the Financial Conduct Authority was selected to replace Mark Carney as the Bank of England governor. The yield on the country’s 10-year Gilt yield increased by nearly 13 basis points to finish the month at 0.82%.