Tradeweb Government Bond Update – August 2019

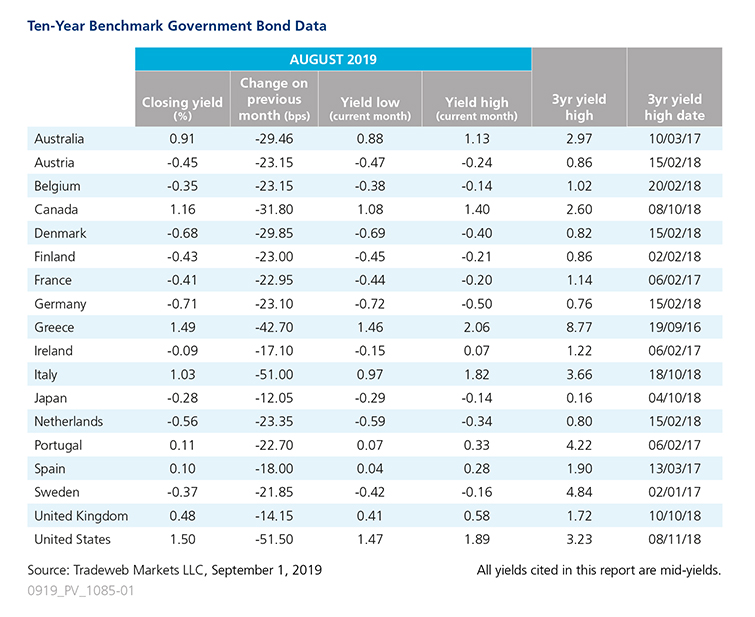

Yields on 10-year government debt continued to decline in August. All of the 18 sovereign markets Tradeweb tracks in its monthly Government Bond Update saw yields fall by more than 10 basis points, with some even hitting record low levels in the process.

Leading the pack was the 10-year U.S. Treasury note. Dropping a considerable 51.5 basis points, its mid-yield reached a low of 1.47% on August 28, before finishing the month at 1.50%. Speculation of another rate cut from the Fed at its September meeting intensified amid tepid economic data and fears of a global economic slowdown, and there were no signs of progress with trade negotiations.

Meanwhile, the yield on Canada’s 10-year government bond declined by 32 basis points, finishing August at 1.16%. Amid talk of a recession, there was speculation about interest rate policy from the Bank of Canada at its September meeting, where the key interest rate was kept steady.

In Europe, the largest moves came from the Italian and Greek 10-year bonds, whose yields plummeted by 51 and 43 basis points to end August at record lows of 1.03% and 1.49%, respectively. Italy’s former deputy prime minister, Matteo Salvini, brought down the coalition government with the anti-establishment Five Star Movement (M5S), hoping to trigger a snap election that would further strengthen his far-right League party. However, his plans suffered a setback, when M5S and the centre-left Democratic party (PD) agreed to form a new coalition government led by Giuseppe Conte, thus staving off a new election.

Other European 10-year government bond yields dipped further into negative territory during the month, with those for France and Germany closing 23 basis points lower at -0.43% and -0.71%, respectively. While not negative, the U.K. 10-year Gilt yield closed at 0.48%, after hitting a record low of 0.41% on August 15. Both Germany and the UK are confronting the possibility of greatly weakened economies, while the latter has yet to settle on a Brexit deal.

In the Asia-Pacific region, Australian and Japanese 10-year mid-yields dropped 29 and 12 basis points to close at 0.91% and -0.28%, respectively. According to Japan’s Ministry of Internal Affairs, the country’s jobless rate decreased to a 26-year low of 2.2% in July, while consumer price inflation fell to a four-month low of 0.5% year-on-year, in line with market expectations.