Tradeweb Government Bond Update – April 2019

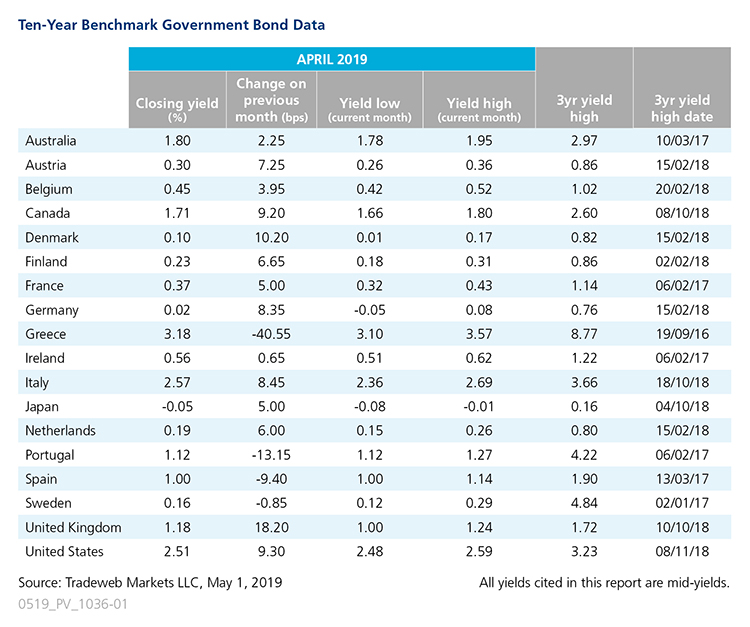

During April’s government bond sell-off, the 10-year Treasury mid-yield climbed 9 basis points to close the month at 2.51%. Federal Reserve data showed that U.S. industrial production fell by 0.1% in March, the third straight decline, yet retail sales posted a 1.6% increase, their biggest gain since September 2017.

Finishing at 1.71%, the Canadian 10-year bond yield also rose by 9 basis points. At its April 24 meeting, the Bank of Canada maintained its target for the overnight rate at 1.75%, as it downgraded its growth forecasts for 2019.

Movement was more muted for the Japanese 10-year benchmark bond yield. It remained in negative territory throughout April, ranging from a high of -0.01% to a low of -0.08%, before closing the month 5 basis points higher at -0.05%. The Bank of Japan left monetary policy unchanged, and said it would maintain its dovish outlook at least through the spring of 2020.

In the UK, the 10-year Gilt yield rose by 18 basis points to close the month at 1.18%, after reaching a high of 1.24% on April 17. Elsewhere in Europe, the yield on Germany’s 10-year Bund increased by 8 basis points to end April at 0.02%. German exports and imports declined by 1.3% and 1.6%, respectively, despite growth expectations for both. Additionally, an Ifo Institute business climate indicator fell again, registering a reading of 99.2 compared to 99.7 in March.

Bucking the widespread sell-off trend, Greece’s 10-year benchmark note saw its mid-yield drop for the fourth consecutive month, this time by 40.5 basis points to close April at 3.18%. The country’s government reported that it had closed 2018 with a surplus of 1.1% of GDP, compared to a deficit of 5.6% of GDP at the height of its debt crisis in 2015. Spain’s 10-year bond yield fell 9 basis points to 1.0% on April 30, while its Portuguese equivalent decreased by 13 basis points to end the month at 1.12%, a 3-year low.