Tradeweb Government Bond Update - October 2021

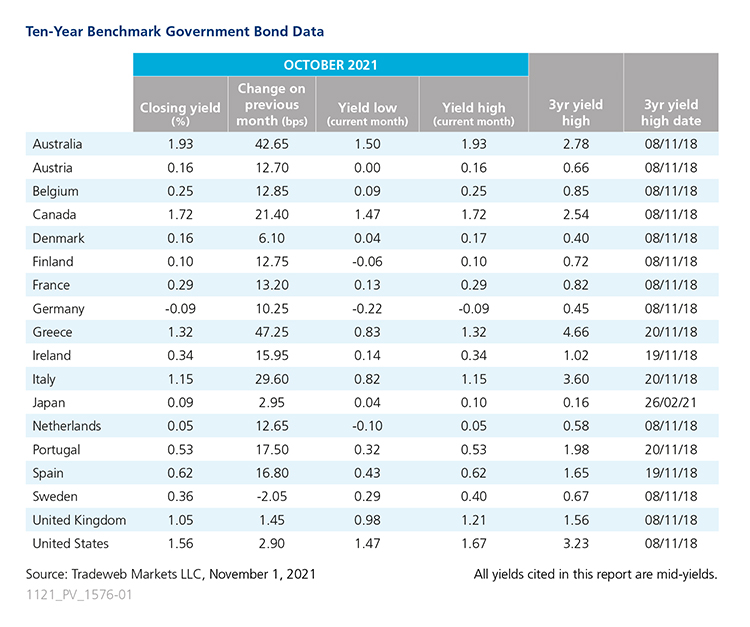

Amid rising inflation concerns and shifting monetary policy expectations, 10-year government bonds experienced another sell-off in October, with only Sweden’s benchmark note bucking the trend. Leading the pack, the mid-yield on Greece’s 10-year bond surged by 47 basis points to end the month at 1.32%, the highest closing point since June 2020. In its global economic outlook report, the International Monetary Fund said Greek GDP is expected to grow by 6.5% this year and 4.6% in 2022.

Staying in the Euro area, Italy’s 10-year government bond yield rose by nearly 30 basis points to close October at 1.15%, the highest level observed since July 2020. The IHS Markit Italy Manufacturing PMI increased to 61.1 in October from 59.7 in September, the 16th straight month of improvement and the third highest reading on record.

At its meeting on October 28, the European Central Bank’s Governing Council left interest rates unchanged and said that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the pandemic emergency purchase programme (PEPP) than in the second and third quarters of this year. The yield on Germany’s 10-year Bund finished the month 10 basis points higher, but still in negative territory at -0.09%. Its UK equivalent increased by just 1.5 basis points to 1.05%, after reaching a month high of 1.2% on October 21.

Australia’s 10-year government bond yield saw the month’s second largest move, climbing nearly 43 basis points to 1.93%, its highest closing point since April 2019. The IHS Markit Flash Australia Composite PMI showed a reading of 52.2 in October, up from 46.0 in September and the first expansion in four months, amid loosening of pandemic restrictions and plans to further open up the economy.

Meanwhile, the U.S. 10-year Treasury yield closed at 1.56% on October 29, nearly 3 basis points up from the previous month end. Its Canadian counterpart moved up by over 21 basis points to 1.72%, the highest closing point since May 2019. The Bank of Canada held its policy rate and forward guidance, but ended quantitative easing and moved into the reinvestment phase, during which it will purchase Government of Canada bonds solely to replace maturing bonds. According to the central bank, the country’s economy is projected to grow by 5% this year, before moderating to 4.25% in 2022 and 3.75% in 2023.