Tradeweb Government Bond Update - May 2022

Global government bond yields continued to rise during May, as economies grapple with increasing inflation and soaring costs as a result of the war in Ukraine and pandemic-related supply chain issues.

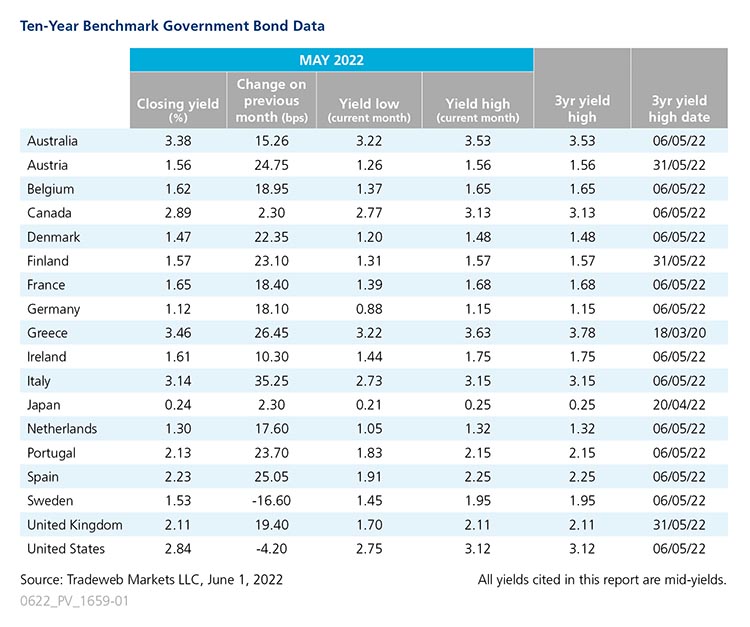

The majority of global 10-year benchmark notes hit 3-year yield highs early in the month after central banks around the world began to tighten monetary policy to fight record-high inflation.

The Federal Open Market Committee (FOMC) raised its key interest rate by 50 basis points to a range of 0.75% to 1% at the committee’s May 4 meeting, marking its largest rate increase in more than two decades. The FOMC also outlined plans to start winding down its USD 9 trillion balance sheet by USD 47.5 billion a month beginning in June. Despite the bond sell-off after the Fed rate hike, the U.S. 10-year Treasury mid-yield rallied by the end of month resulting in a 4 basis point drop from the month prior and a closing yield of 2.84%.

Additionally, the Bank of England’s Monetary Policy Committee (MPC) voted by a majority of 6-3 to raise interest rates by 0.25 percentage points to 1% at its May 5 meeting. The MPC forecasts inflation to soar as high as 10%, and is considering a Gilt sales plan for August 2022. The yield on the 10-year Gilt ended the month at 2.11%, its highest level in three years.

The greatest mover in May was Italy, gaining 35 basis points for a 3.14% closing yield, with Greece behind it, gaining 26 basis points and ending the month with a yield of 3.46%. In a speech given in Slovenia on May 11, European Central Bank (ECB) president, Christine Lagarde, signalled she would support raising the ECB’s interest rate in July and will likely end the ECB’s large-scale asset purchase program in early third quarter. Across Europe, inflation has soared, increasing to 8.1% in May from 7.4% in April, as the region continues to deal with the impact of the war in Ukraine and supply chain issues following the Covid-19 pandemic.

The German 10-year Bund yield climbed 18 basis points to 1.12%, its highest peak in three years. Data released on May 30 showed consumer prices in Germany jumped 8.7% from a year ago in May, exceeding analyst expectations.

Japan moved up by over 2 basis points, ending the month with a closing yield of 0.24% as the Bank of Japan ruled out a widening yield band to stem the fall of the yen. The next Bank of Japan meeting will take place on June 17.