Tradeweb Government Bond Update - May 2020

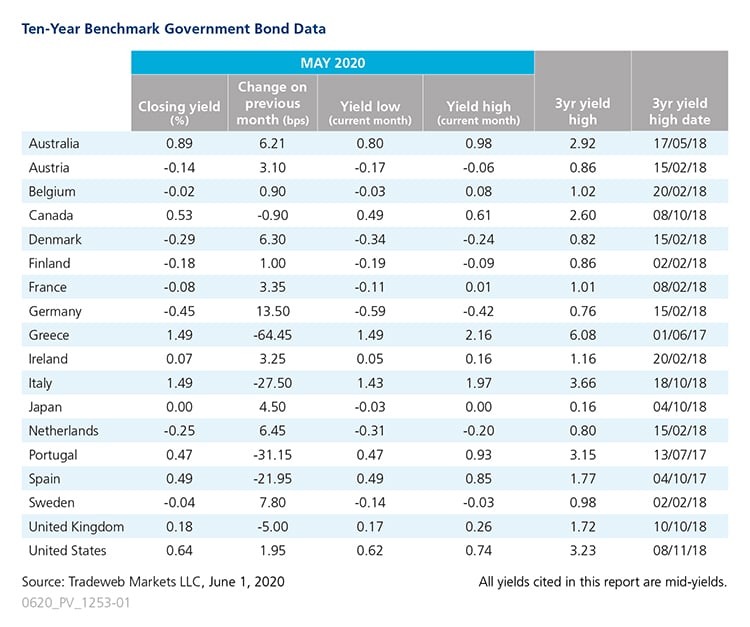

Government bond market volatility subsided in May compared to the previous two months, despite a barrage of weak economic data published around the world. In the euro area, the majority of 10-year government bond mid-yields rose slightly during the month, with those for Germany registering the biggest increase of 13.5 basis points to close May at -0.45%. The country’s Federal Statistical Office (Destatis) estimated that the annual inflation rate would fall to 0.6% in May, its lowest level since September 2016.

In contrast, peripheral nations logged double-digit yield declines, with those for Greece and Portugal’s 10-year debt dropping by 64.5 and 31 basis points to finish May at 1.49% and 0.47%, respectively. Their Italian and Spanish counterparts also fell during the month by 27.50 basis points to 1.49% and 22 basis points to 0.49%, respectively. Paolo Gentiloni, European Commissioner for the Economy, identified peripheral economies as among those expected to contract the most in 2020.

Elsewhere in Europe, the UK 10-year Gilt yield ended the month 5 basis points lower at 0.18%, only marginally above its 3-year low of 0.16%. Like many countries, the UK’s economy has been hard hit by the Covid-19 pandemic. Bank of England governor, Andrew Bailey, said he would not rule out the implementation of negative interest rates, during an appearance in front of a UK parliamentary committee on May 20. His comments came just as the UK sold negative-yielding bonds for the first-time in its history.

Other benchmark bonds also saw very minor yield changes in May. Dipping in and out of negative territory throughout the month, the Japanese 10-year bond mid-yield increased by 4.5 basis points to close at 0%. Meanwhile, its U.S. Treasury equivalent rose by nearly 2 basis points to 0.64%. Minutes from April’s Federal Open Market Committee meeting showed officials’ concerns over the effects of the coronavirus outbreak on economic activity, employment, and inflation not only in the near term, but also later in the year, particularly in the case of a second wave.