Tradeweb Government Bond Update - January 2021

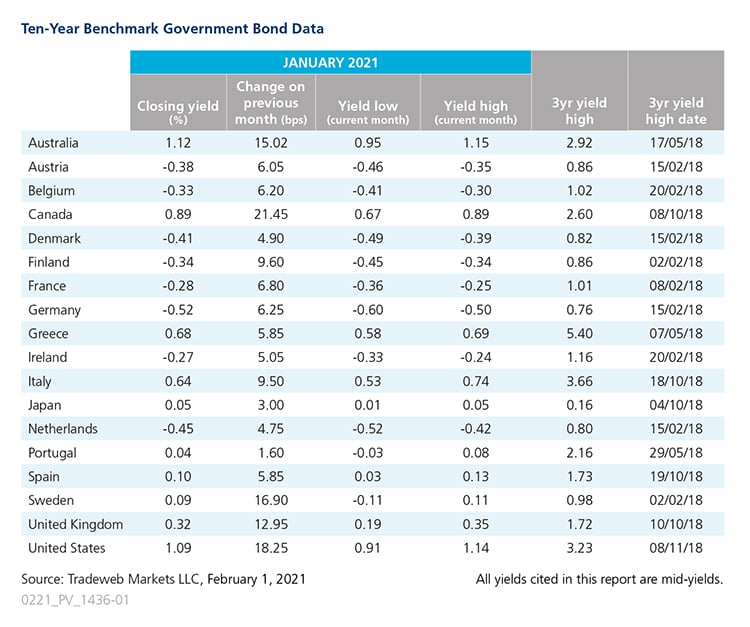

After a fairly calm December for global government bonds, 2021 got off to an active start with a widespread market sell-off. The largest movements came from North America. Rising throughout the month, the Canadian 10-year mid-yield climbed 21.5 basis points to end at 0.89%. At its latest monetary policy meeting, the Bank of Canada left its benchmark rate at 0.25% and pledged to keep it there “until the recovery is well underway.” In neighboring U.S., the Treasury 10-year yield finished the month up 18 basis points at 1.09%, after breaking though the 1% barrier - for the first time since March 2020 - on January 6. The Federal Reserve maintained the target range for its overnight funds rate at 0-0.25%, and said it would keep buying at least USD 120 billion of bonds each month.

In Europe, the yield on Sweden’s 10-year benchmark note saw the largest increase among its peers. After spending most of 2020 in negative territory, it finished January nearly 17 basis points higher at 0.09%. The country’s economy grew by 0.5% in the fourth quarter of 2020, down from a 0.7% preliminary estimate. Next up, the UK 10-year Gilt yield rose by nearly 13 basis points to 0.32%. In its latest World Economic Outlook Update, the IMF cut its UK GDP projection for 2021 to 4.5% from an initial 6% prediction. Meanwhile, the Gfk Consumer Confidence decreased to -28 in January from -26 in December 2020.

A political crisis engulfed Italy on January 13, when Matteo Renzi withdrew his party’s support from the coalition government led by Giuseppe Conte, forcing the latter to resign. The Italian 10-year bond mid-yield closed the month 9.5 basis points higher at 0.64%. Its German equivalent shifted over 6 basis points to end at -0.52%. According to Destatis, Germany’s economy shrank by 5% in 2020, less than the forecasted 9.3% and 9% drop for France and Italy, respectively. At its first policy meeting for the year, the European Central Bank left rates unchanged, with the main refinancing rate at 0% and the deposit facility rate at -0.5%.

In the Asia-Pacific region, the Australian 10-year mid-yield climbed 15 basis points to 1.12% at month end. Consumer confidence fell 4.5% month-over-month to 107 in January from 112 in December, while the annual inflation rate rose to 0.9% in the last three months of 2020, the highest reading in three quarters. The Japanese 10-year government bond yield moved higher by 3 basis points to 0.05%. The Bank of Japan left short term interest rates unchanged at -0.1% at its January meeting. The central bank expects the economy to follow an improving trend in the new fiscal year, with the impact of COVID-19 waning gradually.