Tradeweb Government Bond Update - February 2020

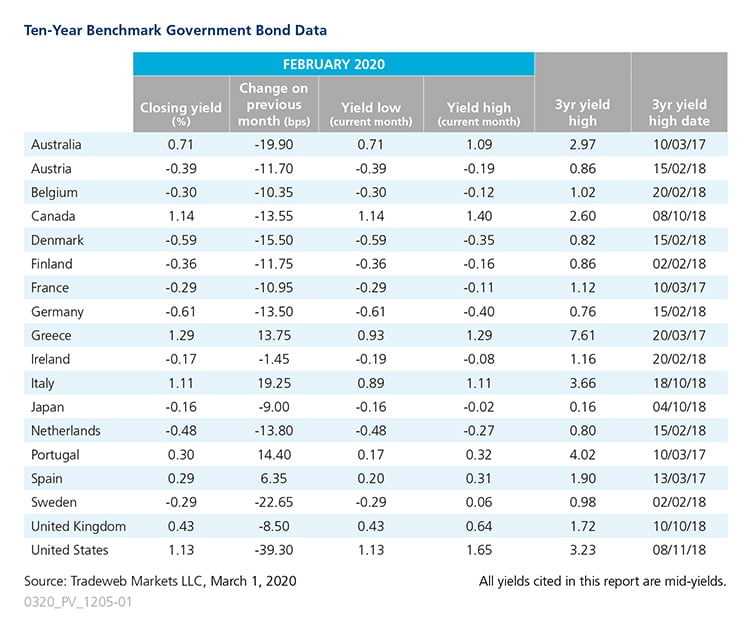

Financial markets were in a tailspin in February, particularly towards the end of the month, amid fears of economic stress stemming from the coronavirus outbreak. Ten-year government bond yields declined in several parts of the world, with those on the U.S. Treasury hitting a record low of 1.13% on February 28, down 39 basis points from the previous month end.

Significant moves were also on display in Sweden, whose 10-year government bond mid-yield dropped nearly 23 basis points to end the month at -0.29%. Similarly, the yield on Denmark’s 10-year benchmark note fell by 15.5 basis points to -0.59%, while its Dutch equivalent decreased by 14 basis points to -0.48%. Denmark’s economy expanded by 0.2% in the fourth quarter of 2019, the weakest GDP growth rate in over two years. Meanwhile, Finland’s Q4 2019 GDP shrank by 0.7%, its first contraction in nearly five years. The country’s 10-year government bond yield finished February 12 basis points lower at -0.36%.

Yields on German and UK 10-year government debt were also down, as official data showed that both countries’ economies had stagnated in the last three months of 2019. During February, Germany’s 10-year Bund yield decreased by 13.5 basis points to -0.61%, while the UK’s 10-year Gilt yield dropped by 8.5 basis points to 0.43%. However, not all European government bond yields declined in February. With the exception of Ireland, Europe’s peripheral economies all saw their 10-year benchmark note yields rise over the course of the month, with those for Italy climbing 19 basis points to close at 1.11%.

In the Asia-Pacific region, the mid-yield on Australia and Japan’s 10-year government bonds fell by 20 and 9 basis points to close out February at 0.71% and -0.16%, respectively. The Australian economy expanded by 0.5 % in Q4 2019, beating market expectations of a 0.3% growth. In Japan, consumer confidence dipped to 38.4 in February, well below market expectations of 40.6.