Tradeweb Government Bond Update - April 2021

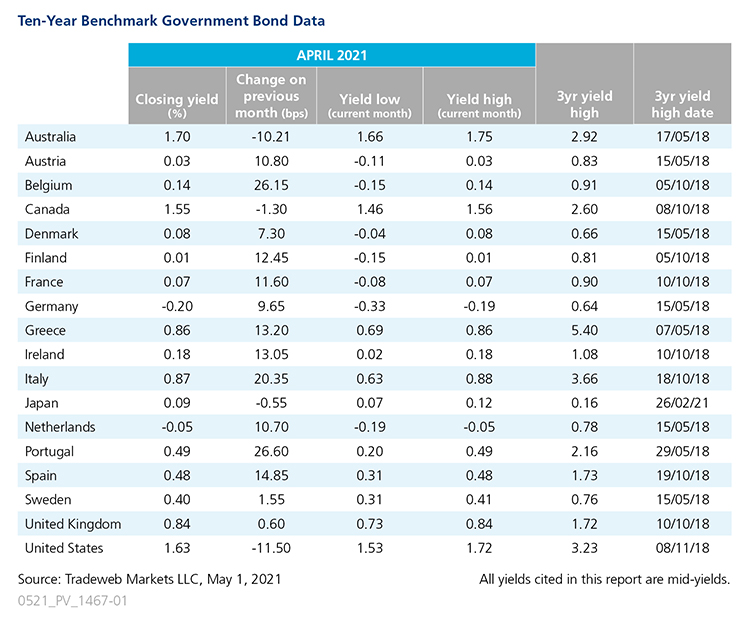

Volatility returned to government bond markets in April, amid a flood of central bank decisions and noteworthy economic data. Yields on 10-year benchmark notes mostly increased, with some exiting negative territory.

The largest movement came from the Portuguese 10-year government bond, whose mid-yield surged by nearly 27 basis points to close at 0.49%, the highest level since June 2020. Its Belgian equivalent followed closely behind with an increase of over 26 basis points to end the month at 0.14%, back into positive territory for the first time since June 2020. France and Finland’s 10-year government bond yields were also positive at month end, closing at 0.07% and 0.01%, respectively.

In contrast, yields on the German and Dutch 10-year benchmark notes remained negative, ending April at -0.20% and -0.05%, respectively. The European Central Bank left rates unchanged and stated it would continue to conduct net asset purchases under the pandemic emergency purchase programme (PEPP) totalling EUR 1.85 trillion until at least the end of March 2022 and, in any case, until the pandemic crisis is over.

On April 21, Germany’s constitutional court, Bundesverfassungsgericht, rejected an application to block the EU’s coronavirus recovery fund, also known as ‘Next Generation EU’, which would allow the European Commission to borrow up to EUR 750 billion in 2018 prices on capital markets on behalf of the European Union. Five days later, Italy’s prime minister Mario Draghi outlined his spending plan to revive the country’s economy, which last year contracted by 8.9%, its worst annual recession since World War II. Italian 10-year bond yields climbed 20 basis points during the month to close at 0.87%.

Meanwhile, the yield on the U.S. 10-year Treasury fell by 11.5 basis points to 1.63%, its first monthly drop this year. At its April 28 meeting, the Federal Reserve said it will maintain an accommodative stance of monetary policy until it achieves its objectives of maximum employment and inflation at the rate of 2% over the longer term. The central bank kept the target range for the federal funds rate at 0-0.25% and asset purchases at USD 120 billion a month.

The Reserve Bank of Australia also left rates unchanged at a record low of 0.1%. The Westpac-Melbourne Institute Index of Consumer Sentiment increased by 6.2% in April, the highest reading since August 2010. The country’s 10-year government bond yield finished the month 10 basis points lower at 1.70%, while its Japanese counterpart fell less than a basis point to 0.09%, in line with the Bank of Japan’s target of around 0%. The central bank held its key short-term interest rate at -0.1% at its latest meeting, while consumer confidence decreased to 34.7 in April, down 1.4 points from March.