Tradeweb Exchange-Traded Funds Update – September 2019

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European-listed ETF marketplace surpassed EUR 35.5 billion in September, just EUR 770 million shy of August’s record breaking performance. The proportion of transactions executed via Tradeweb’s Automated Intelligent Execution Tool (AiEX) climbed to 75%.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “September marked the end of our strongest quarter yet, with total traded volume reaching EUR 102.5 billion, up EUR 18.2 billion from Q2 2019. Last month, we also announced our collaboration with EuroCCP to facilitate central clearing for European ETFs and, subsequently, help clients minimise settlement fails and enhance their trading workflows.”

Volume breakdown

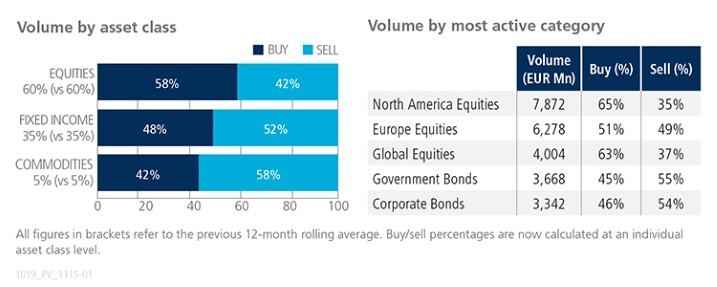

In contrast to their fixed income and commodity-based counterparts, equity ETFs saw net buying in September, with ‘buys’ in the asset class outperforming ‘sells’ by 16 percentage points. Combined trading activity in North America and European Equity ETFs accounted for nearly 40% of the overall platform flow during the month.

Top ten by traded notional volume

The iShares Core Corp Bond UCITS ETF was September’s most heavily-traded instrument on Tradeweb’s European ETF platform. The fund, which offers investor exposure to EUR-denominated investment grade bonds across sectors, returned to the top spot after last occupying it in August 2018.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in September 2019 was USD 11.7 billion.

Volume breakdown

As a percentage of total notional value, equities accounted for 37% and fixed income for 56%, with the remainder comprised of commodity and specialty ETFs. During September, 56% of U.S. ETF trades on the platform were executed via the Tradeweb AiEX tool.

Adam Gould, head of U.S. equities at Tradeweb, said: “September was another busy month on the U.S. ETF platform, particularly for fixed income ETFs which made up 56% of our notional volume. In addition, seven of the top ten most actively traded funds on Tradeweb were fixed income ETFs, and for the first time, our three highest volume products traded were all benchmarked to Treasuries.”

Top ten by traded notional volume

During the month, 511 unique tickers traded on Tradeweb’s U.S. ETF platform. Fixed income ETFs dominated September’s top ten list by notional volume, with the iShares 20 Plus Year Treasury Bond ETF ranked first. The fund seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than 20 years.