Tradeweb Exchange-Traded Funds Update – May 2022

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

May proved to be another strong month for European ETF trading on Tradeweb. Total traded volume amounted to EUR 52.7 billion, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was a record 83.5%.

Adam Gould, head of equities at Tradeweb, said: “Client adoption of automated workflows reached new heights in May, as nearly one-fifth of European ETF notional volume on our platform was executed via AiEX. One of the tool’s most popular features among our clients is time release, which allows traders to schedule multiple orders at a specific point in time, so they can focus on larger-size transactions.”

Volume breakdown

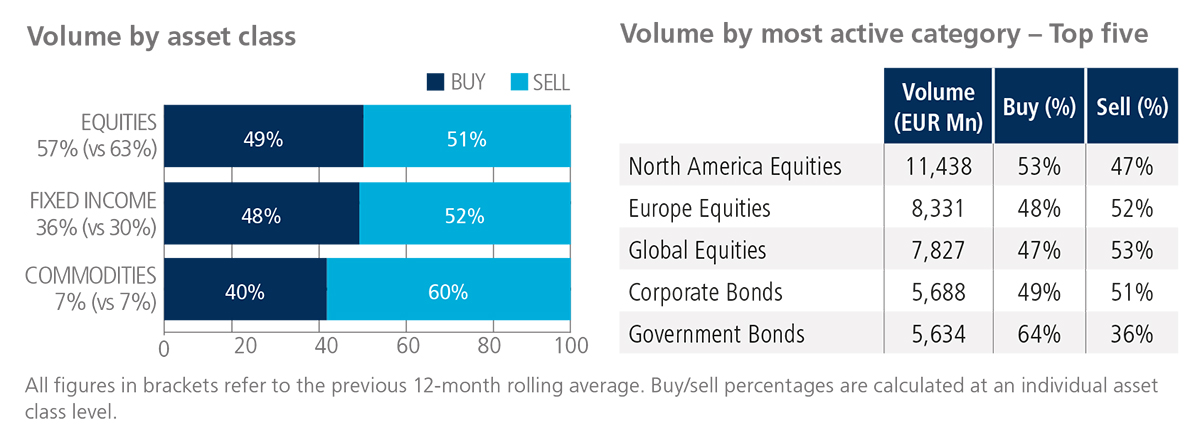

April’s buying trend was reversed across all asset classes in May, particularly for commodity ETFs, where ‘buys’ lagged ‘sells’ by 20 percentage points. Activity in fixed income ETFs increased to 36% of the overall platform flow, beating the previous 12-month rolling average by six percentage points.

Products offering investment exposure to North America Equities were once again the most heavily traded ETFs, with EUR 11.4 billion in notional volume.

Top ten by traded notional volume

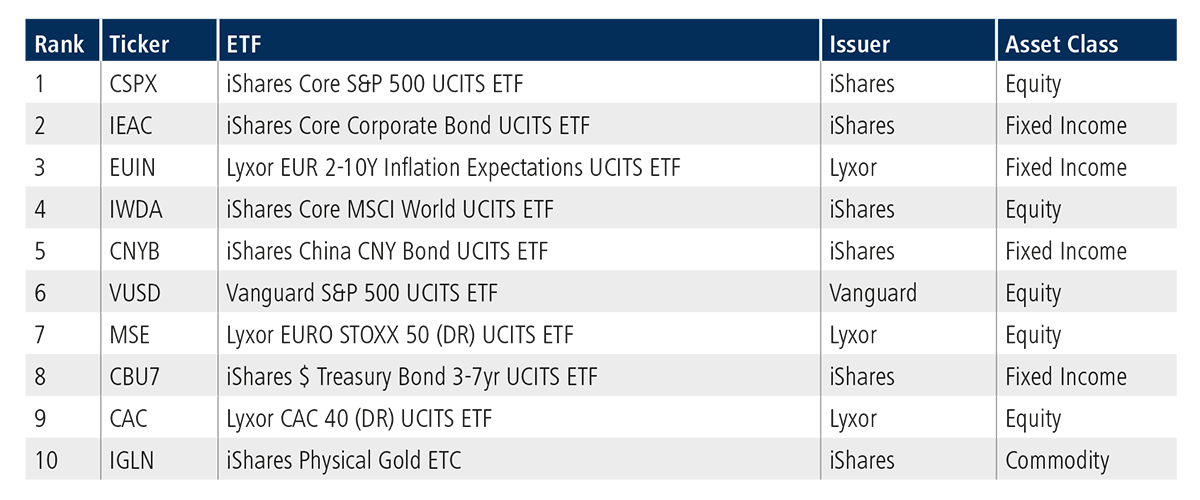

The iShares Core S&P 500 UCITS ETF moved up two places from April to return to the top spot in May. Ranked third, the Lyxor EUR 2-10Y Inflation Expectations UCITS ETF made its second appearance in the list this year. The fund aims to reflect the performance of the Markit iBoxx EUR Breakeven Euro-Inflation France & Germany Index.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in May 2022 was a record USD 59.4 billion, narrowly beating the platform’s previous best performance in March 2022.

Volume breakdown

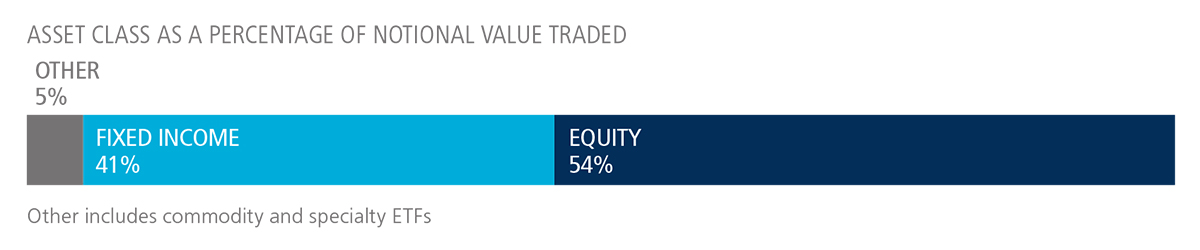

As a percentage of total notional value, equities accounted for 54% and fixed income for 41%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “Trading activity in U.S.-listed ETFs accelerated to record levels on our platform during May. As investors try to make sense of the highest annual inflation in the U.S. since December 1981 coupled with a slowdown in economic growth, they increasingly use ETFs to transfer risk quickly and efficiently.”

Top ten by traded notional volume

A record 2,076 unique tickers traded on the Tradeweb U.S. ETF marketplace in May. During the month, there was an equal split between equity and fixed income products in the top ten list by traded notional volume, with the iShares National Muni Bond ETF ranked first.