Tradeweb Exchange-Traded Funds Update – May 2020

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Monthly activity on the Tradeweb European-listed ETF marketplace reached EUR 29.65 billion in May. The proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool rose to 70.2%.

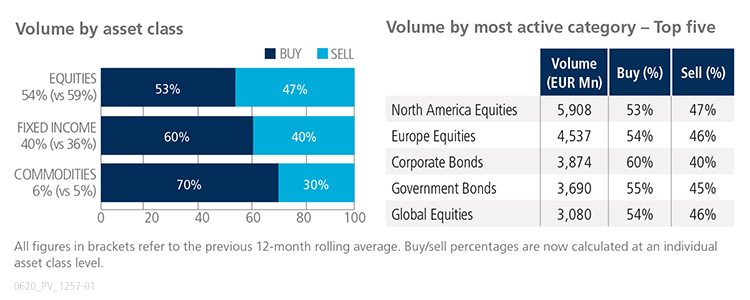

Volume breakdown

All ETF asset classes saw net buying in May, particularly fixed income and commodities. Equity-based products saw their total traded volume increase to 54% of the overall platform flow, with ‘buys’ surpassing ‘sells’ by six percentage points. North America Equities was the month’s most aggressively-traded ETF category with EUR 5.9 billion in notional volume.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “The overall percentage of fixed income ETFs traded remained high in May, amid calmer financial markets and normalized volumes. Nearly all European-listed ETF categories saw net buying during the month, particularly High Yield, Money Markets, Aggregates and Precious Metals.”

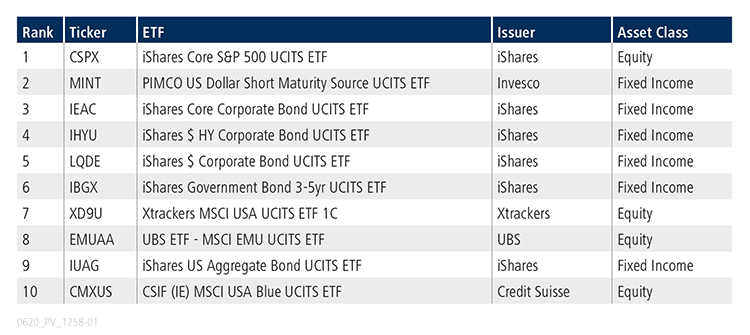

Top ten by traded notional volume

Fixed income ETFs continued to dominate the top ten list by traded notional volume in May. However, the stocks-based iShares Core S&P 500 UCITS ETF moved up one spot from April to be ranked first.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in May 2020 amounted to USD 13.2 billion.

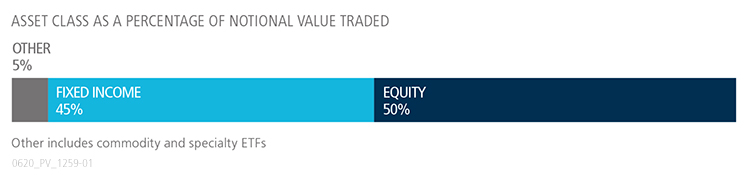

Volume breakdown

As a percentage of total notional value, equities accounted for 50% and fixed income for 45%, with the remainder comprising commodity and specialty ETFs. The proportion of U.S. ETF trades executed on the platform via the Tradeweb AiEX tool was 35%.

Adam Gould, head of U.S. equities at Tradeweb, said: “As markets continued to stabilize, May proved to be another busy month across the ETF space and on the platform. Many clients continued to pile back into equity ETFs. We also saw a diverse group of customers trading a range of high yield and investment grade ETFs, with five of our ten most actively-traded funds falling into those buckets.”

Top ten by traded notional volume

During May, 730 unique tickers traded on the Tradeweb U.S. ETF platform, with the iShares MSCI EAFE ETF topping the list of most heavily-traded products. The funds seeks to track the investment results of an index composed of large- and mid-capitalization developed market equities, excluding the U.S. and Canada.