Tradeweb Exchange-Traded Funds Update – June 2020

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

June proved to be the third best-performing month on record for the Tradeweb European-listed ETF marketplace. Total traded volume reached EUR 41.5 billion, while 71.5% of transactions were processed via Tradeweb’s Automated Intelligent Execution Tool (AiEX).

Adriano Pace, head of equities (Europe) at Tradeweb, said: “June capped the second strongest quarter for our platform since launch, with more than EUR 104.7 billion in notional value. About half of the volume executed was in trades with an average size exceeding EUR 10 million. This shows that our platform continues to provide institutional investors with an effective solution for larger size trades, even as the number of smaller size transactions via AiEX grows.”

Volume breakdown

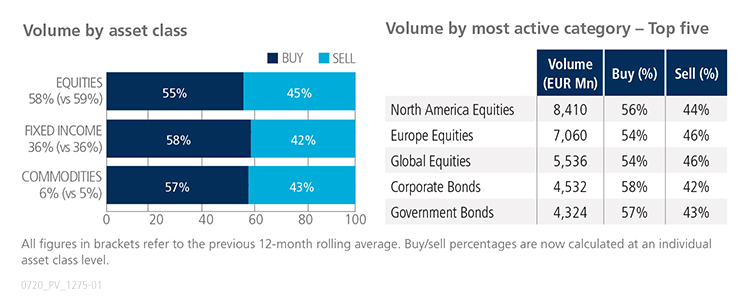

All ETF asset classes saw net buying for the second consecutive month. Trading activity in equity-based products increased to 58% of the overall traded volume, with ‘buys’ surpassing ‘sells’ by ten percentage points. North America Equities was once again the most heavily-traded ETF category with over EUR 8.4 billion in notional volume. Nearly all European-listed ETF categories were bought during the month, with the exception of Aggregates, Energy and Money Markets.

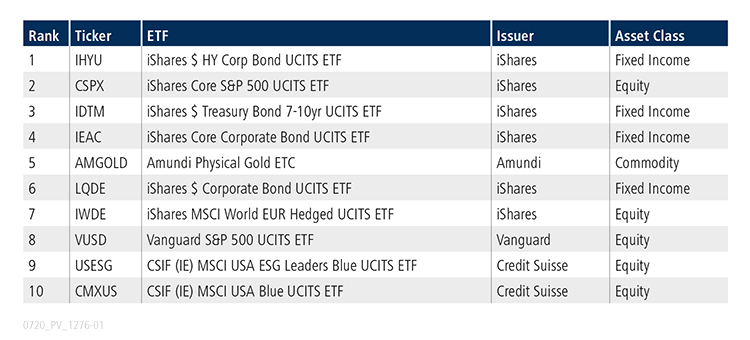

Top ten by traded notional volume

In June, four of the top ten ETFs by traded notional volume aim to replicate U.S. stocks benchmarks. One of them, the CSIF (IE) MSCI USA ESG Leaders Blue UCITS ETF, tracks an index offering exposure to U.S. companies with high Environmental, Social and Governance (ESG) performance relative to their sector peers. More than 3% of the entire platform flow was attributed to ESG-focused ETFs during the month.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in June 2020 amounted to USD 22.2 billion, the platform’s second strongest monthly performance since March 2020.

Volume breakdown

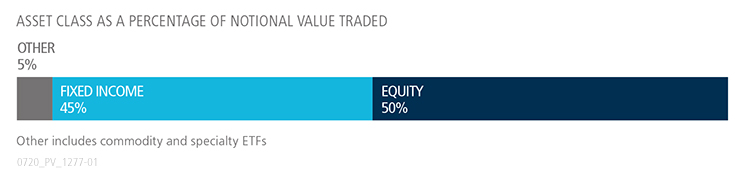

As a percentage of total notional value, equities accounted for 50% and fixed income for 45%, with the remainder comprising commodity and specialty ETFs. The proportion of U.S. ETF trades executed on the platform via the Tradeweb AiEX tool increased to 41%.

Adam Gould, head of U.S. equities at Tradeweb, said: “In June, U.S.-listed ETF trading on our platform surpassed USD 20 billion for the third month this year. Continued equity market volatility coupled with quarter-end rebalancing buoyed institutional activity in U.S. ETFs, with the average block size rising to USD 9.6 million.”

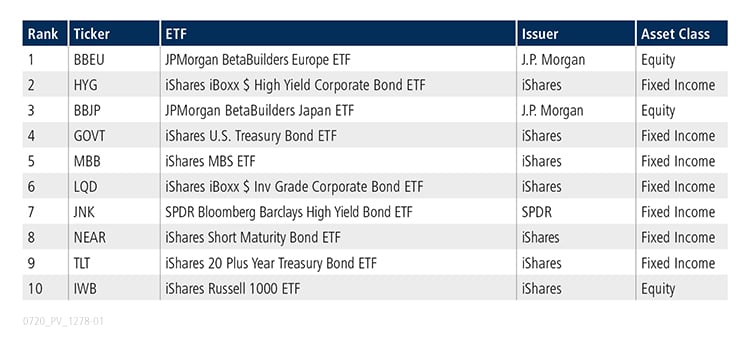

Top ten by traded notional volume

During the month, 747 unique tickers traded on the Tradeweb U.S. ETF platform. The single most traded product by notional value was the JPMorgan BetaBuilders Europe ETF, which seeks investment results that closely correspond to the Morningstar® Developed Europe Target Market Exposure Index.