Tradeweb Exchange-Traded Funds Update – July 2022

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

July was another strong month for the Tradeweb European ETF marketplace, with trading activity amounting to EUR 58.7 billion. The proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool increased to 83.1%.

Adam Gould, head of equities at Tradeweb, said: “Although summer was and is in full gear, ETF volumes across Tradeweb remained strong. One major theme continues to be the adoption of fixed income ETFs along the curve and in Europe, we also saw three ESG-focused products featuring in the top ten list by traded notional volume.”

Volume breakdown

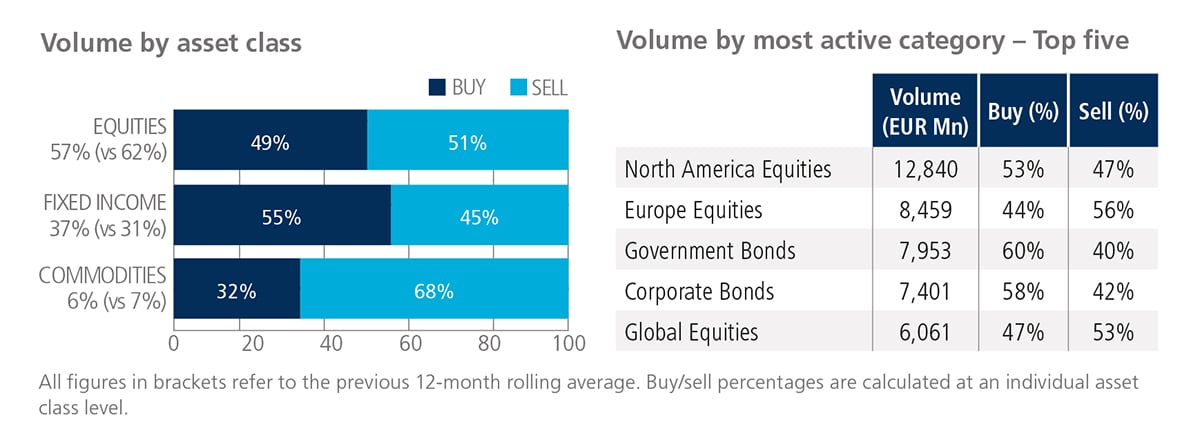

Both equity and commodity-based ETFs saw net selling in July, with ‘buys’ in the latter lagging ‘sells’ by 36 percentage points. In contrast, fixed income ETFs were mostly bought for the third month running. Activity in the asset class climbed to 37% of the overall platform flow, beating the previous 12-month rolling average by six percentage points.

Top ten by traded notional volume

The iShares Core S&P 500 UCITS ETF was the most actively-traded product on our European ETF platform for the third consecutive month. July’s top ten list also comprised four corporate bond-based ETFs, including the Xtrackers II ESG EUR Corporate Bond UCITS ETF 1D, which aims to reflect the performance of the Bloomberg MSCI Euro Corporate Sustainable and SRI Index.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in July 2022 reached USD 44.1 billion.

Volume breakdown

As a percentage of total notional value, equities accounted for 51% and fixed income for 43%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “To the surprise of many, July ended up being a very strong month across markets globally. During the month, we saw a large spike in activity (buying and selling) in short duration ETFs. These have certainly become mainstream tools across a wide range of investors.”

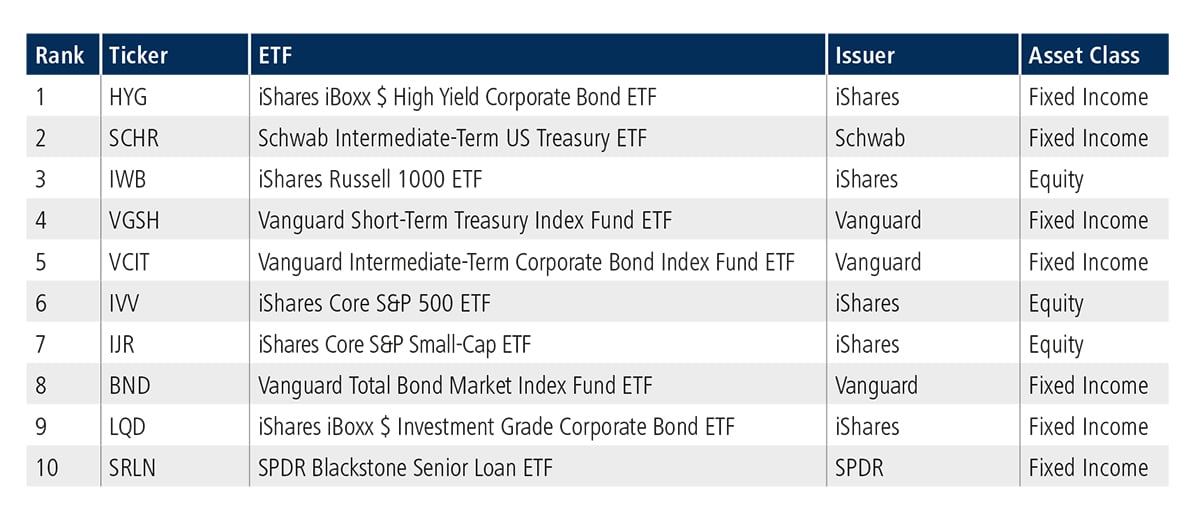

Top ten by traded notional volume

Throughout July, 1,832 unique tickers traded on the Tradeweb U.S. ETF marketplace. The iShares iBoxx $ High Yield Corporate Bond ETF proved to be the month’s most heavily-traded fund, after last occupying the top spot in February 2022.