Tradeweb Exchange-Traded Funds Update – December 2019

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Activity on the Tradeweb European-listed ETF marketplace reached EUR 30.7 billion in December. The proportion of transactions processed via Tradeweb’s Automated Intelligent Execution tool (AiEX) was 76%.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “December capped off a record-breaking year for European ETF trading on Tradeweb. Total notional volume executed in 2019 exceeded EUR 360 billion, up 43.5% from 2018 and 117.6% from 2017. Since our launch in 2012, we’ve worked hard to provide investors with an efficient mechanism to access European ETF liquidity, and our volumes show how deeply ingrained we are in the European ETF ecosystem.”

Volume breakdown

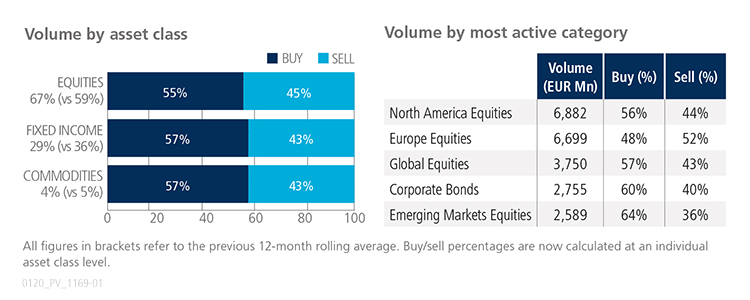

All ETF asset classes saw net buying in December, particularly fixed income and commodities products. Trading activity in equity ETFs increased to 67% of the overall platform flow, beating the previous 12-month rolling average by eight percentage points. North America Equities was the most heavily-traded ETF category, closely followed by Europe Equities.

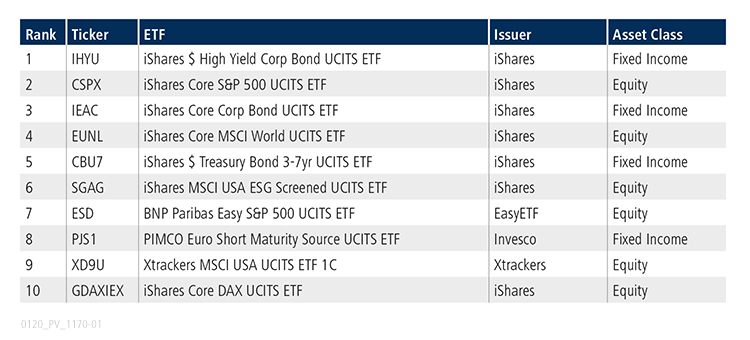

Top ten by traded notional volume

A fixed income product proved to be the most actively-traded ETF for the fourth consecutive month. The iShares $ High Yield Corporate Bond UCITS ETF, which aims to track the performance of the Markit iBoxx USD Liquid High Yield Capped Index, appeared in the top ten list six times in 2019.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in December 2019 was USD 10.7 billion.

Volume breakdown

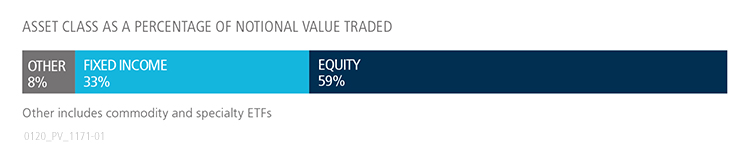

As a percentage of total notional value, equities accounted for 59% and fixed income for 33%, with the remainder comprised of commodity and specialty ETFs. During December, 60% of U.S. ETF trades on the platform were executed via the Tradeweb AiEX tool.

Adam Gould, head of U.S. equities at Tradeweb, said: “Despite the holiday slowdown, trading activity on our U.S. ETF platform remained strong. The number of unique tickers traded was above average, surpassing 600 for the first time in 2019. Looking back at the entire year, total notional volumes increased by 17% vs. 2018, a clear indication of our ability to streamline clients’ workflows and improve their access to liquidity.

Top ten by traded notional volume

During the month, 638 unique tickers traded on Tradeweb’s U.S. ETF platform. The iShares Core S&P 500 ETF moved up five places from November to lead December’s top ten list by traded notional volume.