Tradeweb Exchange-Traded Funds Update – August 2021

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European-listed ETF marketplace amounted to EUR 29.4 billion in August, while the proportion of transactions completed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 71.4%.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “Adoption of our rules-based AiEX solution continues to grow among customers trading European ETFs. This is evidenced not just by the number of tickets processed this way, but also by the consistently higher notional volume attributed to AiEX, which in August was a record 17.5% of the overall platform flow.”

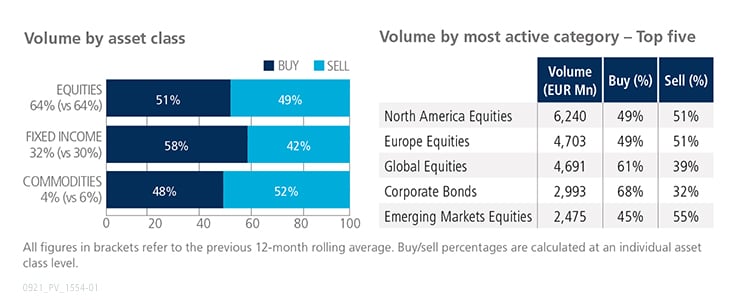

Volume breakdown

Equity and fixed income ETFs saw net buying in August. In contrast, ‘sells’ in commodity-based products surpassed ‘buys’ by four percentage points. North America Equities was the most actively-traded category for the second consecutive month, with EUR 6.2 billion in traded volume.

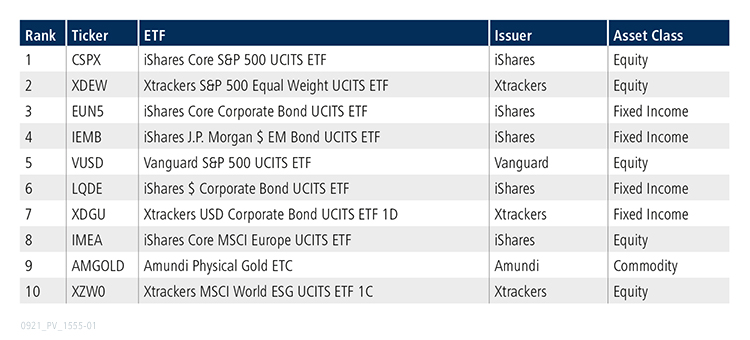

Top ten by traded notional volume

August’s top ten by traded notional volume comprised five equity funds, with the iShares Core S&P 500 UCITS ETF ranked first. The Xtrackers MSCI World ESG UCITS ETF - 1C, which tracks the performance of the MSCI World Low Carbon SRI Leaders Index, entered the list for the first time in tenth place.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in August 2021 reached USD 21.3 billion.

Volume breakdown

As a percentage of total notional value, equities accounted for 70% and fixed income for 26%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of U.S. equities at Tradeweb, said: “Our U.S. ETF platform, which tends to be evenly split between equity and fixed income, saw 70% of its volume across equity funds. The names at the top of the list varied including mid cap, utilities financials and large cap, with HYG being the only fixed income ticker to crack the top five. Customers continued to transition to electronic RFQ trading, with overall platform volumes up 126% over the same month last year.”

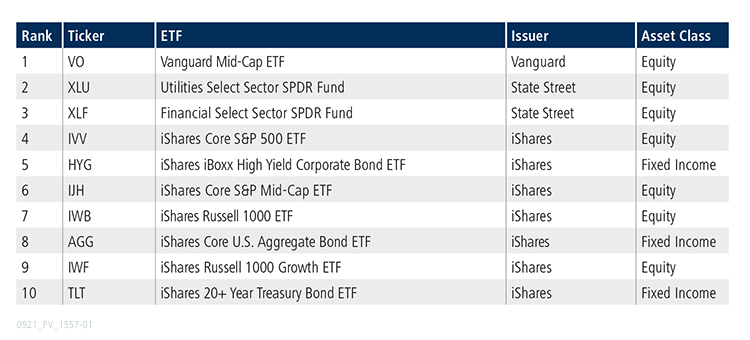

Top ten by traded notional volume

In August, a record 1315 unique tickers traded on the Tradeweb U.S. ETF platform. The month’s most heavily-traded product was the Vanguard Mid-Cap ETF, which last appeared in the top ten list in December 2020.