Tradeweb Exchange-Traded Funds Update – April 2022

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European-listed ETF marketplace reached EUR 46.3 billion in April 2022, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 81%.

Adam Gould, head of equities at Tradeweb, said: “AiEX continues to be incredibly popular among our clients trading European ETFs. The technology makes it possible for traders to automate transactions based on a wide range of pre-determined criteria, including pricing, size, timing and counterparty selection.”

Volume breakdown

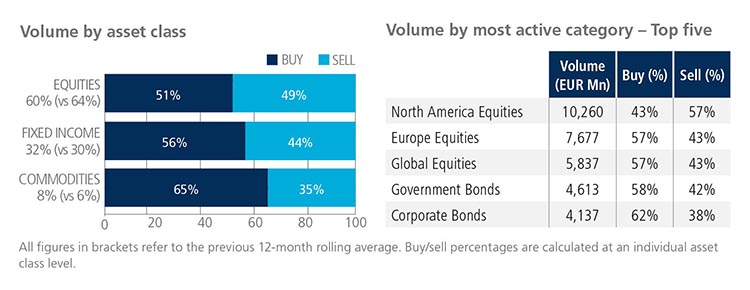

All ETF asset classes saw net buying in April, particularly commodities, where ‘buys’ surpassed ‘sells’ by 30 percentage points. Activity in the asset class dropped to 8% of the overall platform flow. Conversely, total traded volume in equity and fixed income ETFs increased to 60% and 32%, respectively.

North America Equities was the month’s most actively-traded ETF category with EUR 10.3 billion in notional volume.

Top ten by traded notional volume

After occupying the top spot for eight consecutive months, the iShares Core S&P 500 UCITS ETF moved down two places in April to be ranked third. In first place, the iShares Core FTSE 100 UCITS ETF last featured in the top ten list in September 2021.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in April 2022 was just over USD 43 billion, the platform’s fourth strongest performance on record.

Volume breakdown

As a percentage of total notional value, equities accounted for 52% and fixed income for 41%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “Rising inflation and ongoing geopolitical tensions dominated headlines in April, a tough month for U.S. stocks. As institutional investors adapt their positions to divergent monetary policies from major central banks, momentum in U.S. ETF trading on our platform continues to be strong."

Top ten by traded notional volume

During April, 1,530 unique tickers traded on the Tradeweb U.S. ETF marketplace. The iShares 7-10 Year Treasury Bond ETF proved to be the month’s most heavily-traded fund, after last occupying the top spot in November 2021.