Saving Muniland: Overcoming the Liquidity Crisis

Bill Buzaid

Director of Sales, Tradeweb Direct

The $4 trillion municipal bond market is in a state of flux. Since the passage of the Tax Cuts and Jobs Act on December 22, 2017, the twin dynamics of limited new issuance (until the recent taxable refunding bonanza) and SALT deduction cap- induced demand have driven record amounts of individual investors’ cash into municipal bond separate accounts and mutual funds.

Muni separate accounts now boast a whopping $600bn in assets, three times the amount held in 2010. What’s more, after 46 consecutive weeks of inflows, muni funds now hold $739bn, more than double their holdings in 2010.

As new issue supply has waned and investor appetite only grown more insatiable, separate account and mutual fund managers have been forced to turn to the secondary market to make up the difference. Consequently, spreads have been compressed significantly and absolute municipal yields are near all-time lows, making alpha generation increasingly difficult without reaching down the credit spectrum.

The broker/dealer community, integral for its ability to warehouse risk and facilitate trading, is contending with its own set of obstacles. Dealer municipal inventory has halved from $40bn to $22bn since 2010, a result of more stringent balance sheet requirements. During the same period, muni bid/ask spreads have contracted by more than 50%, forcing dealers to execute more, less profitable trades to compensate for lost revenue, in what has become a vicious cycle.

It is amidst this challenging backdrop that Tradeweb is partnering with clients to develop innovative solutions to mitigate the effects of these new market realities. Our solutions fall into three distinct categories: all-to-all aggregation, trading flexibility, and workflow efficiency.

All-to-All Aggregation

It is universally acknowledged that aggregation is important, even essential, in the municipal market, where there are over 50,000 issuers and nearly one million unique securities outstanding.

Traditionally, aggregation has been understood to encompass only the broker/dealer and buy-side communities. But what is sometimes lost in this, is the relative importance of retail investors to the broader marketplace.

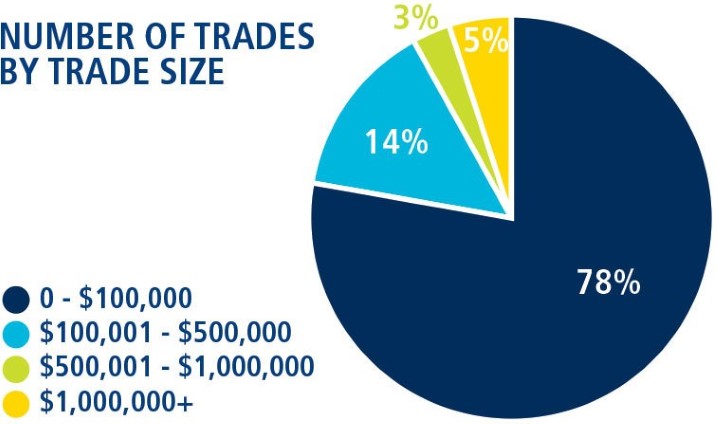

Incredibly, two thirds of all municipal bonds are held by individual investors. This phenomenon is evidenced by the fact that, year to date in 2019, 97% of all trades reported to MSRB are less than 1mm in size and 92% are less than 500m.

Recognizing the importance of this oft-overlooked liquidity source, Tradeweb has created an all-to-all ecosystem, where 190 broker/dealers, 352 institutional asset managers, 45,000 retail financial advisers, and 60,000 mom & pop investors can interact with one another.

By connecting all potential counterparties, Tradeweb affords broker/dealers unprecedented, one-stop shop distribution and provides investors seamless sourcing for bonds. As you might imagine in this liquidity starved environment…everyone is taking advantage! Twenty percent of municipal trades reported to MSRB now occur on the Tradeweb platform.

Trading Flexibility

Opportunity is hard to come by in the municipal market these days, as participants have been squeezed by compressed spreads. In an environment this competitive, every basis point counts and Tradeweb is delivering its clients flexible trading protocols to help generate alpha and improve velocity.

Institutional separate account and fund managers can now respond to bid lists coming from their counterparts, as well as from retail clients and dealers, enhancing the potential for improved execution. What’s more, if liquidation timelines are long enough, these same clients can offer bonds rather than putting them out for bid, thereby reducing transaction costs. Lastly, enhanced matchers functionality allows portfolio managers and traders to opportunistically add on to existing positions at advantageous levels.

Broker/dealers, meanwhile, can now enhance the network effect afforded by Tradeweb’s all-to-all liquidity pool to pin point trading opportunities and view aggregate order flow, reducing manual effort and increasing volume.

Workflow Efficiency

With trading desks thinly staffed and an avalanche of cash continually pouring into the municipal market, traders need to optimize their time by making workflows more efficient. Those that don’t, risk wasting precious time on the sidelines, uninvested or with aged inventory, allowing more technologically sophisticated firms the opportunity to deliver better returns or turnover their books faster.

To that end, Tradeweb has rolled out several enhancements geared towards streamlining municipal trading for its clients, including:

Straight-Thru Processing

- Seamlessly route and execute multiple orders leveraging both the solicited and unsolicited workflows

- Order Management Systems (OMS/EMSs) supported: Axe Trading; Bloomberg AIM; Bloomberg TOMS; Charles River; Investortools Perform; SS&C Moxy; ZIA

Proprietary FIX integration

- Build out custom integrations for market data, liquidity taking, and liquidity provision

MMD partnership

- Quickly determine relative value, optimize trading strategies, and configure MMD spreads in the platform to avoid swivel-chairing.

Taking these three themes together, it’s clear that municipal market is changing just as rapidly as any asset class garnering more headlines. At Tradeweb, we’re working with its clients to transform it.

To learn more about our Tradeweb Direct offering, click here.