Retail to the Rescue: How Retirees and Their Wealth Managers Have Breathed New Life into Institutional Muni Markets

Bill Buzaid

Director of Sales, Tradeweb Direct

It’s been a tough few years for municipal bonds. First, there was the coronavirus pandemic, which unleashed a liquidity crisis that saw municipal bond funds lose over $28 billion in the month of March of 2020 alone. More recently, as the specter of rising inflation and ongoing economic turbulence have dominated headlines, municipal bond prices have fallen ~9% through June, according to the Bloomberg Municipal Bond Index.

The volatility sent institutional asset managers scrambling, with many trying to unload bid lists of upwards of 500 - 1,000 line items at a time, all at fire sale prices. Then the retirees stepped in.

While plummeting prices were bad news for institutional investors, the rising yields that accompanied them were making munis increasingly attractive to retail investors. Historically, those two classes of investors would never cross paths, but – thanks to recent advances in electronic trading that have given retail wealth managers a direct conduit to the institutional sell-side – retiree investors have come to wield big buying power in the institutional municipal bond markets.

Homogenizing Muni Markets

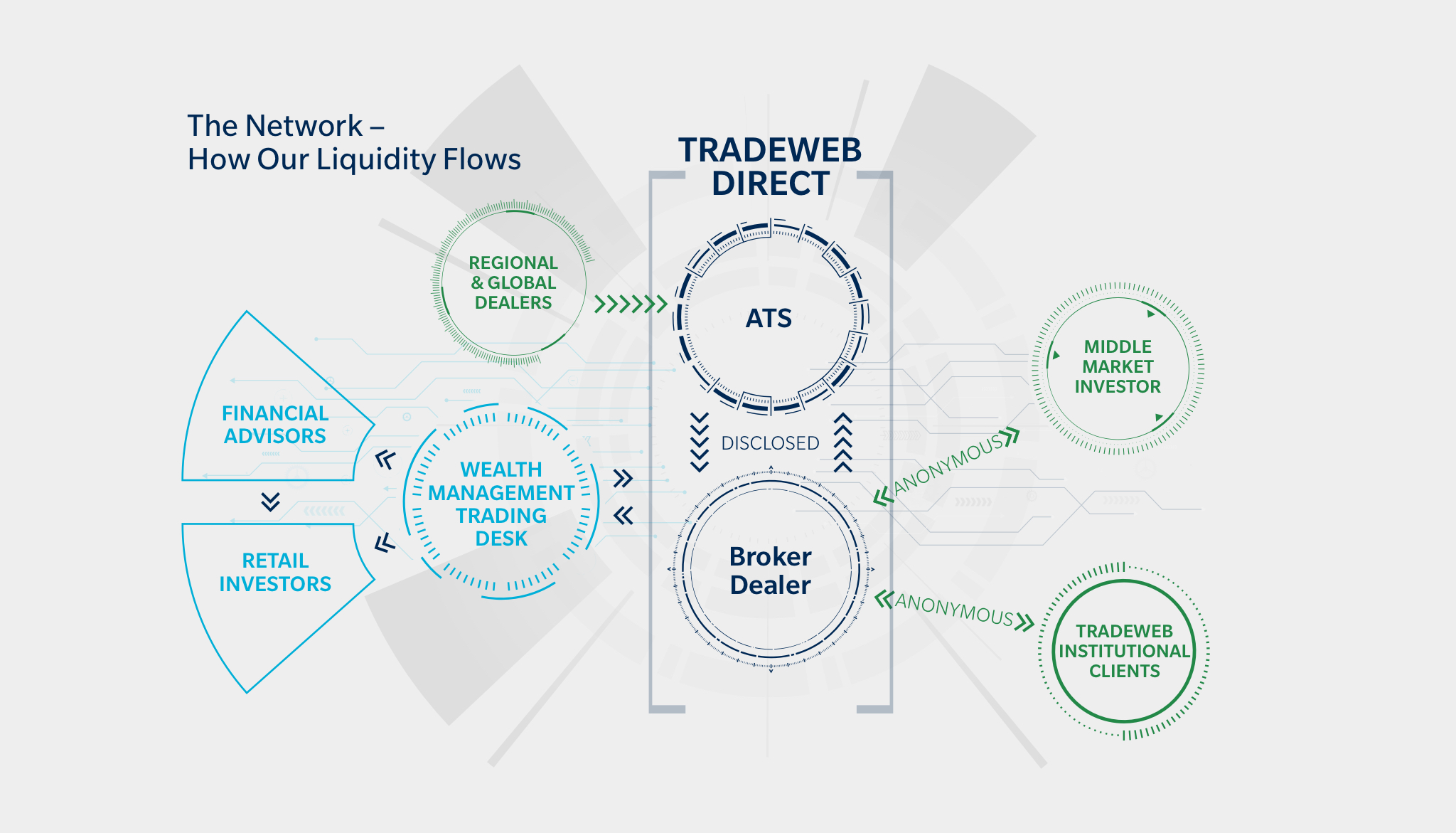

This opportunistic alignment between retail and institutional investors was made possible by a series of electronic onramps and offramps that Tradeweb has been building into the Tradeweb Direct platform for the last several years.

On the retail side, Tradeweb has been consistently building direct connectivity to the world’s largest wealth management firms, giving their advisors the ability to route municipal order flow for clients straight into the Tradeweb Direct alternative trading system (ATS) via their own order management systems. On its own, that connectivity has created a thriving pool of retail liquidity within the wealth management community, facilitating muni trading on the Tradeweb platform.

But that’s only half the equation. Because Tradeweb also has a robust presence in the institutional markets, we are able to combine that institutional liquidity with our retail volumes to create a two-way market between retail and institutional investors that never existed before.

In stable, routine market environments, the added supply-and-demand has created a super-efficient workflow for municipal bond trading. When muni markets turned volatile, however, it became a lifeline connecting institutional sellers with retail buyers.

By-the-Numbers

Segmenting municipal trading volumes on Tradeweb Direct illustrates just how significant an impact the comingling of retail and institutional markets has had. With the broader municipal bond market experiencing fund outflows in 18 of the past 19 weeks, the contrast between retail and institutional behavior has been stark. Mom & pop investors have been buying up munis at a 4-1 clip, whereas the professionals managing funds have been sellers at a nearly 2-1 ratio. This dynamic has led to an interesting realization, which is reinforced by a similar trend in March 2020: retail is the buyer of last resort in Muniland. This phenomenon has led to a mutually beneficial outcome - the institutions selling municipal bonds via Tradeweb Direct are doing so at significantly better price points than they would if they were trying to unload a bid list via traditional channels and retail investors are getting the tax-free yields they so crave. As median bid/ask spreads hover near 20bps or more, institutions offering bonds directly to retail are delivering substantial alpha relative to their competitors.

What’s Next

As the Tradeweb Direct platform continues to build critical mass – and gets put to the test in difficult market conditions – the network effect in the muni market will continue to grow, opening up new paths to liquidity. Whether or not armies of retiree investors will continue to be the buyer of last resort for the institutional fixed income market remains to be seen. But we believe that by using technology to create a free flow of liquidity between all investor types, with all of the seamless transaction and back-end compliance functionality built directly into the process, Tradeweb will continue to create new pockets of opportunity.

Related Content