Mixed economic data doesn't dampen a buoyed investor sentiment

The second half of 2013 set the scene for a long-awaited turning point in the course of the global economy. The Federal Reserve’s decision last month to wind down its stimulus efforts came amidst positive non-farm payroll and trade reports; while growth projections for the UK were revised upwards more than once in the last quarter. The good news continued in the New Year. This week, the World Bank predicted more robust growth for 2014, led by a recovery in advanced economies and stronger performance by developing countries, especially China. The International Monetary Fund is also set to raise its global growth forecast in the coming weeks, according to its managing director, Christine Lagarde.

Weaker than expected U.S. jobs data for December published on January 10 hasn’t dampened a buoyed investor sentiment, as it was followed by encouraging retail sales and inventory figures. This is being reflected in the fixed income markets, with Europe’s peripheral economies emerging as the primary beneficiaries so far.

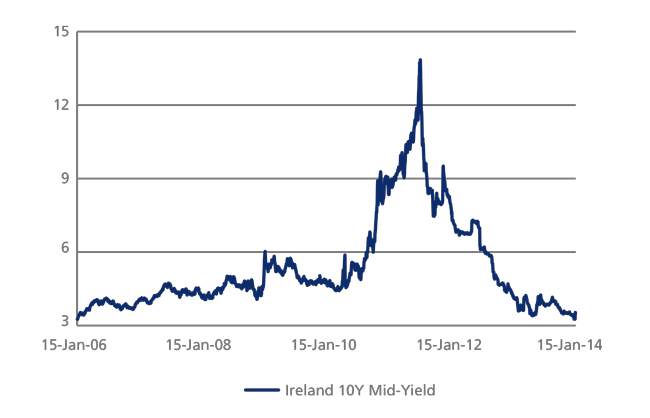

Demand for Ireland’s first bond auction since its bailout exit in December raised €3.75bn, while the total order book amounted to some €14bn. Interest came mainly from European and US investors, as Ireland’s sub-investment grade sovereign rating with Moody’s seems to have deterred potential investors in Asia. A review is on the cards for tomorrow and Ireland is holding its breath for a rating upgrade, which would help the country even more in its efforts to cover its debt obligations. Mid-yields for the country’s ten-year benchmark government bond dropped to eight-year lows of 3.260% on January 10.

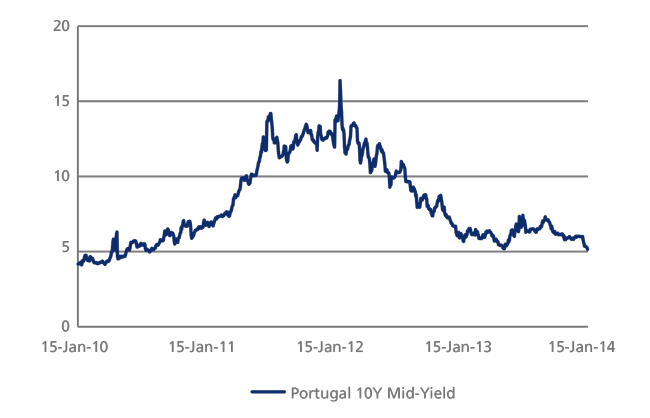

Hot on Ireland’s heels, Portugal saw the sale of its newly-issued five-year bonds on January 9 achieve similar levels of success, securing €3.25bn. The country braces itself for its bailout exit, which could materialise as early as May 17, according to the Vice President of the European Parliament, Othmar Karas. Ten-year benchmark bond mid-yields closed yesterday at 5.145%, the lowest since August 2, 2010.

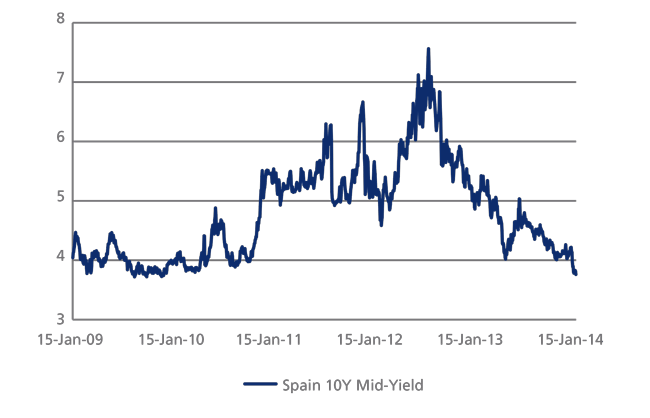

Spanish ten-year mid-yields are also at levels not seen in more than four years. Yesterday’s close value at 3.760% was only higher compared to the 3.759% level reached on October 2, 2009. News of an increase in 2014’s planned issuance went down well with the markets, as it was accompanied by optimistic economic indicators including a falling unemployment rate in December and a growing services sector. Last week’s sale of new five-year bonds and existing paper maturing in 2028 raised more than €5.2bn for Spain. Similarly, today’s triple bond auction yielded €5.92bn, beating the target range of €4.5bn to €5.5bn.

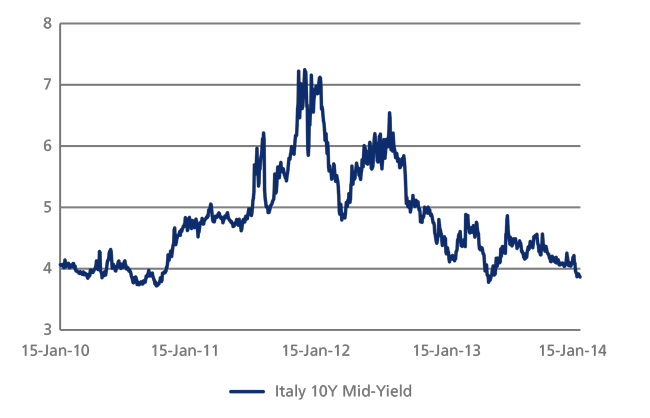

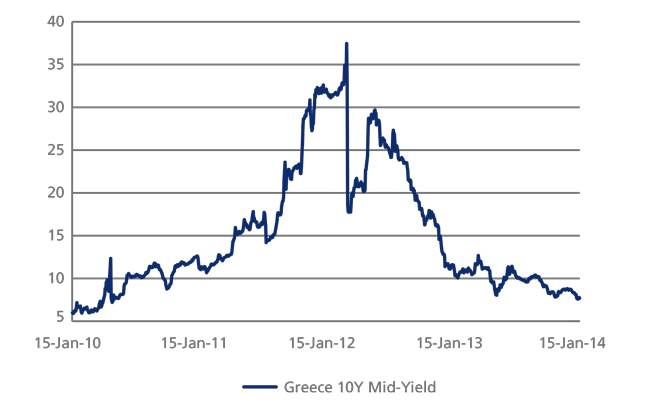

Italy and Greece have not been left out of the party taking place in Europe’s peripheral debt markets. Italian ten-year benchmark bond mid-yields closed yesterday at 3.865%, which represents an almost four-year low. Greece’s lowest yield since May 18, 2010 was achieved last Friday at 7.582%, and speculation is mounting about a possible return to the capital markets in the near future.