Market Snapshot: Shorter-Dated U.S. Yields Remain Elevated, German 10yr Yield Up Following Jobs Report

Yields on shorter-dated U.S. Treasury securities remain elevated following the jobs report, according to data from Tradeweb.

In the U.S., the bid yield on the 1-year U.S. Treasury note was 0.561% as of 1:53 PM EST, up 1.5 bps from yesterday’s close of 0.546%. Today’s intraday high was 0.564%, while the intraday low was 0.538%.

The bid yield on the bid yield on the 2-year U.S. Treasury note was 0.943% as of 1:53 PM EST, down 1.5 bps from yesterday’s close of 0.958%. Today’s intraday low was 0.923%, while the high was 0.991%.

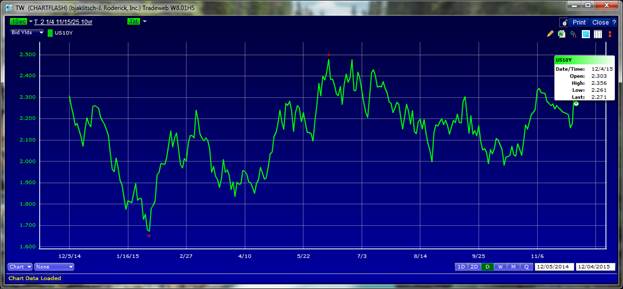

The bid yield on the 10-year U.S. Treasury note was 2.271% as of 1:53 PM EST, down 5.7 bps from yesterday’s close of 2.328%. Today’s intraday low was 2.261%, while the intraday high was 2.356%.

These moves follow the release of BLS jobs report, which showed a gain of 211,000 jobs in November and come amid heightened discussion of a December rate increase from the Fed.

In Europe, the bid yield on the 10-year German Bund was 0.682%, up 3.1 bps from yesterday’s close of 0.651%. Today’s intraday high was 0.737%, while today’s intraday low was 0.644%.

The bid yield on the 2-year German note was -0.289%, down 0.2 bps from yesterday’s close of -0.289%. Today’s intraday low was -0.303%, while the intraday high was -0.229%.

These moves come amid ongoing speculation of whether the ECB’s extension of QE and deposit rate cut will spur inflation.

The charts below are based on indicative, real-time data from Tradeweb.

CHART 1: U.S. 1-Year Treasury Yields – December 5, 2014 – December 4, 2015 (12 Month View)

CHART 2: U.S. 2-Year Treasury Yields – December 5, 2014 – December 4, 2015 (12 Month View)

CHART 3: U.S. 10-Year Treasury Yields – December 5, 2014 – December 4, 2015 (12 Month View)