March Madness in Corporate Bonds

Written by:

Iseult E.A. Conlin, CFA, U.S. Institutional Credit Product Manager, Tradeweb

Data Analysis by:

Carol Luk, U.S. Institutional Credit Data Strategist, Tradeweb

Electronically linking Spotting and Hedging is Now Essential

March is known for its madness. But I think we can all agree—this year’s madness belonged to something other than college basketball. Volatility in financial markets may feel like a distant memory and it is easy to overlook short periods of extreme price dislocation when the S&P 500 is back to flat on the year and liquidity seems to have normalized. But there is one critical thing from March that stuck out for me – never in my time as a bond trader did I experience such a crisis of spotting, or the flip side of that, hedging.

It is more apparent than ever that linking corporate bond pricing electronically to the actual hedge reference price is a requirement. These purely operational tasks that happen at the very end of a trade – be it an electronic execution or manual/voice trade -- determine the final corporate bond price and remove unnecessary interest rate risk exposure. More importantly, spotting and hedging must occur to complete the bond trade. So what happens when these vital operational tasks can’t occur? Well, certainty of execution of all corporate bond trades is called into question and ultimately end investors pay the cost. But it really doesn’t have to work that way.

Spotting is to a Client as Hedging is to a Dealer

Let’s set the scene here–spread trading, in which a spread is quoted above the corresponding benchmark government bond yield, is a conventional form of transacting in investment grade credit markets. Spotting is a process of “snapshotting” the price of the US Treasury benchmark to calculate the final price of the corporate bond. Simultaneously, a dealer will hedge out the interest rate exposure of the corporate trade they just did by buying/selling the corresponding US Treasury benchmark bond. While it is not exclusive that buy-side traders are always spotting whereas dealers are always hedging, it is this workflow that predominates in the marketplace.

The Madness in March

In March, the U.S. Treasury market dislocated significantly. Buying and selling of US Treasuries could get done, but the level and time of execution were far less certain. This liquidity crunch in the most liquid, safest, risk-free asset in the global economy had a ripple effect. All of the sudden it became jarringly difficult to fully price a corporate bond trade. If you can’t trade Treasury bonds -- the bedrock of all types of interest rates and yields in the global economy -- you can’t derive the price of any corporate bond. Imagine then the impact on the marketplace for the thousands of bond traders attempting to spot and/or hedge every trade.

Devil is in the Details

We decided to quantify the impact of this dislocation on hedging and spotting to determine the costs investors absorbed as a result.

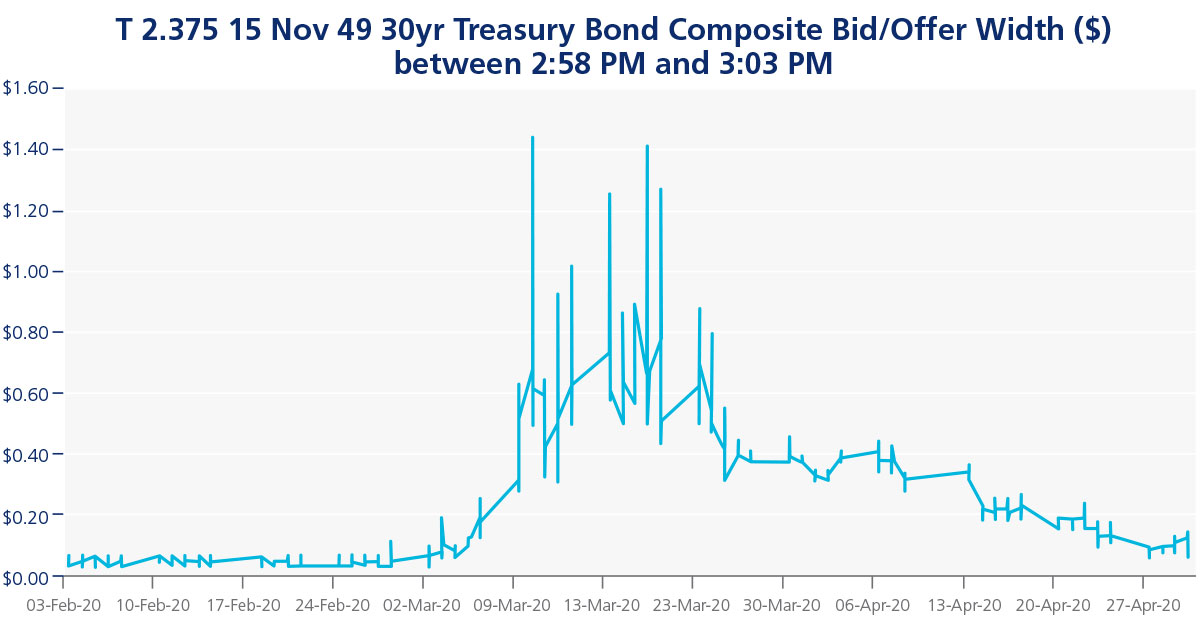

To do this we ran tick data (300,000+ data points) for each Treasury benchmark between 2:58 PM and 3:03 PM from February to April in 2020. We used 3 PM as the timing source because it’s the standard time for spotting corporate trades given index pricing marks. What we found is astonishing and concerning for any corporate bond market that doesn’t link electronic spotting and hedging.

Let’s use the old 30yr Treasury benchmark bond as an example. The first trading day in February the bid/offer of the 30yr US Treasury bond was around $105.51/$105.56 or a width of $0.05. This is important because the more narrow the width of the Treasury composite, the less trading costs you have to endure when you “spot” your corresponding corporate bond. By March, the bid/offer width was as wide as $1.20-$1.40 or 28x what it was in February. So not only were market participants enduring substantial trading costs with a wider bid/offer Treasury composite, but they also faced the possibility that they may not be able to spot or hedge their corporate trades at all.

*T 2.25 15 Aug 49 30yr as on-the-run benchmark before 02/18/2020

Let’s use a liquid generic 30yr corporate bond – let’s pick AAPL 3.450 02/09/45 – and do a back of the envelope calculation. On March 10th at 3 PM, the bid/offer of the T 2.375 15 Nov 49 30yr was $126.75 / $128.1875 or a width of $1.4375. Assuming a trader agrees to trade AAPL 3.450 02/09/45 at a spread of +90 basis points and then must spot, they are incurring a cost of $110,816. Put another way, the process of spotting cost 5bps. The bid/offer on a generic liquid corporate bond isn’t even 5 bps…

|

Dollar Price of Corporate |

Net Proceeds |

||

|---|---|---|---|

|

Treasury Bid Side Composite |

Spot at $126.75 |

$124.14 |

12,445,792.47 |

|

Treasury Offer Side Composite |

Spot at $128.1875 |

$125.25 |

12,556,609.31 |

|

Difference in Net Proceeds |

($110,816.84) |

||

There are always minimal transactions costs when you spot, but they are greater when the bid/ask on the underlying Treasury is atypically wide. This cost is paid by the end investor and I am using an example of one trader and one trade. Hundreds of millions of bonds are spotting at 3 PM and this type of cost affects every single one of them…

Tradeweb – Linking Spotting and Hedging since the inception of the Credit Platform

Clearly then, the market requires a more robust mechanism. Traders and investors need to have the option to keep liquidity moving. At Tradeweb, we solved for this issue.

Tradeweb was the first eTrading platform to electronically link corporate bond pricing electronically to the actual hedge reference price. This certainty of execution avoids any lag or slippage in pricing for buy-side client and dealer simultaneously. This is imperative for market environments of the sort we observed in March and is a service that we make available to both electronically executed trades and those agreed to over phone or chat.

By automating the spotting process the buy-side traders no longer need to wait for a Treasury spot - reducing the chance of slippage. Conversely, the dealer never needs to engage in a manual Treasury hedge trade when they buy or sell corporate bonds since Tradeweb automatically hedged them electronically.

Having learned the potential for cost and time savings of electronically linking spotting and hedging in corporate bond trading, the real “madness” (in my opinion) would be not leveraging electronically linked spotting and hedging when trading corporate bonds, and let’s be honest, we could all use a little less madness in our lives right about now.