Japan Government Bond Update - July 2015

Key Points:

- BoJ trims growth and inflation forecasts

- IMF urges Japan to boost structural reforms

- JGBs rally in July except for two-year debt

July started with the release of the Tankan survey by the Bank of Japan. The business sentiment report showed improved confidence among large manufacturers and service companies during the second quarter of 2015. Later in the month, the central bank announced it had downgraded its economic growth forecast for the current fiscal year from 2% to 1.7%. The BoJ also trimmed its inflation forecast from 0.8% to 0.7%.

Meanwhile, the International Monetary Fund predicted that Japan’s real GDP would increase at an annual rate of 0.8% this year, in its latest assessment of the country published on July 23. The IMF warned, however, that “further high-impact structural reforms are urgently needed to lift growth, facilitate fiscal consolidation, and unburden monetary policy.”

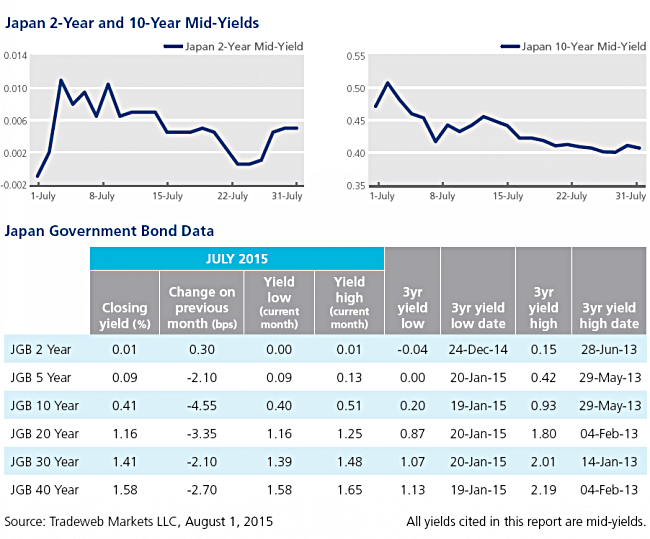

Japanese government debt rallied in July with the exception of the two-year benchmark bond; its mid-yield closed at -0.001% on July 1, but finished the month higher at 0.005%. In contrast, the mid-yield on the 10-year benchmark bond fell from an early July peak of 0.51% to end the month 10 basis points lower at 0.41%.